Despite lower earnings than five years ago, Vertoz (NSE:VERTOZ) investors are up 661% since then

Vertoz Limited (NSE:VERTOZ) shareholders might be concerned after seeing the share price drop 15% in the last quarter. But over five years returns have been remarkably great. In that time, the share price has soared some 661% higher! So it might be that some shareholders are taking profits after good performance. Of course what matters most is whether the business can improve itself sustainably, thus justifying a higher price. It really delights us to see such great share price performance for investors.

Although Vertoz has shed ₹3.5b from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

See our latest analysis for Vertoz

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Vertoz's earnings per share are down 7.0% per year, despite strong share price performance over five years.

Essentially, it doesn't seem likely that investors are focused on EPS. Because earnings per share don't seem to match up with the share price, we'll take a look at other metrics instead.

It is not great to see that revenue has dropped by per year over five years. It certainly surprises us that the share price is up, but perhaps a closer examination of the data will yield answers.

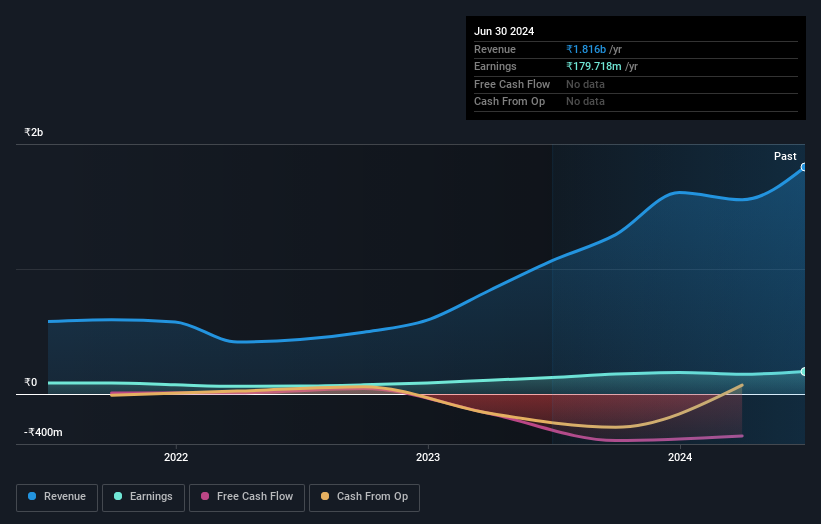

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We're pleased to report that Vertoz shareholders have received a total shareholder return of 113% over one year. That's better than the annualised return of 50% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 1 warning sign for Vertoz that you should be aware of.

Of course Vertoz may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:VERTOZ

Vertoz

Engages in the programmatic advertising business in India and internationally.

Flawless balance sheet with proven track record.