Investors more bullish on Hathway Cable and Datacom (NSE:HATHWAY) this week as stock hikes 11%, despite earnings trending downwards over past year

If you want to compound wealth in the stock market, you can do so by buying an index fund. But you can significantly boost your returns by picking above-average stocks. For example, the Hathway Cable and Datacom Limited (NSE:HATHWAY) share price is up 63% in the last 1 year, clearly besting the market return of around 49% (not including dividends). That's a solid performance by our standards! On the other hand, longer term shareholders have had a tougher run, with the stock falling 9.3% in three years.

Since it's been a strong week for Hathway Cable and Datacom shareholders, let's have a look at trend of the longer term fundamentals.

View our latest analysis for Hathway Cable and Datacom

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over the last twelve months, Hathway Cable and Datacom actually shrank its EPS by 53%.

So we don't think that investors are paying too much attention to EPS. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

We think that the revenue growth of 5.4% could have some investors interested. We do see some companies suppress earnings in order to accelerate revenue growth.

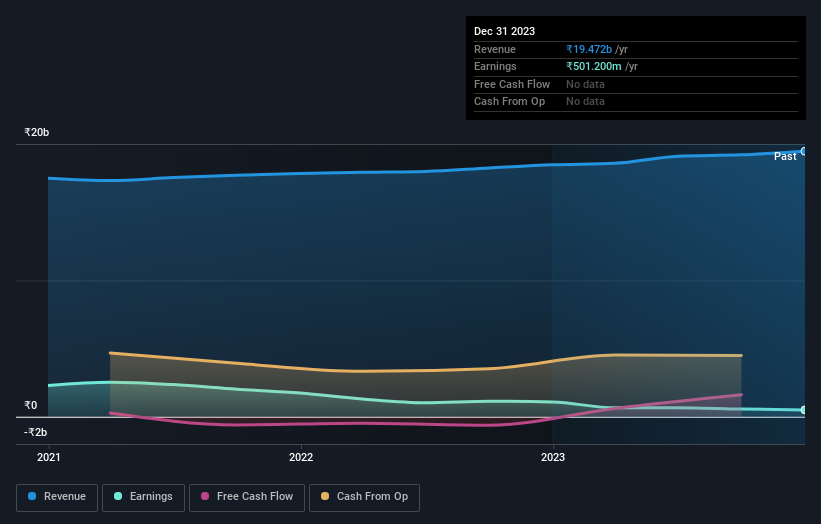

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's nice to see that Hathway Cable and Datacom shareholders have received a total shareholder return of 63% over the last year. Notably the five-year annualised TSR loss of 4% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Hathway Cable and Datacom has 2 warning signs we think you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hathway Cable and Datacom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HATHWAY

Hathway Cable and Datacom

Provides cable television network and Internet services.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives