We Think Pyramid Technoplast (NSE:PYRAMID) Is Taking Some Risk With Its Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Pyramid Technoplast Limited (NSE:PYRAMID) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Pyramid Technoplast

How Much Debt Does Pyramid Technoplast Carry?

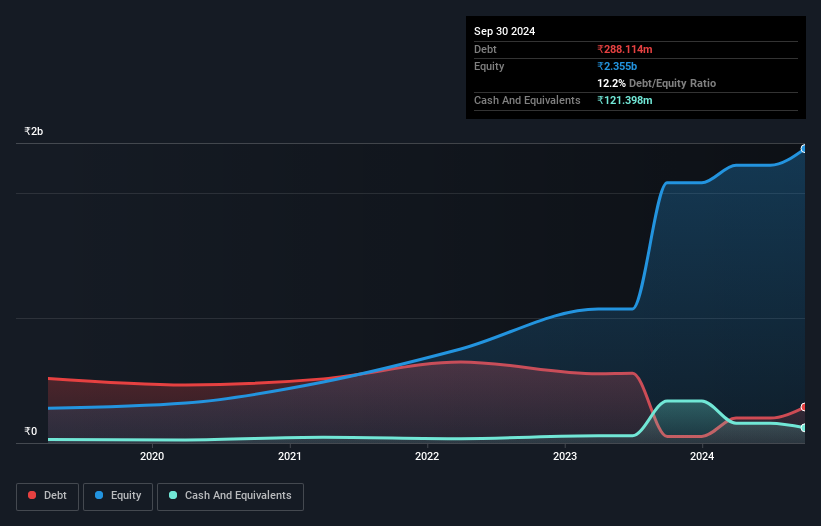

The image below, which you can click on for greater detail, shows that at September 2024 Pyramid Technoplast had debt of ₹288.1m, up from ₹51.9m in one year. However, it does have ₹121.4m in cash offsetting this, leading to net debt of about ₹166.7m.

A Look At Pyramid Technoplast's Liabilities

According to the last reported balance sheet, Pyramid Technoplast had liabilities of ₹816.7m due within 12 months, and liabilities of ₹111.0m due beyond 12 months. On the other hand, it had cash of ₹121.4m and ₹924.3m worth of receivables due within a year. So it actually has ₹118.0m more liquid assets than total liabilities.

This state of affairs indicates that Pyramid Technoplast's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So while it's hard to imagine that the ₹6.85b company is struggling for cash, we still think it's worth monitoring its balance sheet.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Pyramid Technoplast's net debt is only 0.39 times its EBITDA. And its EBIT covers its interest expense a whopping 50.5 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. On the other hand, Pyramid Technoplast's EBIT dived 17%, over the last year. We think hat kind of performance, if repeated frequently, could well lead to difficulties for the stock. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Pyramid Technoplast will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. During the last three years, Pyramid Technoplast burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

We feel some trepidation about Pyramid Technoplast's difficulty conversion of EBIT to free cash flow, but we've got positives to focus on, too. To wit both its interest cover and net debt to EBITDA were encouraging signs. We think that Pyramid Technoplast's debt does make it a bit risky, after considering the aforementioned data points together. That's not necessarily a bad thing, since leverage can boost returns on equity, but it is something to be aware of. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example Pyramid Technoplast has 3 warning signs (and 1 which is potentially serious) we think you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PYRAMID

Pyramid Technoplast

An industrial packaging company, engages in the manufacture and marketing of polymer-based molded products for chemical, agrochemical, specialty chemical, and pharmaceutical companies for their packaging applications in India.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives