- India

- /

- Metals and Mining

- /

- NSEI:NATIONALUM

Here's Why I Think National Aluminium (NSE:NATIONALUM) Might Deserve Your Attention Today

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like National Aluminium (NSE:NATIONALUM). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for National Aluminium

How Fast Is National Aluminium Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. Impressively, National Aluminium has grown EPS by 22% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). National Aluminium shareholders can take confidence from the fact that EBIT margins are up from 6.0% to 26%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

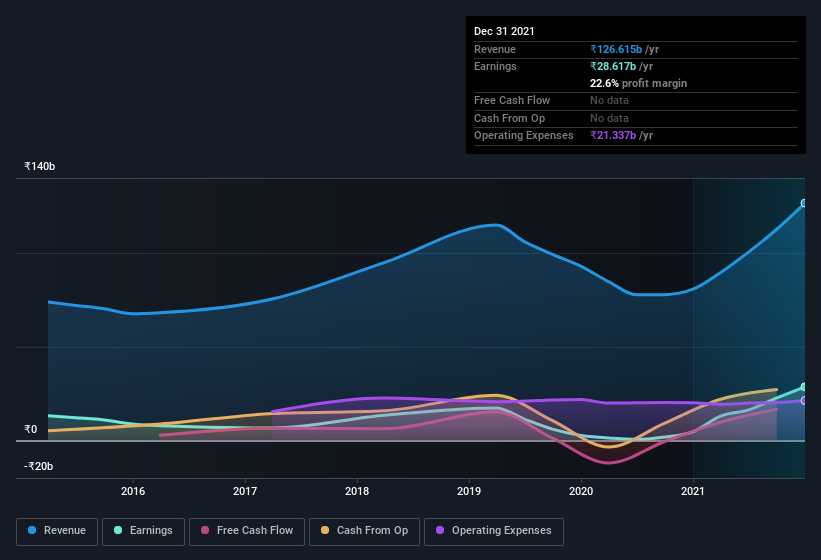

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are National Aluminium Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. So it is good to see that National Aluminium insiders have a significant amount of capital invested in the stock. To be specific, they have ₹3.0b worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 1.4% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

It means a lot to see insiders invested in the business, but I find myself wondering if remuneration policies are shareholder friendly. Well, based on the CEO pay, I'd say they are indeed. For companies with market capitalizations between ₹152b and ₹485b, like National Aluminium, the median CEO pay is around ₹46m.

The National Aluminium CEO received total compensation of just ₹4.9m in the year to . That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is National Aluminium Worth Keeping An Eye On?

Given my belief that share price follows earnings per share you can easily imagine how I feel about National Aluminium's strong EPS growth. If that's not enough, consider also that the CEO pay is quite reasonable, and insiders are well-invested alongside other shareholders. Each to their own, but I think all this makes National Aluminium look rather interesting indeed. It is worth noting though that we have found 1 warning sign for National Aluminium that you need to take into consideration.

Although National Aluminium certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if National Aluminium might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NATIONALUM

National Aluminium

Engages in the manufacture and sale of alumina and aluminum products in India and internationally.

Flawless balance sheet with solid track record and pays a dividend.