- India

- /

- Paper and Forestry Products

- /

- NSEI:KUANTUM

Should Kuantum Papers (NSE:KUANTUM) Be Disappointed With Their 52% Profit?

Passive investing in index funds can generate returns that roughly match the overall market. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). To wit, the Kuantum Papers Limited (NSE:KUANTUM) share price is 52% higher than it was a year ago, much better than the market return of around 35% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

Check out our latest analysis for Kuantum Papers

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over the last twelve months Kuantum Papers went from profitable to unprofitable. While some may see this as temporary, we're a skeptical bunch, and so we're a little surprised to see the share price go up. We might get a clue to explain the share price move by looking to other metrics.

We doubt the modest 0.4% dividend yield is doing much to support the share price. Unfortunately Kuantum Papers' fell 47% over twelve months. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

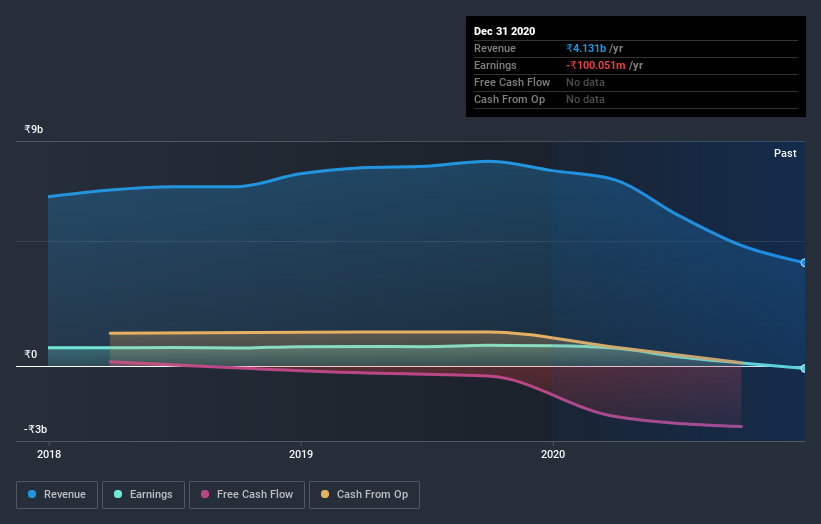

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling Kuantum Papers stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Kuantum Papers shareholders should be happy with the total gain of 53% over the last twelve months, including dividends. A substantial portion of that gain has come in the last three months, with the stock up 54% in that time. This suggests the company is continuing to win over new investors. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Kuantum Papers (of which 1 is a bit unpleasant!) you should know about.

But note: Kuantum Papers may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you’re looking to trade Kuantum Papers, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kuantum Papers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:KUANTUM

Kuantum Papers

Produces, markets, and sells agro and wood-based paper products in India.

Average dividend payer with mediocre balance sheet.

Market Insights

Community Narratives