- India

- /

- Metals and Mining

- /

- NSEI:JINDALSTEL

Should You Be Adding Jindal Steel & Power (NSE:JINDALSTEL) To Your Watchlist Today?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

So if you're like me, you might be more interested in profitable, growing companies, like Jindal Steel & Power (NSE:JINDALSTEL). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Jindal Steel & Power

How Fast Is Jindal Steel & Power Growing Its Earnings Per Share?

In the last three years Jindal Steel & Power's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like a firecracker arcing through the night sky, Jindal Steel & Power's EPS shot from ₹35.88 to ₹85.93, over the last year. You don't see 139% year-on-year growth like that, very often. The best case scenario? That the business has hit a true inflection point.

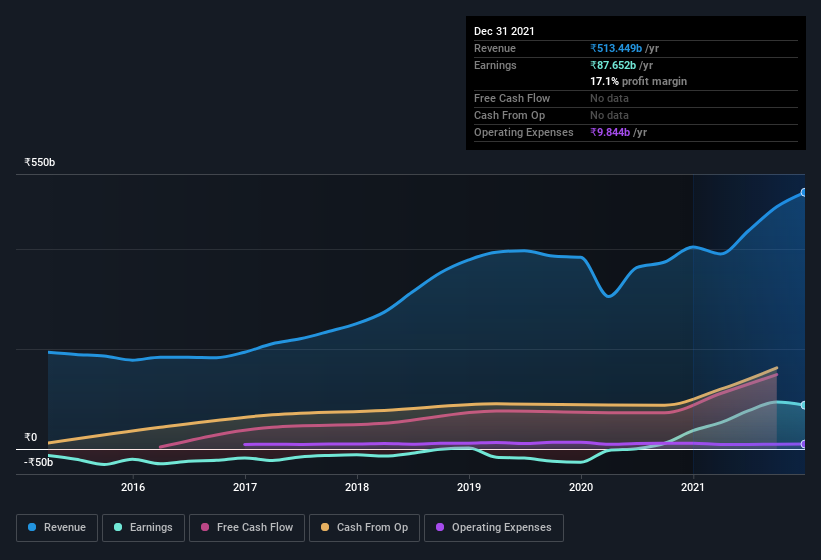

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Jindal Steel & Power is growing revenues, and EBIT margins improved by 8.2 percentage points to 29%, over the last year. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future Jindal Steel & Power EPS 100% free.

Are Jindal Steel & Power Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

In the last year insider at Jindal Steel & Power were both selling and buying shares; but happily, as a group they spent ₹14m more on stock, than they netted from selling it. Although I don't particularly like to see selling, the fact that they put more capital in, than they extracted, is a positive in my mind. It is also worth noting that it was Urmila Bhuwalka who made the biggest single purchase, worth ₹10m, paying ₹378 per share.

On top of the insider buying, it's good to see that Jindal Steel & Power insiders have a valuable investment in the business. Indeed, they have a glittering mountain of wealth invested in it, currently valued at ₹16b. I would find that kind of skin in the game quite encouraging, if I owned shares, since it would ensure that the leaders of the company would also experience my success, or failure, with the stock.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Vidya Sharma, is paid less than the median for similar sized companies. I discovered that the median total compensation for the CEOs of companies like Jindal Steel & Power with market caps between ₹304b and ₹912b is about ₹60m.

Jindal Steel & Power offered total compensation worth ₹34m to its CEO in the year to . That seems pretty reasonable, especially given its below the median for similar sized companies. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. I'd also argue reasonable pay levels attest to good decision making more generally.

Is Jindal Steel & Power Worth Keeping An Eye On?

Jindal Steel & Power's earnings have taken off like any random crypto-currency did, back in 2017. What's more insiders own a significant stake in the company and have been buying more shares. Because of the potential that it has reached an inflection point, I'd suggest Jindal Steel & Power belongs on the top of your watchlist. Before you take the next step you should know about the 1 warning sign for Jindal Steel & Power that we have uncovered.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Jindal Steel & Power, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:JINDALSTEL

Jindal Steel & Power

Operates in the steel, mining, and infrastructure sectors in India and internationally.

Undervalued with solid track record.