- India

- /

- Metals and Mining

- /

- NSEI:JINDALSTEL

Jindal Steel & Power And Two More Indian Exchange Stocks Considered Below Estimated Intrinsic Values

Reviewed by Simply Wall St

The Indian stock market has experienced a notable fluctuation, declining by 1.3% over the past week, yet showing a robust increase of 43% over the past year with earnings expected to grow by 16% annually. In this context, identifying stocks like Jindal Steel & Power that are considered undervalued relative to their intrinsic values could be particularly compelling for investors looking for potential growth opportunities in a generally bullish market.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| HEG (NSEI:HEG) | ₹2125.10 | ₹3307.40 | 35.7% |

| KSB (BSE:500249) | ₹996.45 | ₹1608.57 | 38.1% |

| IOL Chemicals and Pharmaceuticals (BSE:524164) | ₹412.80 | ₹636.71 | 35.2% |

| Updater Services (NSEI:UDS) | ₹315.65 | ₹538.46 | 41.4% |

| Vedanta (NSEI:VEDL) | ₹430.90 | ₹720.33 | 40.2% |

| Rajesh Exports (NSEI:RAJESHEXPO) | ₹316.50 | ₹508.95 | 37.8% |

| Mahindra Logistics (NSEI:MAHLOG) | ₹515.30 | ₹854.52 | 39.7% |

| Strides Pharma Science (NSEI:STAR) | ₹989.20 | ₹1664.05 | 40.6% |

| Delhivery (NSEI:DELHIVERY) | ₹379.75 | ₹750.97 | 49.4% |

| Godrej Properties (NSEI:GODREJPROP) | ₹3099.15 | ₹5526.09 | 43.9% |

Underneath we present a selection of stocks filtered out by our screen.

Jindal Steel & Power (NSEI:JINDALSTEL)

Overview: Jindal Steel & Power Limited is a company engaged in the steel, mining, and infrastructure sectors both in India and globally, with a market capitalization of approximately ₹99.20 billion.

Operations: The firm's operations span steel production, mining activities, and infrastructure development across both domestic and international markets.

Estimated Discount To Fair Value: 25.4%

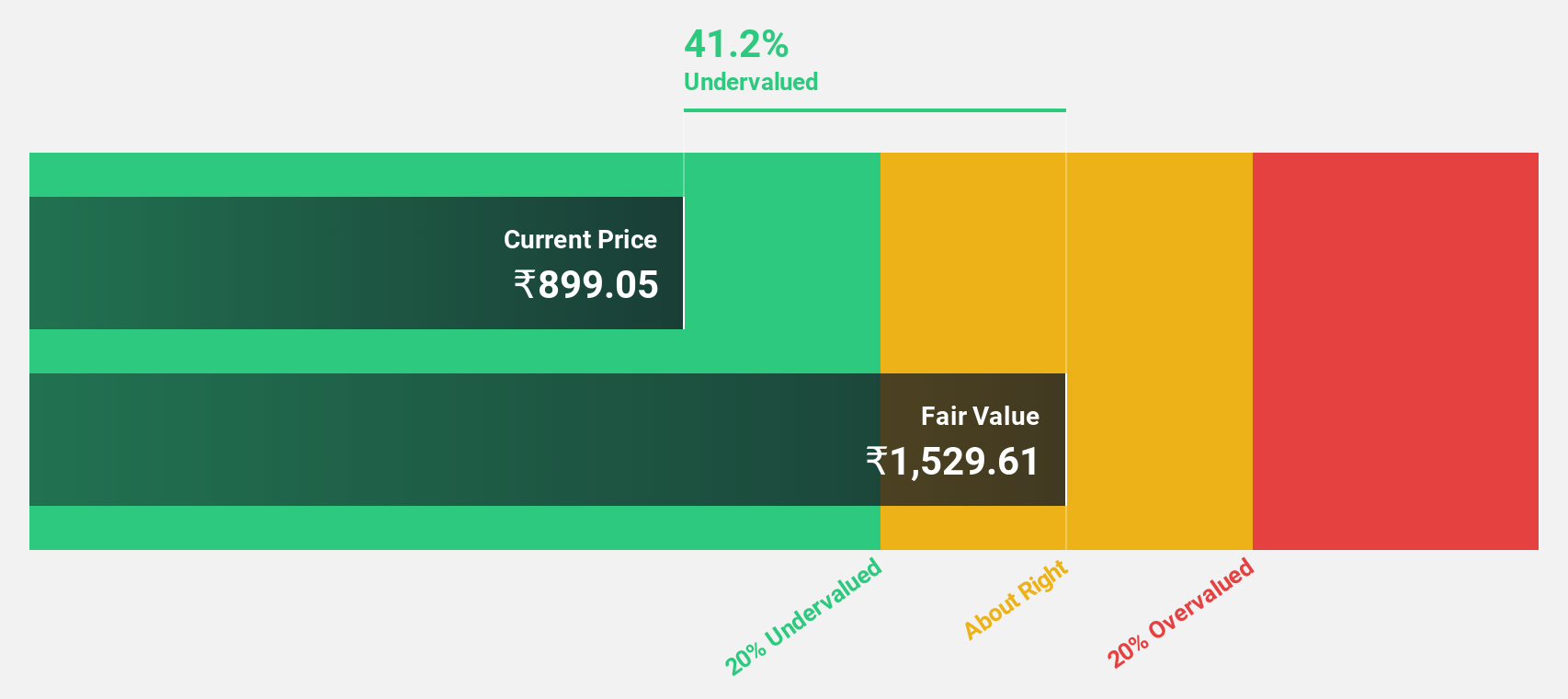

Jindal Steel & Power Limited, trading at ₹937.8, is considered undervalued based on discounted cash flow analysis, with a fair value estimate of ₹1257.66. Despite a recent drop in net income to INR 13,401.5 million from INR 16,869.4 million year-over-year for Q1 2025, the company's earnings have grown by 95% over the past year and are projected to increase by 24.02% annually. Additionally, Jindal Steel's revenue growth is expected to outpace the Indian market average at 14.4% per year compared to 9.5%. However, its Return on Equity is forecasted to be low at around 15.3% in three years' time.

- Upon reviewing our latest growth report, Jindal Steel & Power's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Jindal Steel & Power stock in this financial health report.

Piramal Pharma (NSEI:PPLPHARMA)

Overview: Piramal Pharma Limited is a global pharmaceutical company with operations in North America, Europe, Japan, India, and other international markets, boasting a market capitalization of approximately ₹220.80 billion.

Operations: The company generates ₹81.71 billion in revenue from its pharmaceutical operations.

Estimated Discount To Fair Value: 30.9%

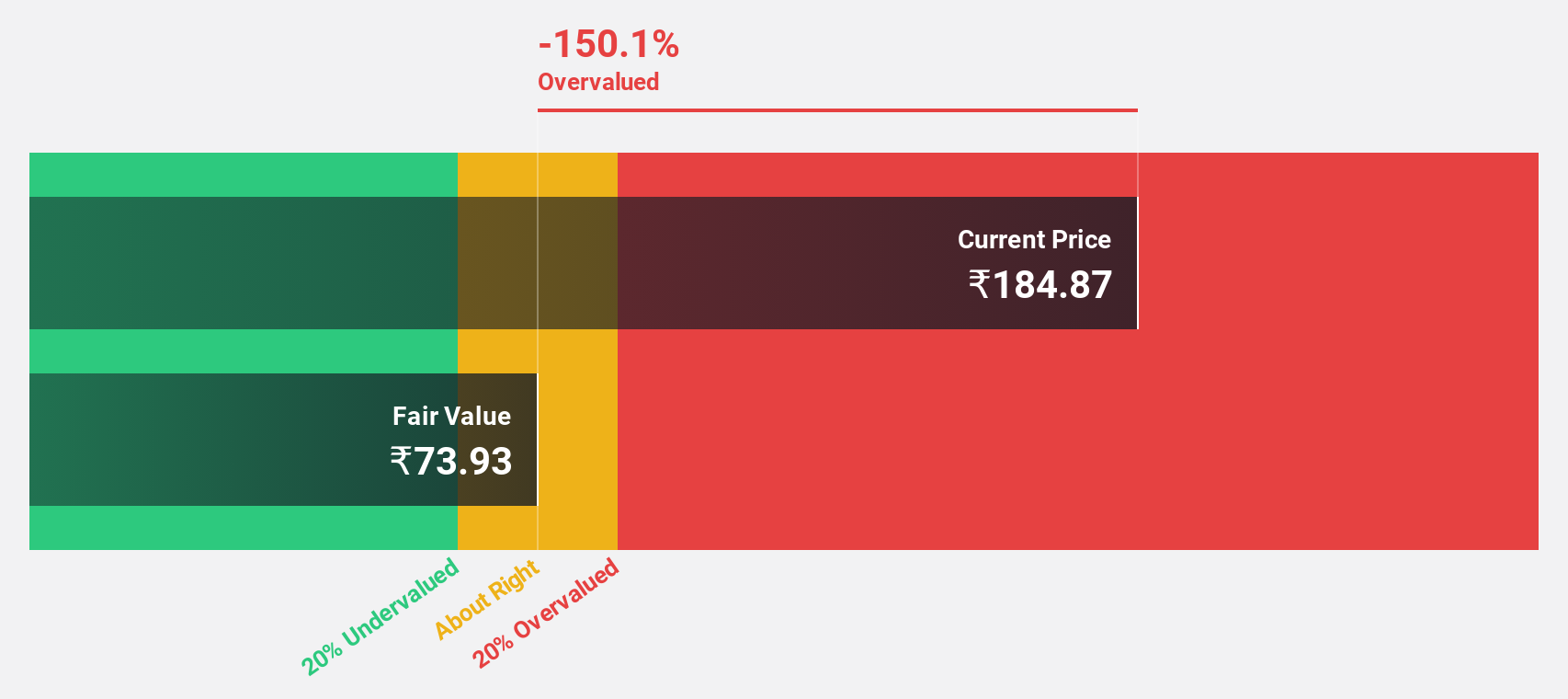

Piramal Pharma Limited, priced at ₹166.3, is currently valued below its fair value estimate of ₹240.54, indicating a potential undervaluation by over 20%. The company's earnings are expected to surge significantly at 67.15% annually, outstripping the Indian market's growth rate. Despite these promising financial projections and trading at a 30.9% discount to estimated fair value, concerns remain as interest payments are poorly covered by earnings and recent penalties related to GST and excise discrepancies could pose risks.

- The analysis detailed in our Piramal Pharma growth report hints at robust future financial performance.

- Get an in-depth perspective on Piramal Pharma's balance sheet by reading our health report here.

RITES (NSEI:RITES)

Overview: RITES Limited offers consultancy, engineering, and project management services across various sectors including railways, highways, and renewable energy, with a market capitalization of approximately ₹166.26 billion.

Operations: RITES Limited generates revenue through several key segments: domestic consultancy services contribute ₹11.94 billion, domestic turnkey construction projects add another ₹9.03 billion, domestic leasing activities account for ₹1.38 billion, export sales bring in ₹1.03 billion, and consultancy abroad totals approximately ₹0.95 billion.

Estimated Discount To Fair Value: 27.2%

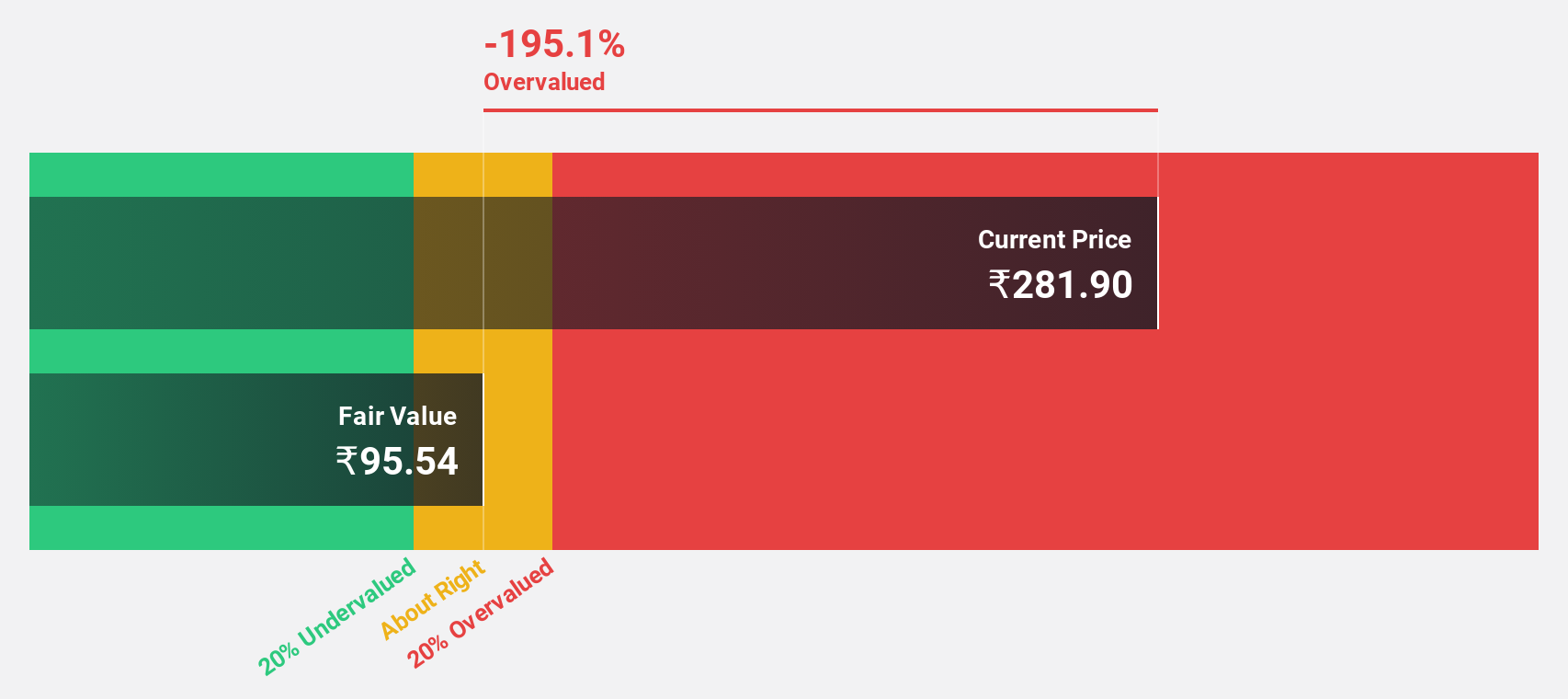

RITES Limited, priced at ₹675.2, trades 27.2% below its estimated fair value of ₹927.39, suggesting undervaluation based on cash flows. While its earnings are expected to grow by 18.54% annually, surpassing the Indian market's forecasted 16%, this growth is not considered significantly high. Additionally, recent contracts worth INR 501.8 million for road quality control in Assam and INR 267.9 million for railway consultancy in Karnataka indicate operational expansion despite dividends being poorly covered by earnings or free cash flows.

- The growth report we've compiled suggests that RITES' future prospects could be on the up.

- Click here to discover the nuances of RITES with our detailed financial health report.

Key Takeaways

- Unlock our comprehensive list of 19 Undervalued Indian Stocks Based On Cash Flows by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:JINDALSTEL

Jindal Steel & Power

Operates in the steel, mining, and infrastructure sectors in India and internationally.

Solid track record with excellent balance sheet.