- India

- /

- Basic Materials

- /

- NSEI:BIGBLOC

Bigbloc Construction Limited's (NSE:BIGBLOC) 28% Cheaper Price Remains In Tune With Earnings

To the annoyance of some shareholders, Bigbloc Construction Limited (NSE:BIGBLOC) shares are down a considerable 28% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 43% share price drop.

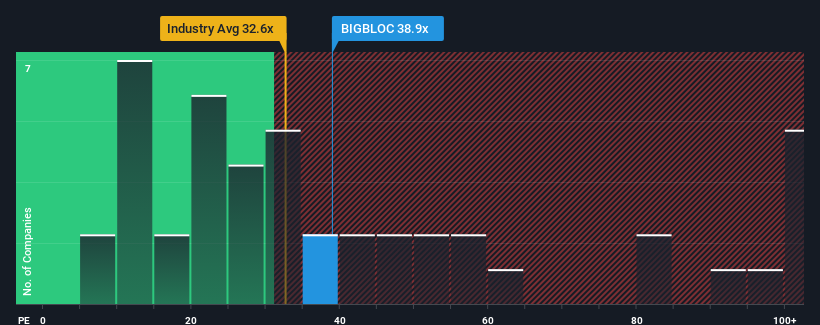

Although its price has dipped substantially, given around half the companies in India have price-to-earnings ratios (or "P/E's") below 27x, you may still consider Bigbloc Construction as a stock to potentially avoid with its 38.9x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

For instance, Bigbloc Construction's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

See our latest analysis for Bigbloc Construction

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Bigbloc Construction's is when the company's growth is on track to outshine the market.

Retrospectively, the last year delivered a frustrating 12% decrease to the company's bottom line. Still, the latest three year period has seen an excellent 154% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 25% shows it's noticeably more attractive on an annualised basis.

With this information, we can see why Bigbloc Construction is trading at such a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Bottom Line On Bigbloc Construction's P/E

There's still some solid strength behind Bigbloc Construction's P/E, if not its share price lately. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Bigbloc Construction revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Bigbloc Construction (2 don't sit too well with us!) that you should be aware of before investing here.

Of course, you might also be able to find a better stock than Bigbloc Construction. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Bigbloc Construction might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BIGBLOC

Bigbloc Construction

Engages in the manufacturing, sales, and marketing of aerated autoclave concrete blocks in India.

Low risk with questionable track record.

Market Insights

Community Narratives