Bharat Rasayan (NSE:BHARATRAS) sheds 13% this week, as yearly returns fall more in line with earnings growth

The Bharat Rasayan Limited (NSE:BHARATRAS) share price has had a bad week, falling 13%. But at least the stock is up over the last five years. However we are not very impressed because the share price is only up 52%, less than the market return of 211%. Unfortunately not all shareholders will have held it for five years, so spare a thought for those caught in the 30% decline over the last three years: that's a long time to wait for profits.

While the stock has fallen 13% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

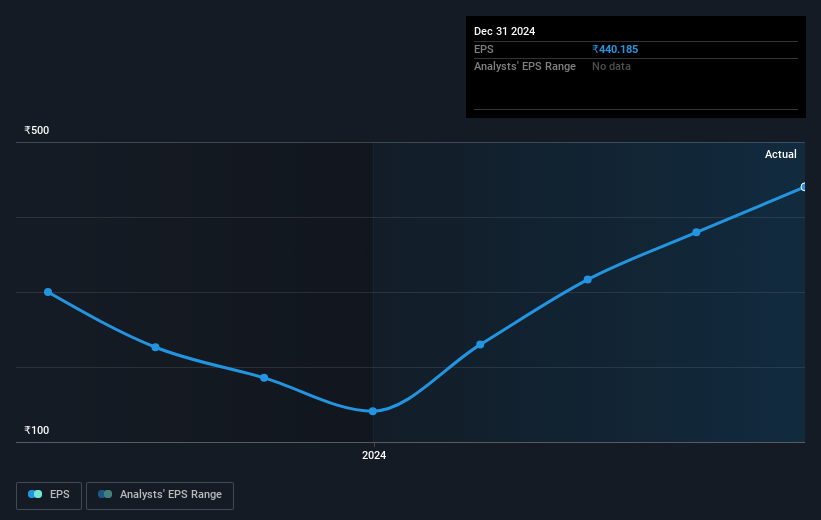

During five years of share price growth, Bharat Rasayan achieved compound earnings per share (EPS) growth of 4.4% per year. This EPS growth is lower than the 9% average annual increase in the share price. So it's fair to assume the market has a higher opinion of the business than it did five years ago. That's not necessarily surprising considering the five-year track record of earnings growth.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into Bharat Rasayan's key metrics by checking this interactive graph of Bharat Rasayan's earnings, revenue and cash flow .

A Different Perspective

While it's never nice to take a loss, Bharat Rasayan shareholders can take comfort that , including dividends,their trailing twelve month loss of 1.4% wasn't as bad as the market loss of around 3.2%. Of course, the long term returns are far more important and the good news is that over five years, the stock has returned 9% for each year. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. It's always interesting to track share price performance over the longer term. But to understand Bharat Rasayan better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Bharat Rasayan , and understanding them should be part of your investment process.

Of course Bharat Rasayan may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Bharat Rasayan might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BHARATRAS

Bharat Rasayan

Engages in the manufacture and sale of technical grade pesticides and intermediates in India.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives