Is Now The Time To Put Asian Paints (NSE:ASIANPAINT) On Your Watchlist?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In contrast to all that, I prefer to spend time on companies like Asian Paints (NSE:ASIANPAINT), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Asian Paints

How Quickly Is Asian Paints Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Asian Paints managed to grow EPS by 12% per year, over three years. That growth rate is fairly good, assuming the company can keep it up.

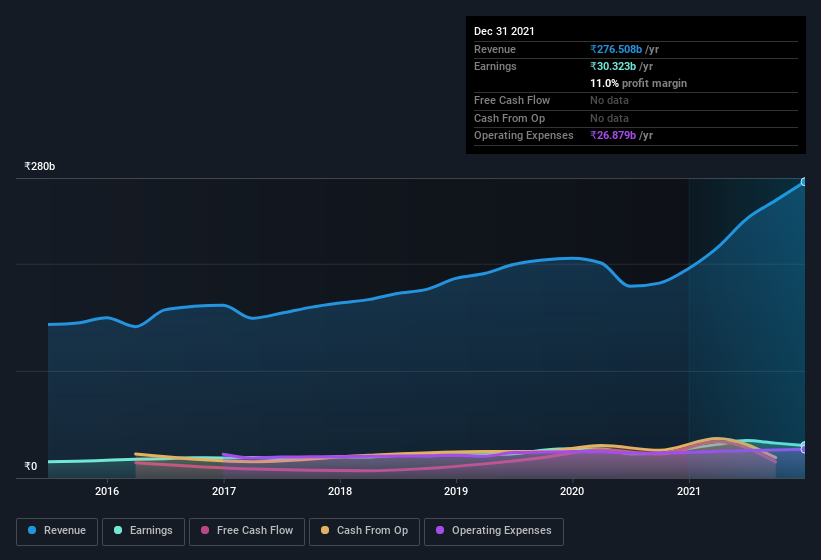

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. While Asian Paints did well to grow revenue over the last year, EBIT margins were dampened at the same time. So it seems the future my hold further growth, especially if EBIT margins can stabilize.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Asian Paints's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Asian Paints Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We haven't seen any insiders selling Asian Paints shares, in the last year. So it's definitely nice that Thulaseedharan Nair bought ₹1.2m worth of shares at an average price of around ₹3,029.

The good news, alongside the insider buying, for Asian Paints bulls is that insiders (collectively) have a meaningful investment in the stock. Notably, they have an enormous stake in the company, worth ₹261b. This suggests to me that leadership will be very mindful of shareholders' interests when making decisions!

Is Asian Paints Worth Keeping An Eye On?

One positive for Asian Paints is that it is growing EPS. That's nice to see. Better yet, insiders are significant shareholders, and have been buying more shares. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. You should always think about risks though. Case in point, we've spotted 1 warning sign for Asian Paints you should be aware of.

As a growth investor I do like to see insider buying. But Asian Paints isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ASIANPAINT

Asian Paints

Engages in the manufacturing, selling, and distribution of paints, coatings, and products related to home decoration and bath fittings in Asia, the Middle East, Africa, and the South Pacific region.

Excellent balance sheet established dividend payer.