We Ran A Stock Scan For Earnings Growth And Ambica Agarbathies Aroma & Industries (NSE:AMBICAAGAR) Passed With Ease

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Ambica Agarbathies Aroma & Industries (NSE:AMBICAAGAR). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Ambica Agarbathies Aroma & Industries

Ambica Agarbathies Aroma & Industries' Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. To the delight of shareholders, Ambica Agarbathies Aroma & Industries has achieved impressive annual EPS growth of 40%, compound, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

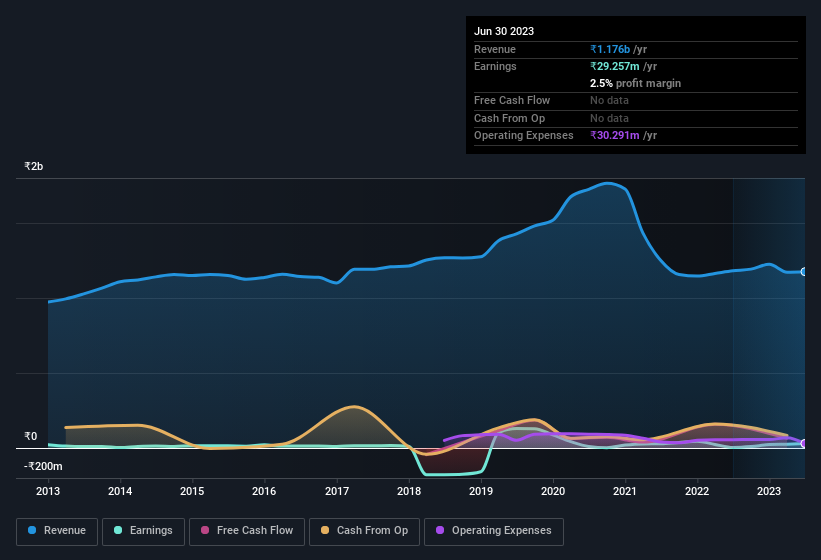

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Ambica Agarbathies Aroma & Industries' EBIT margins have fallen over the last twelve months, but the flat revenue sends a message of stability. Shareholders will be hopeful that the company can buck this trend.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Since Ambica Agarbathies Aroma & Industries is no giant, with a market capitalisation of ₹625m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Ambica Agarbathies Aroma & Industries Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So those who are interested in Ambica Agarbathies Aroma & Industries will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. In fact, they own 79% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. Of course, Ambica Agarbathies Aroma & Industries is a very small company, with a market cap of only ₹625m. That means insiders only have ₹492m worth of shares, despite the large proportional holding. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Well, based on the CEO pay, you'd argue that they are indeed. Our analysis has discovered that the median total compensation for the CEOs of companies like Ambica Agarbathies Aroma & Industries with market caps under ₹17b is about ₹3.6m.

The CEO of Ambica Agarbathies Aroma & Industries was paid just ₹2.4m in total compensation for the year ending March 2023. This total may indicate that the CEO is sacrificing take home pay for performance-based benefits, ensuring that their motivations are synonymous with strong company results. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add Ambica Agarbathies Aroma & Industries To Your Watchlist?

Ambica Agarbathies Aroma & Industries' earnings per share growth have been climbing higher at an appreciable rate. An added bonus for those interested is that management hold a heap of stock and the CEO pay is quite reasonable, illustrating good cash management. The drastic earnings growth indicates the business is going from strength to strength. Hopefully a trend that continues well into the future. Ambica Agarbathies Aroma & Industries certainly ticks a few boxes, so we think it's probably well worth further consideration. What about risks? Every company has them, and we've spotted 2 warning signs for Ambica Agarbathies Aroma & Industries you should know about.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:AMBICAAGAR

Ambica Agarbathies Aroma & Industries

Engages in the manufacture and sale of incense sticks in India and internationally.

Proven track record low.