- India

- /

- Healthcare Services

- /

- NSEI:KRSNAA

Flair Writing Industries And 2 Other Stocks On The Indian Exchange That May Be Undervalued

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has dropped 1.7%, but it has risen by 43% over the past year, with earnings expected to grow by 17% annually in the coming years. In this context, identifying undervalued stocks like Flair Writing Industries can be crucial for investors looking to capitalize on potential growth opportunities amidst fluctuating market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| HEG (NSEI:HEG) | ₹2058.80 | ₹3911.74 | 47.4% |

| Shyam Metalics and Energy (NSEI:SHYAMMETL) | ₹744.45 | ₹1127.96 | 34% |

| S Chand (NSEI:SCHAND) | ₹225.48 | ₹352.53 | 36% |

| Krsnaa Diagnostics (NSEI:KRSNAA) | ₹695.55 | ₹1165.33 | 40.3% |

| Titagarh Rail Systems (NSEI:TITAGARH) | ₹1348.70 | ₹2160.82 | 37.6% |

| RITES (NSEI:RITES) | ₹685.15 | ₹1047.32 | 34.6% |

| Prataap Snacks (NSEI:DIAMONDYD) | ₹880.80 | ₹1509.79 | 41.7% |

| Texmaco Rail & Engineering (NSEI:TEXRAIL) | ₹244.30 | ₹395.48 | 38.2% |

| Piramal Pharma (NSEI:PPLPHARMA) | ₹181.52 | ₹289.56 | 37.3% |

| Strides Pharma Science (NSEI:STAR) | ₹1142.70 | ₹2032.10 | 43.8% |

Let's dive into some prime choices out of the screener.

Flair Writing Industries (NSEI:FLAIR)

Overview: Flair Writing Industries Limited manufactures and sells writing instruments, stationeries, and other allied products in India and internationally, with a market cap of ₹32.94 billion.

Operations: Revenue segments include writing instruments, stationeries, and other allied products.

Estimated Discount To Fair Value: 15.7%

Flair Writing Industries appears undervalued based on cash flows, trading at ₹312.5, below its estimated fair value of ₹370.71. Despite recent enforcement actions and a slight decline in net income for Q1 2024, the company’s earnings are forecast to grow significantly at 20.9% per year over the next three years, outpacing the Indian market's average growth rate of 16.8%. Additionally, revenue is expected to increase by 15.9% annually, indicating strong future prospects despite current challenges.

- Our growth report here indicates Flair Writing Industries may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Flair Writing Industries.

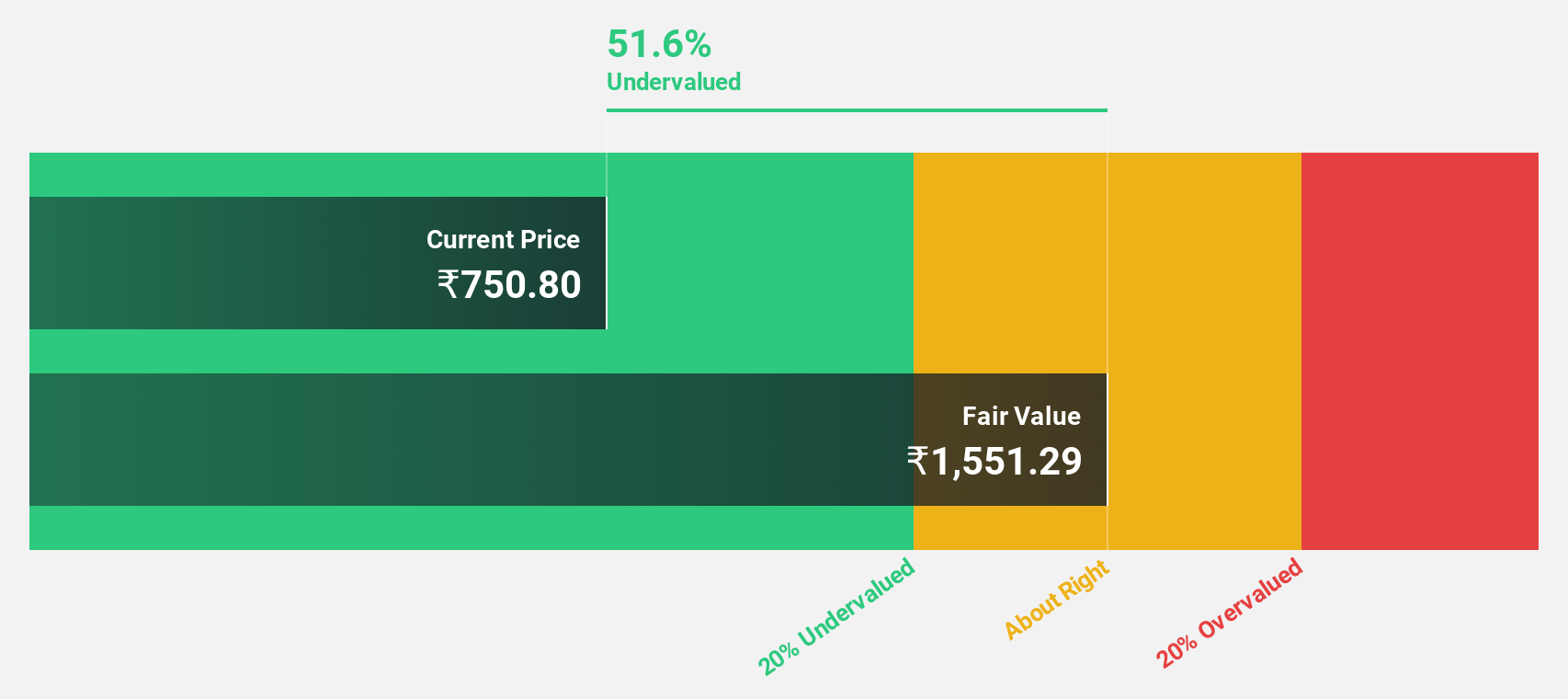

Krsnaa Diagnostics (NSEI:KRSNAA)

Overview: Krsnaa Diagnostics Limited provides diagnostic services and has a market cap of ₹22.46 billion.

Operations: The company generates revenue from diagnostic services.

Estimated Discount To Fair Value: 40.3%

Krsnaa Diagnostics Limited is trading at ₹695.55, significantly below its estimated fair value of ₹1,165.33. The company's Q1 2024 earnings report showed a notable increase in net income to ₹179.21 million from ₹146.43 million year-over-year, and revenue rose to ₹1,775.48 million from ₹1,438.01 million a year ago. Despite recent executive changes, Krsnaa's earnings are forecast to grow 36.85% annually over the next three years, outpacing the Indian market's average growth rate of 16.8%.

- Our earnings growth report unveils the potential for significant increases in Krsnaa Diagnostics' future results.

- Unlock comprehensive insights into our analysis of Krsnaa Diagnostics stock in this financial health report.

RITES (NSEI:RITES)

Overview: RITES Limited, with a market cap of ₹164.64 billion, offers consultancy, engineering, and project management services across railways, highways, airports, ports, ropeways, urban transport, inland waterways and renewable energy sectors.

Operations: RITES Limited's revenue segments include Export Sale (₹699 million), Power Generation (₹177.80 million), Leasing - Domestic (₹1.41 billion), Consultancy - Abroad (₹766.10 million), Consultancy - Domestic (₹11.79 billion), and Turnkey Construction Projects - Domestic (₹9.10 billion).

Estimated Discount To Fair Value: 34.6%

RITES Limited, trading at ₹685.15, is significantly undervalued with an estimated fair value of ₹1,047.32. Despite a recent show cause notice involving potential liabilities over ₹1.55 billion, the company maintains robust financial health with no immediate operational impact. Recent contracts and partnerships bolster its revenue prospects, while earnings are forecast to grow at 23.5% annually over the next three years, outpacing the Indian market's average growth rate of 16.8%.

- Our comprehensive growth report raises the possibility that RITES is poised for substantial financial growth.

- Navigate through the intricacies of RITES with our comprehensive financial health report here.

Turning Ideas Into Actions

- Unlock more gems! Our Undervalued Indian Stocks Based On Cash Flows screener has unearthed 25 more companies for you to explore.Click here to unveil our expertly curated list of 28 Undervalued Indian Stocks Based On Cash Flows.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

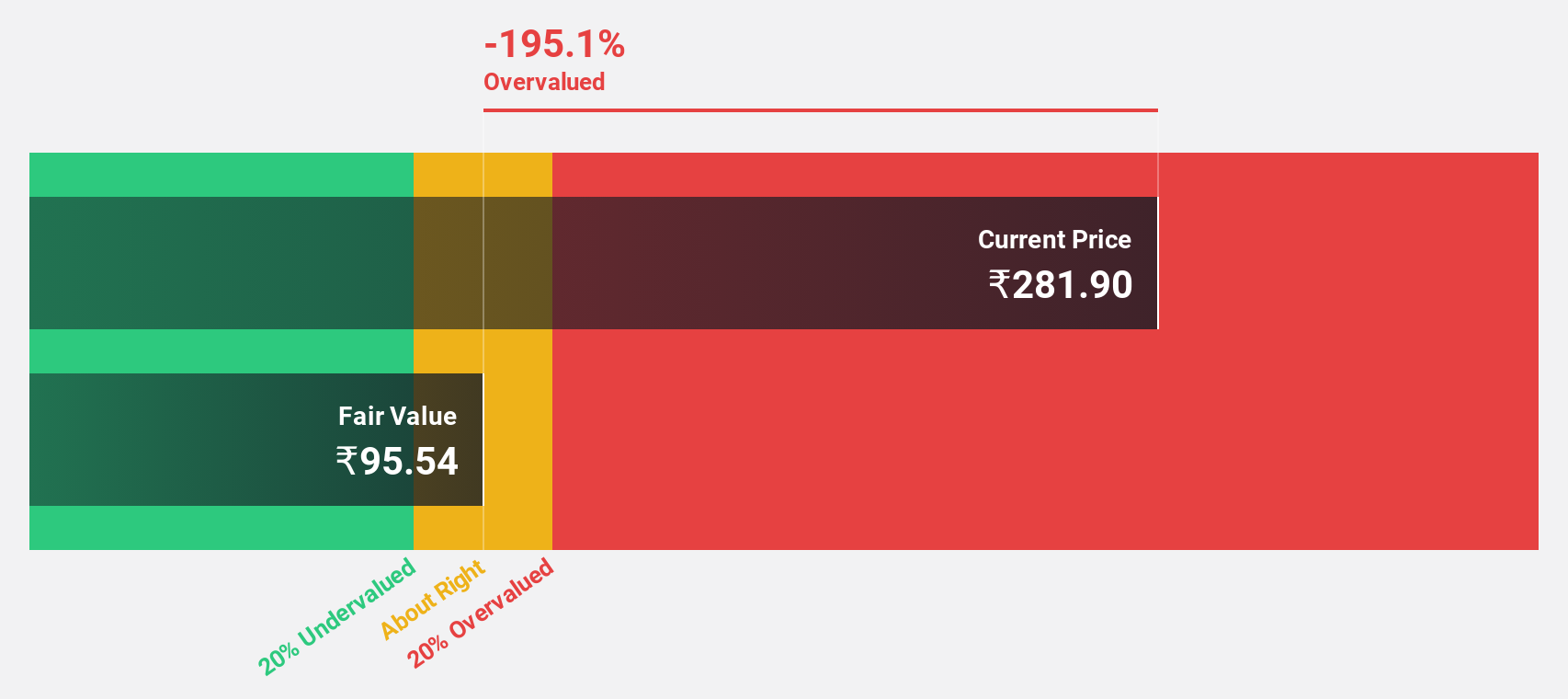

Valuation is complex, but we're here to simplify it.

Discover if Krsnaa Diagnostics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:KRSNAA

Undervalued with high growth potential.