Uncovering Advanced Enzyme Technologies And 2 Other Promising Indian Small Caps

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has dropped 1.1%, but it remains up 40% over the past year with earnings expected to grow by 17% per annum. In this dynamic environment, identifying promising small-cap stocks like Advanced Enzyme Technologies can be key to capitalizing on growth opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bharat Rasayan | 8.15% | 0.10% | -7.93% | ★★★★★★ |

| Om Infra | 13.99% | 43.36% | 27.64% | ★★★★★☆ |

| Indo Tech Transformers | 2.30% | 22.05% | 60.31% | ★★★★★☆ |

| Ingersoll-Rand (India) | 1.05% | 14.88% | 27.54% | ★★★★★☆ |

| Genesys International | 12.13% | 15.75% | 36.33% | ★★★★★☆ |

| BLS E-Services | 1.67% | 15.04% | 51.58% | ★★★★★☆ |

| Monarch Networth Capital | 32.66% | 31.02% | 50.24% | ★★★★☆☆ |

| Sky Gold | 127.01% | 22.02% | 48.03% | ★★★★☆☆ |

| Sanstar | 50.30% | -8.41% | 48.59% | ★★★★☆☆ |

| Rir Power Electronics | 54.23% | 16.42% | 34.78% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Advanced Enzyme Technologies (NSEI:ADVENZYMES)

Simply Wall St Value Rating: ★★★★★★

Overview: Advanced Enzyme Technologies Limited, together with its subsidiaries, engages in the research, development, manufacture, and marketing of enzymes and probiotics in India, Europe, the United States, Asia, and internationally with a market cap of ₹57.14 billion.

Operations: Advanced Enzyme Technologies generates revenue primarily from the manufacturing and sales of enzymes, amounting to ₹6.31 billion. The company's financial performance includes a notable gross profit margin of 55%.

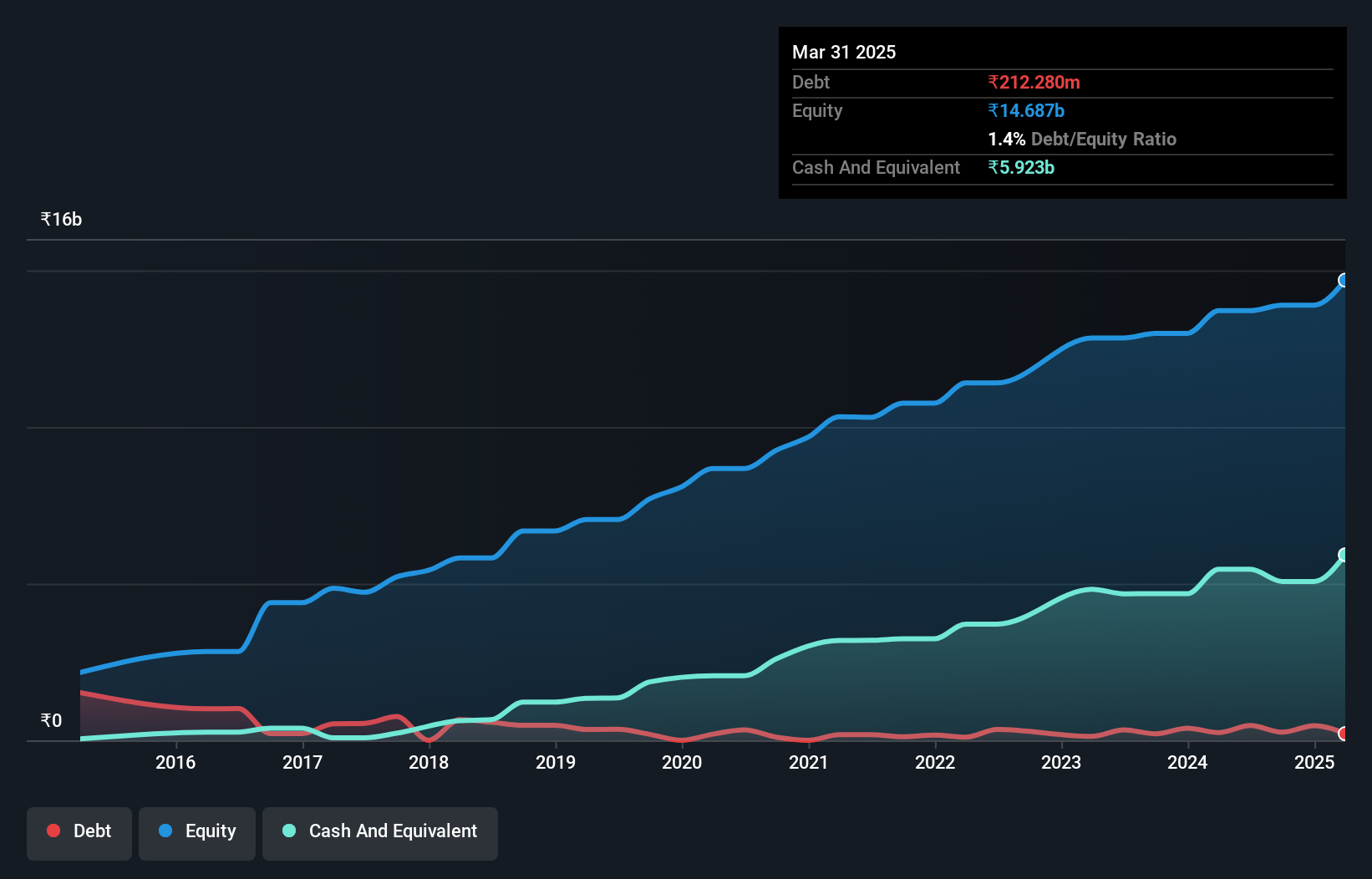

Advanced Enzyme Technologies has shown promising growth, with earnings rising 18.9% over the past year, outpacing the Chemicals industry’s 10.7%. The company’s debt to equity ratio improved from 5% to 3.5% in five years, and it holds more cash than its total debt. Recent Q1 results reported sales of ₹1,545 million and net income of ₹341 million compared to ₹288 million a year ago. Earnings per share increased from ₹2.58 to ₹3.05, reflecting solid performance despite insider selling in the last quarter.

Gokul Agro Resources (NSEI:GOKULAGRO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Gokul Agro Resources Limited engages in the manufacture and trading of edible and non-edible oils, meals, and other agro products in India, with a market cap of ₹44.60 billion.

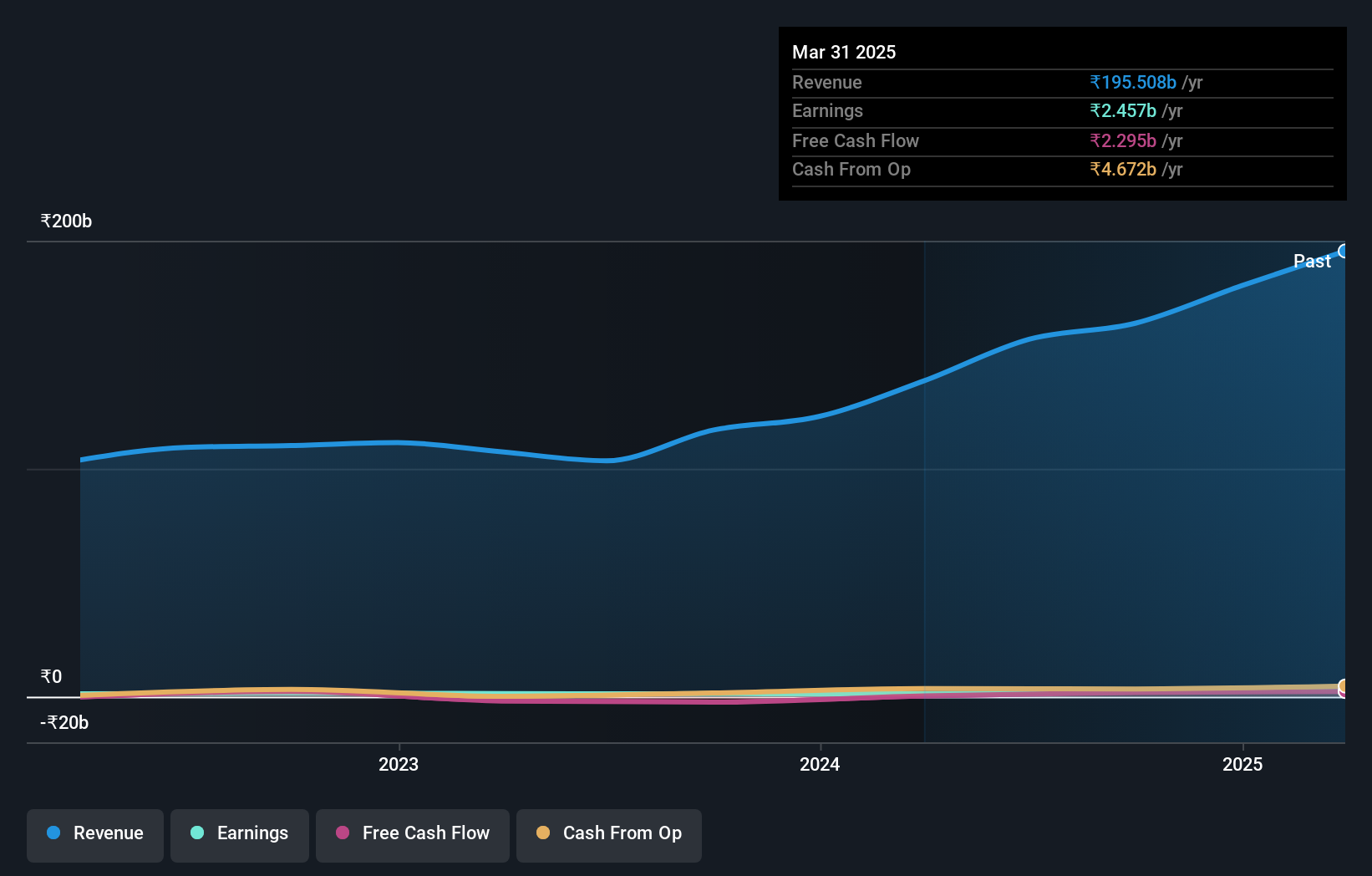

Operations: The primary revenue stream for Gokul Agro Resources Limited is from agro-based commodities, amounting to ₹156.80 billion. The company has a market cap of ₹44.60 billion.

Gokul Agro Resources has shown impressive financial health with a 28.4% earnings growth over the past year, outpacing the Food industry’s 16.6%. The debt to equity ratio improved significantly from 124.4% to 76.8% in five years, while its net debt to equity stands at a satisfactory 20.1%. Despite an EBIT coverage of interest payments at only 2.3x, the company remains profitable and free cash flow positive, indicating strong operational efficiency and stability in its sector.

Zaggle Prepaid Ocean Services (NSEI:ZAGGLE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Zaggle Prepaid Ocean Services Limited develops financial products and solutions to manage business expenses for corporates, SMEs, and startups through automated workflows, with a market cap of ₹54.06 billion.

Operations: Zaggle Prepaid Ocean Services generates revenue primarily from program fees (₹4.01 billion), gift cards (₹4.76 billion), and platform/SaaS/service fees (₹326.27 million).

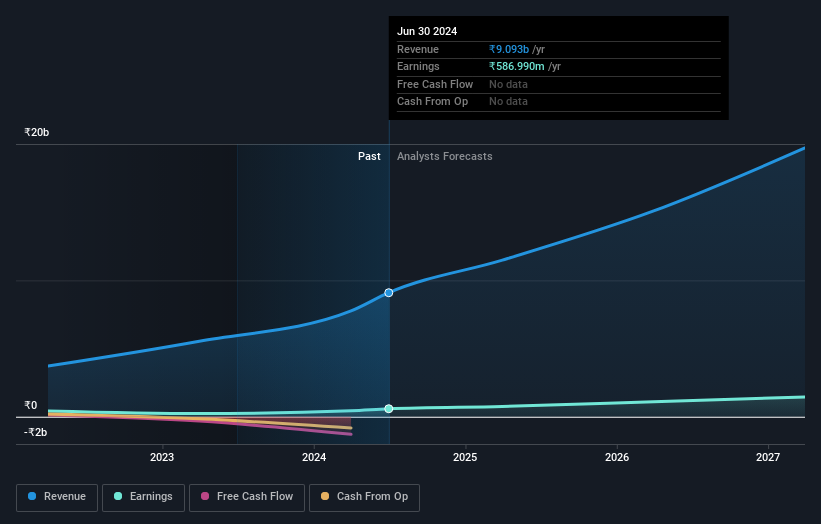

Zaggle Prepaid Ocean Services has shown impressive earnings growth of 108.5% over the past year, far outpacing the software industry's 32.4%. Recent agreements with major firms like HDFC ERGO and Blue Star Ltd highlight its expanding client base and service offerings. Despite a negative levered free cash flow of INR -1286.90 million as of March 2024, Zaggle's EBIT covers interest payments by 31.5 times, indicating strong financial health. The company also reported significant revenue growth for Q1 2025, reaching INR 2,567.23 million from INR 1,199.35 million a year ago.

- Click here to discover the nuances of Zaggle Prepaid Ocean Services with our detailed analytical health report.

Understand Zaggle Prepaid Ocean Services' track record by examining our Past report.

Seize The Opportunity

- Access the full spectrum of 481 Indian Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zaggle Prepaid Ocean Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:ZAGGLE

Zaggle Prepaid Ocean Services

Zaggle Prepaid Ocean Services Limited builds financial products and solutions to manage the business expenses of corporates, small and medium-sized enterprises, and startups through automated workflows.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives