- India

- /

- Oil and Gas

- /

- NSEI:BPCL

Revenues Working Against Bharat Petroleum Corporation Limited's (NSE:BPCL) Share Price

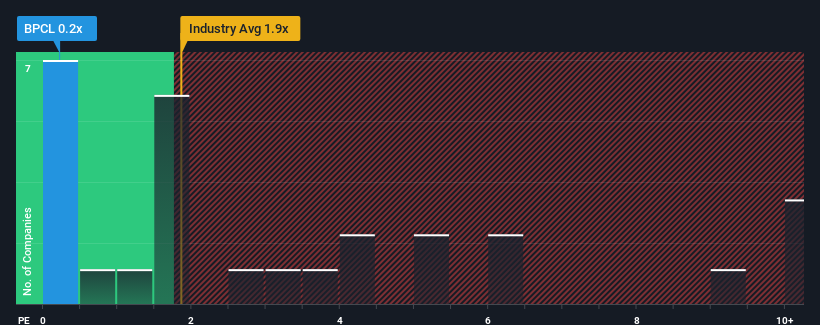

Bharat Petroleum Corporation Limited's (NSE:BPCL) price-to-sales (or "P/S") ratio of 0.2x might make it look like a buy right now compared to the Oil and Gas industry in India, where around half of the companies have P/S ratios above 1.9x and even P/S above 6x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Bharat Petroleum

What Does Bharat Petroleum's Recent Performance Look Like?

There hasn't been much to differentiate Bharat Petroleum's and the industry's revenue growth lately. One possibility is that the P/S ratio is low because investors think this modest revenue performance may begin to slide. Those who are bullish on Bharat Petroleum will be hoping that this isn't the case.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Bharat Petroleum.How Is Bharat Petroleum's Revenue Growth Trending?

Bharat Petroleum's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a decent 4.1% gain to the company's revenues. Pleasingly, revenue has also lifted 96% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 1.9% as estimated by the analysts watching the company. With the industry predicted to deliver 8.1% growth, that's a disappointing outcome.

With this in consideration, we find it intriguing that Bharat Petroleum's P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Bharat Petroleum's P/S is on the lower end of the spectrum. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 2 warning signs for Bharat Petroleum (1 doesn't sit too well with us!) that you should be aware of.

If these risks are making you reconsider your opinion on Bharat Petroleum, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Bharat Petroleum might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BPCL

Bharat Petroleum

Primarily engages in refining crude oil and marketing petroleum products in India and internationally.

Adequate balance sheet average dividend payer.