Stock Analysis

- India

- /

- Consumer Finance

- /

- NSEI:SBICARD

Investors in SBI Cards and Payment Services (NSE:SBICARD) have seen returns of 21% over the past three years

Low-cost index funds make it easy to achieve average market returns. But across the board there are plenty of stocks that underperform the market. That's what has happened with the SBI Cards and Payment Services Limited (NSE:SBICARD) share price. It's up 20% over three years, but that is below the market return. Disappointingly, the share price is down 2.0% in the last year.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

View our latest analysis for SBI Cards and Payment Services

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

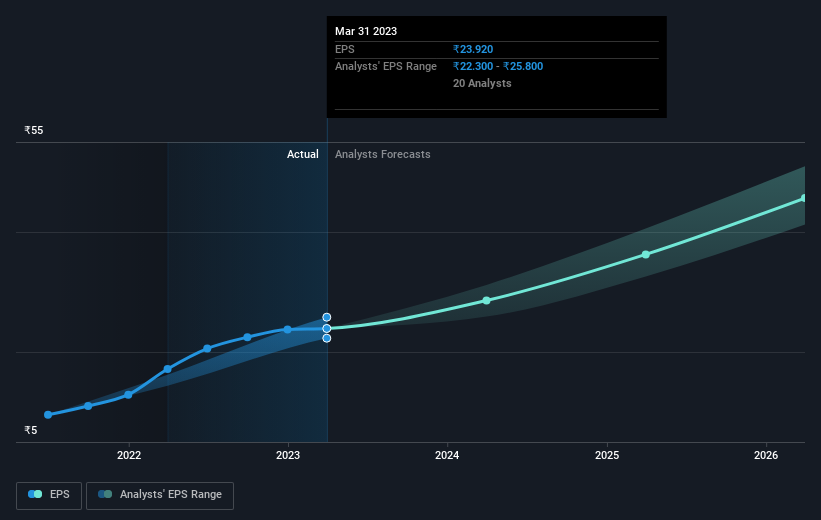

SBI Cards and Payment Services was able to grow its EPS at 21% per year over three years, sending the share price higher. The average annual share price increase of 6% is actually lower than the EPS growth. Therefore, it seems the market has moderated its expectations for growth, somewhat.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Over the last year, SBI Cards and Payment Services shareholders took a loss of 1.7%, including dividends. In contrast the market gained about 20%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Fortunately the longer term story is brighter, with total returns averaging about 6% per year over three years. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. It's always interesting to track share price performance over the longer term. But to understand SBI Cards and Payment Services better, we need to consider many other factors. Even so, be aware that SBI Cards and Payment Services is showing 2 warning signs in our investment analysis , you should know about...

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether SBI Cards and Payment Services is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SBICARD

SBI Cards and Payment Services

SBI Cards and Payment Services Limited, a non-banking financial company, issues credit cards to individual and corporate customers in India.

Reasonable growth potential with mediocre balance sheet.