- India

- /

- Capital Markets

- /

- NSEI:IIFLSEC

Undiscovered Gems in India To Explore This August 2024

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has risen 1.8%, and in the past year, it has climbed an impressive 46%, with earnings forecasted to grow by 17% annually. In this thriving environment, identifying stocks with strong fundamentals and growth potential can uncover some truly promising opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bengal & Assam | 4.48% | 1.53% | 51.11% | ★★★★★★ |

| Vidhi Specialty Food Ingredients | 7.27% | 11.00% | 4.02% | ★★★★★★ |

| All E Technologies | NA | 40.78% | 31.63% | ★★★★★★ |

| NGL Fine-Chem | 12.95% | 15.22% | 8.68% | ★★★★★★ |

| Knowledge Marine & Engineering Works | 35.48% | 42.61% | 42.95% | ★★★★★★ |

| Voith Paper Fabrics India | 0.07% | 10.95% | 9.70% | ★★★★★☆ |

| Gallantt Ispat | 18.85% | 37.56% | 37.26% | ★★★★★☆ |

| Indo Tech Transformers | 2.30% | 22.04% | 60.31% | ★★★★★☆ |

| SG Mart | 16.77% | 98.09% | 96.54% | ★★★★☆☆ |

| Vasa Denticity | 0.11% | 38.37% | 48.77% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

IIFL Securities (NSEI:IIFLSEC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: IIFL Securities Limited offers capital market services in India's primary and secondary markets, with a market cap of ₹85.13 billion.

Operations: IIFL Securities Limited generates revenue primarily from capital market activities (₹20.25 billion), with additional income from facilities and ancillary services (₹375.25 million) and insurance broking and ancillary services (₹2.77 billion).

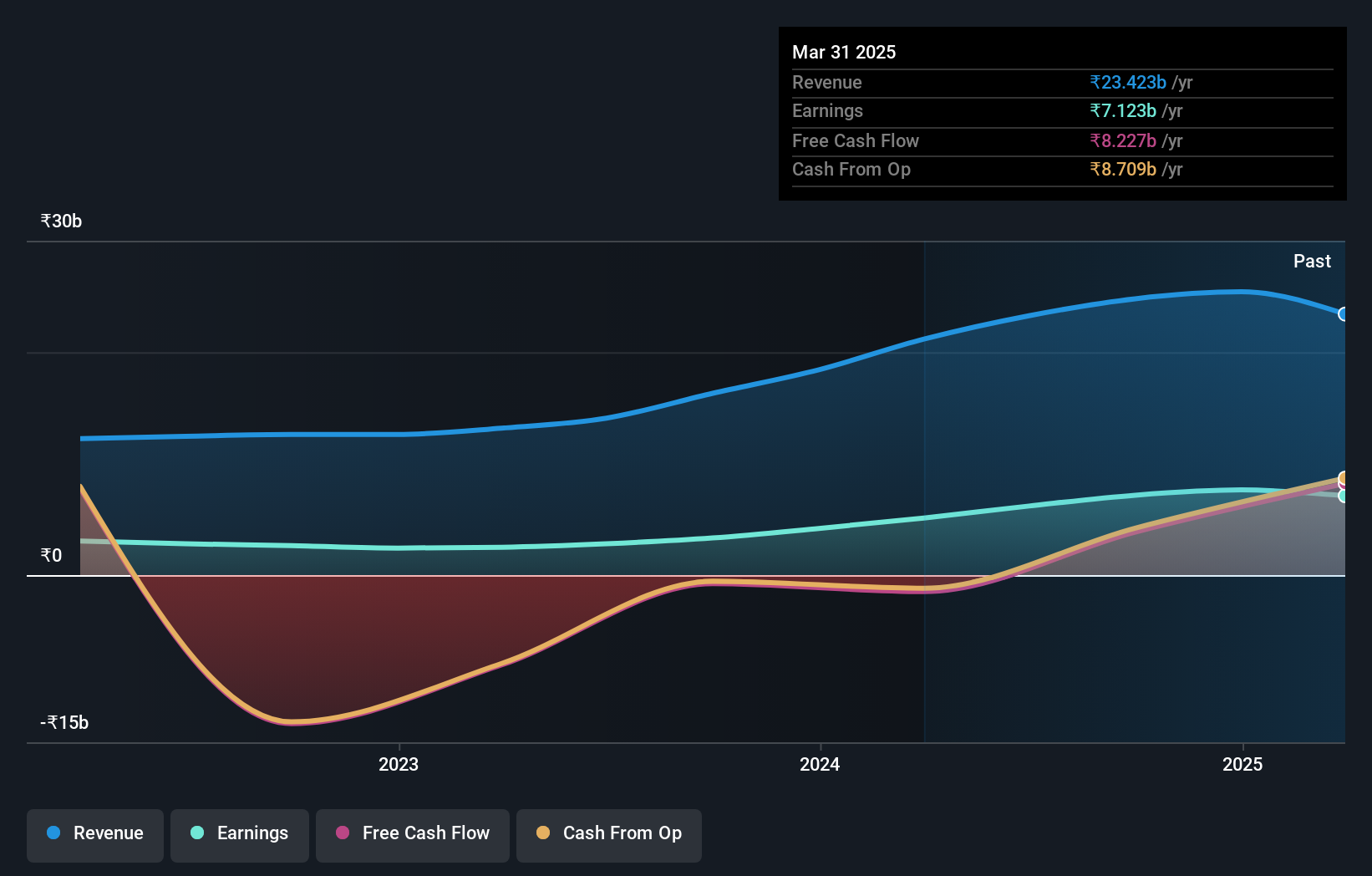

IIFL Securities has shown impressive growth, with earnings rising by 120.4% over the past year, outpacing the Capital Markets industry’s 63.6%. The debt to equity ratio has improved from 117.6% to 67.2% in five years, and its net debt to equity stands at a satisfactory 35.5%. Despite recent volatility in its share price and a regulatory penalty of INR 300K, IIFLSEC remains a strong performer with a P/E ratio of 13.7x compared to the Indian market's average of 33.9x.

- Click here and access our complete health analysis report to understand the dynamics of IIFL Securities.

Understand IIFL Securities' track record by examining our Past report.

Inox Green Energy Services (NSEI:INOXGREEN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Inox Green Energy Services Limited provides operation and maintenance services and common infrastructure facilities for wind turbine generators in India, with a market cap of ₹74.79 billion.

Operations: The primary revenue stream for Inox Green Energy Services Limited comes from operation and maintenance services, amounting to ₹1.66 billion. The company also reports a segment adjustment of ₹244.10 million.

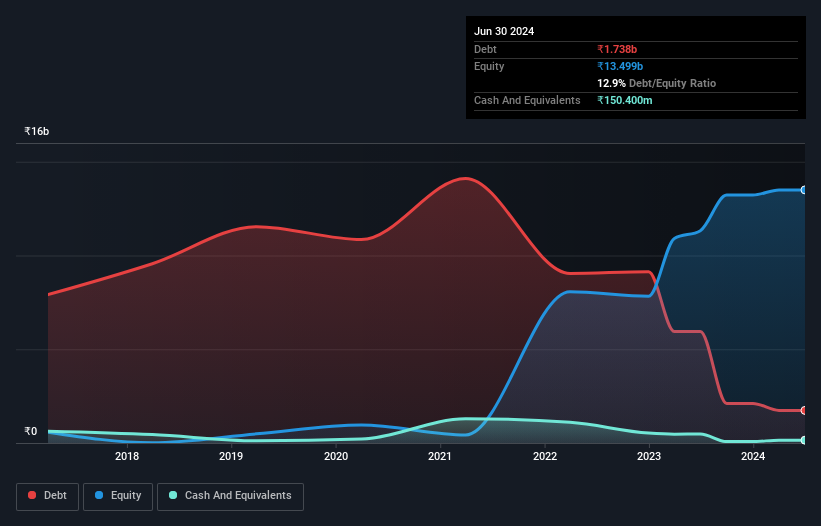

Inox Green Energy Services has shown significant improvement in its financial health, with its net debt to equity ratio dropping from 1870.3% to 12.9% over five years, now at a satisfactory 11.8%. The company reported INR 547.2 million in revenue for Q1 2024 despite a dip from the previous year’s INR 583.1 million, and net income increased to INR 37.5 million from INR 26.2 million last year. However, interest payments on debt are not well covered by EBIT (0.6x).

Raymond (NSEI:RAYMOND)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Raymond Limited operates as a textile, lifestyle, and branded apparel company in India and internationally with a market cap of ₹137.25 billion.

Operations: Raymond Limited generates revenue primarily from its Real Estate and Development of Property segment (₹18.47 billion), Auto Components (₹4.42 billion), and Tools & Hardware (₹4.09 billion).

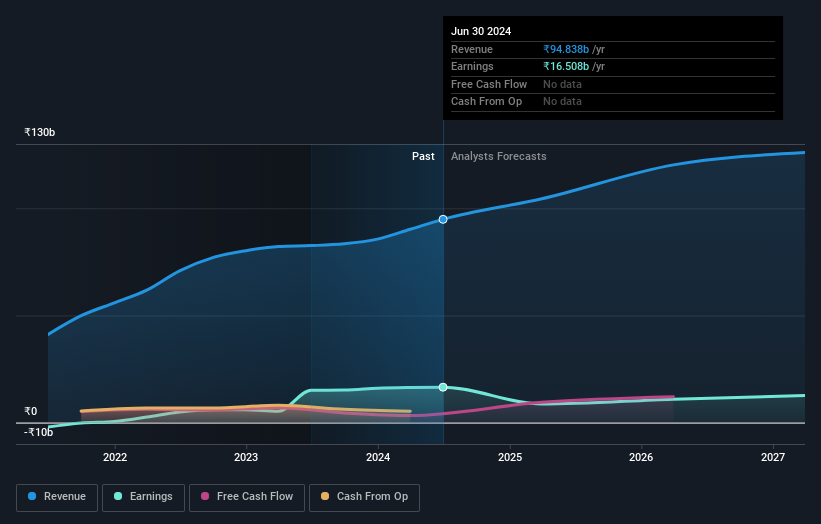

Raymond's net debt to equity ratio stands at 55.5%, which is considered high, but the company has reduced this from 121.2% over the past five years. Earnings have grown at an impressive 60.1% per year during this period, though future earnings are forecasted to decline by 12.8% annually for the next three years. Despite significant insider selling recently, Raymond trades at a value 18.2% below its estimated fair value and maintains solid EBIT coverage of interest payments at 3.7x.

- Dive into the specifics of Raymond here with our thorough health report.

Explore historical data to track Raymond's performance over time in our Past section.

Where To Now?

- Gain an insight into the universe of 468 Indian Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:IIFLSEC

IIFL Securities

Provides capital market services in the primary and secondary markets in India.

Outstanding track record with adequate balance sheet.