Stock Analysis

Exploring Dividend Stocks: Avoid Mahindra Logistics For One Superior Option

Reviewed by Sasha Jovanovic

In the search for steady dividends from Indian stocks, investors often face a mix of attractive and risky options. A critical factor to consider is the dividend cover, particularly in companies with high payout ratios. Such ratios might suggest higher immediate returns but can also indicate underlying financial stress or a lack of sustainability in dividend payments, as seen with Mahindra Logistics.

Top 10 Dividend Stocks In India

| Name | Dividend Yield | Dividend Rating |

| Balmer Lawrie Investments (BSE:532485) | 4.12% | ★★★★★★ |

| Bhansali Engineering Polymers (BSE:500052) | 2.83% | ★★★★★★ |

| D. B (NSEI:DBCORP) | 3.65% | ★★★★★☆ |

| ITC (NSEI:ITC) | 3.20% | ★★★★★☆ |

| Castrol India (BSE:500870) | 2.99% | ★★★★★☆ |

| HCL Technologies (NSEI:HCLTECH) | 3.41% | ★★★★★☆ |

| Indian Oil (NSEI:IOC) | 8.23% | ★★★★★☆ |

| VST Industries (BSE:509966) | 3.72% | ★★★★★☆ |

| Redington (NSEI:REDINGTON) | 3.27% | ★★★★★☆ |

| PTC India (NSEI:PTC) | 3.67% | ★★★★★☆ |

Click here to see the full list of 18 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results and one of the companies to potentially avoid.

Top Pick

Monte Carlo Fashions (NSEI:MONTECARLO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Monte Carlo Fashions Limited specializes in the production and sale of woolen, cotton, and blended fabric garments both in India and abroad, with a market capitalization of approximately ₹14.22 billion.

Operations: The company generates ₹10.62 billion primarily from the manufacturing and trading of textile garments.

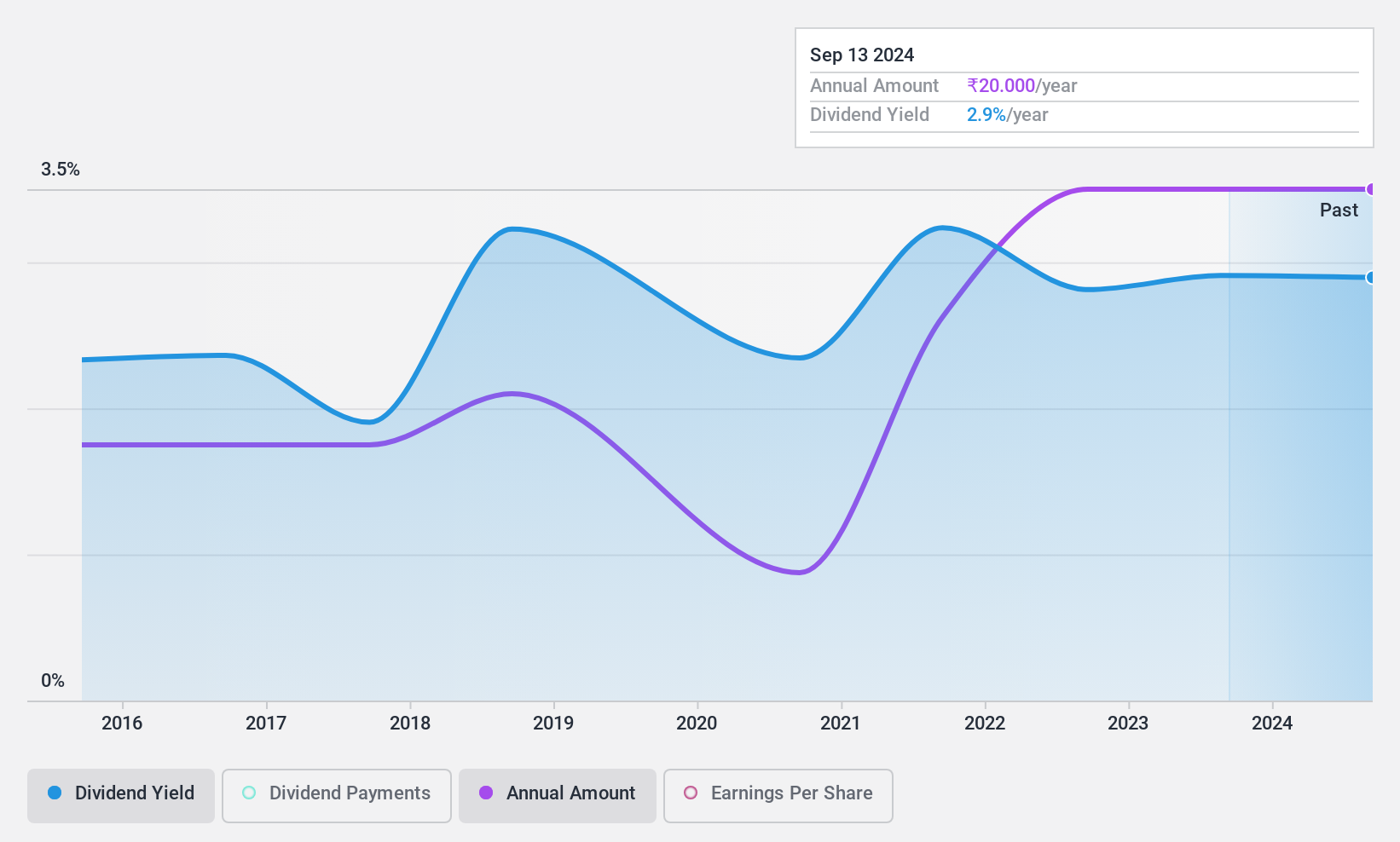

Dividend Yield: 2.9%

Monte Carlo Fashions, despite a challenging fiscal year with a net loss in Q4 2024 and reduced annual profits, maintained its dividend commitment, declaring a final dividend of INR 20 per share. This is supported by a sustainable payout ratio of 69.2% and cash payout ratio of 88.8%, contrasting sharply with some peers struggling with overly high payout ratios. However, the company's dividends have shown volatility over the past nine years, indicating potential concerns for those seeking stable income streams from dividends.

- Click here to discover the nuances of Monte Carlo Fashions with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Monte Carlo Fashions is priced higher than what may be justified by its financials.

One To Reconsider

Mahindra Logistics (NSEI:MAHLOG)

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: Mahindra Logistics Limited operates in providing integrated logistics and mobility solutions both in India and globally, with a market capitalization of approximately ₹37.31 billion.

Operations: The company generates revenue primarily through two segments: Supply Chain Management at ₹51.78 billion and Enterprise Mobility Services at ₹3.28 billion.

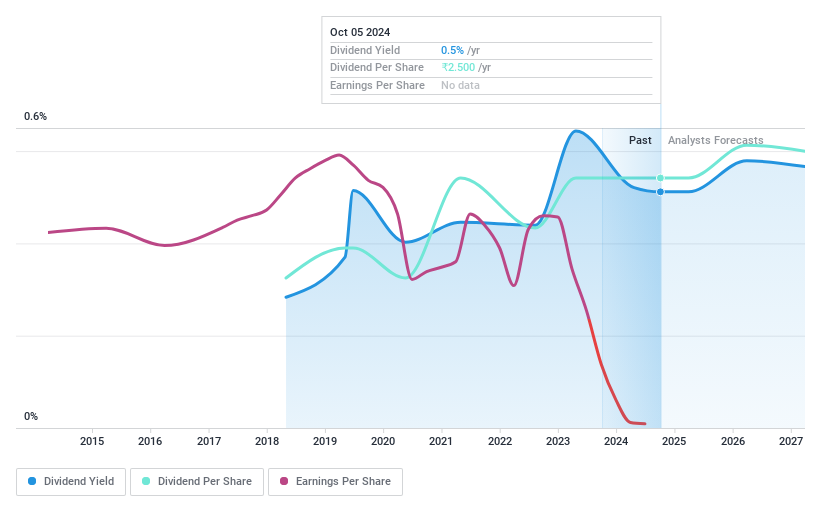

Dividend Yield: 0.5%

Mahindra Logistics, despite its recent venture into a joint business with Seino for warehousing and trucking services, faces challenges as a dividend stock. The company's dividend yield of 0.48% is low compared to the market's top quartile, and its dividends are not well-supported by earnings or cash flows. Additionally, the firm reported a significant shift from net income in the previous year to a net loss of INR 547.4 million in FY 2024, further straining its financial position and impacting dividend sustainability.

Taking Advantage

- Dive into all 18 of the Top Dividend Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Mahindra Logistics is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:MAHLOG

Mahindra Logistics

Provides integrated logistics and mobility solutions in India and internationally.

Undervalued with high growth potential.