- India

- /

- Consumer Durables

- /

- NSEI:JCHAC

Johnson Controls-Hitachi Air Conditioning India Limited's (NSE:JCHAC) P/S Is Still On The Mark Following 26% Share Price Bounce

Despite an already strong run, Johnson Controls-Hitachi Air Conditioning India Limited (NSE:JCHAC) shares have been powering on, with a gain of 26% in the last thirty days. The last 30 days bring the annual gain to a very sharp 82%.

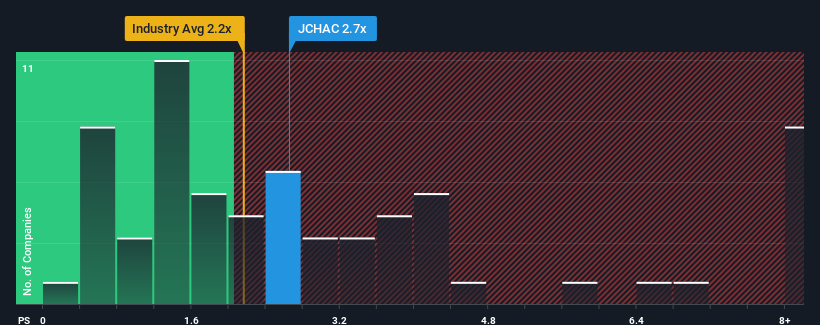

Even after such a large jump in price, there still wouldn't be many who think Johnson Controls-Hitachi Air Conditioning India's price-to-sales (or "P/S") ratio of 2.7x is worth a mention when the median P/S in India's Consumer Durables industry is similar at about 2.2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Johnson Controls-Hitachi Air Conditioning India

What Does Johnson Controls-Hitachi Air Conditioning India's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Johnson Controls-Hitachi Air Conditioning India's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Johnson Controls-Hitachi Air Conditioning India's future stacks up against the industry? In that case, our free report is a great place to start.How Is Johnson Controls-Hitachi Air Conditioning India's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Johnson Controls-Hitachi Air Conditioning India's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 20%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 17% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 34% as estimated by the dual analysts watching the company. With the industry predicted to deliver 31% growth , the company is positioned for a comparable revenue result.

With this information, we can see why Johnson Controls-Hitachi Air Conditioning India is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Key Takeaway

Johnson Controls-Hitachi Air Conditioning India's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at Johnson Controls-Hitachi Air Conditioning India's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Johnson Controls-Hitachi Air Conditioning India that you should be aware of.

If these risks are making you reconsider your opinion on Johnson Controls-Hitachi Air Conditioning India, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Bosch Home Comfort India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:JCHAC

Bosch Home Comfort India

Manufactures and distributes air conditioners, chillers, refrigerators, air purifiers, and variable refrigerant flow systems in India and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives