- India

- /

- Healthcare Services

- /

- NSEI:APOLLOHOSP

Top Indian Growth Companies With High Insider Ownership August 2024

Reviewed by Simply Wall St

In the last week, the Indian market is up 2.8%, contributing to an impressive 48% increase over the past 12 months, with earnings forecasted to grow by 16% annually. In such a robust market environment, companies with high insider ownership often signal strong growth potential and alignment of interests between shareholders and management.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.6% | 30.1% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.9% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.6% | 36.1% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.2% |

| Shivalik Bimetal Controls (BSE:513097) | 19.5% | 28.7% |

| Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 31.9% | 20.7% |

| Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

| JNK India (NSEI:JNKINDIA) | 20.9% | 31.8% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 36% |

| KEI Industries (BSE:517569) | 19.1% | 20.1% |

Let's take a closer look at a couple of our picks from the screened companies.

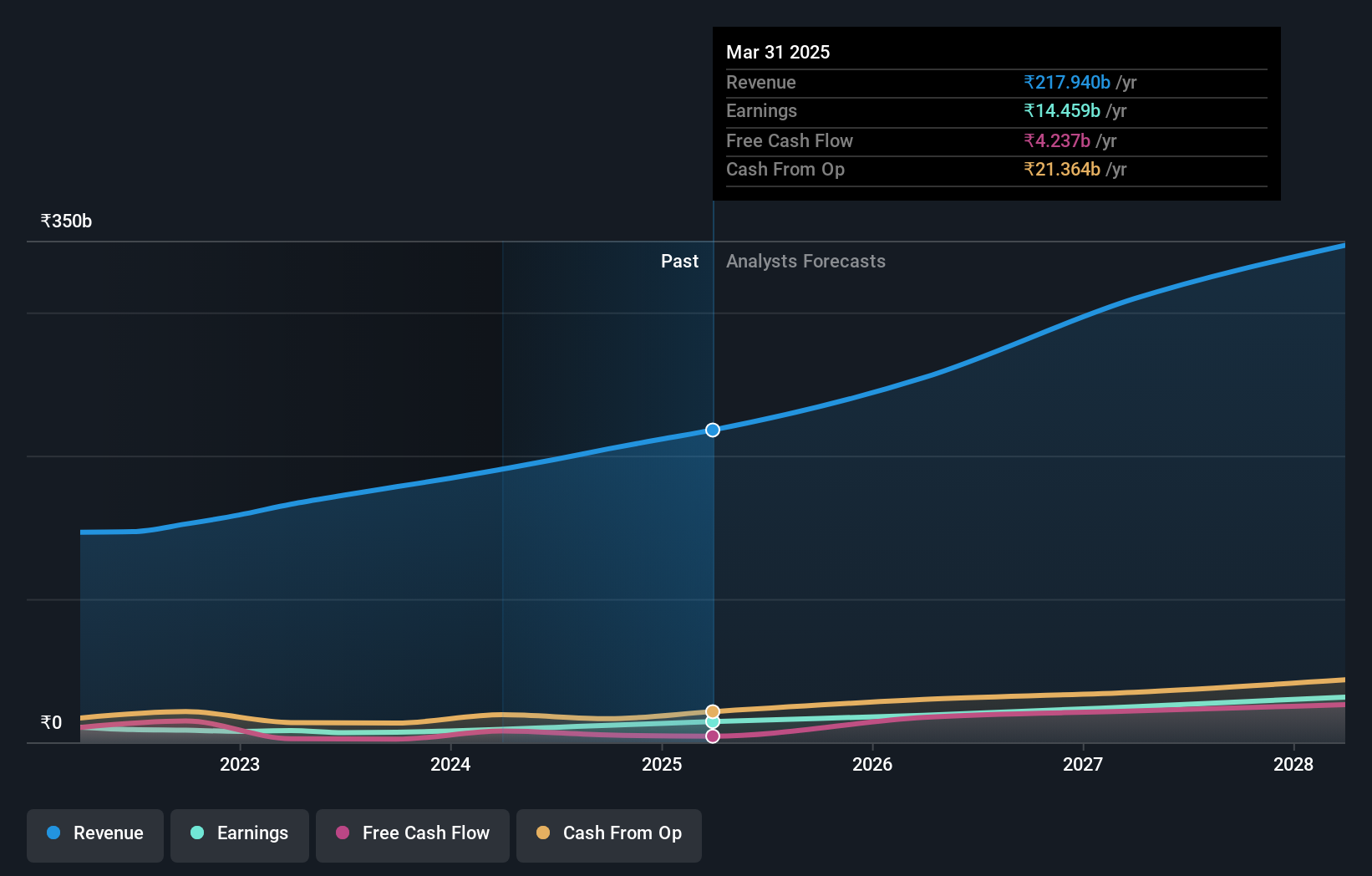

Apollo Hospitals Enterprise (NSEI:APOLLOHOSP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Apollo Hospitals Enterprise Limited, with a market cap of ₹951.18 billion, provides healthcare services in India and internationally through its subsidiaries.

Operations: Apollo Hospitals Enterprise Limited generates revenue primarily from Healthcare Services (₹99.39 billion), Digital Health & Pharmacy Distribution (₹78.27 billion), and Retail Health & Diagnostics (₹13.64 billion).

Insider Ownership: 10.4%

Earnings Growth Forecast: 33% p.a.

Apollo Hospitals Enterprise has demonstrated robust growth, with earnings increasing by 25% annually over the past five years and a forecasted profit growth of 33% per year. Recent developments include interest in acquiring Jaypee Healthcare, indicative of its expansion strategy. Despite a leadership change with Ms Shobana Kamineni stepping down as Executive Vice Chairperson, the company remains focused on its omni-channel pharmacy and digital health business. Revenue for FY2023-24 was ₹191.66 billion, reflecting strong financial performance.

- Dive into the specifics of Apollo Hospitals Enterprise here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Apollo Hospitals Enterprise is priced higher than what may be justified by its financials.

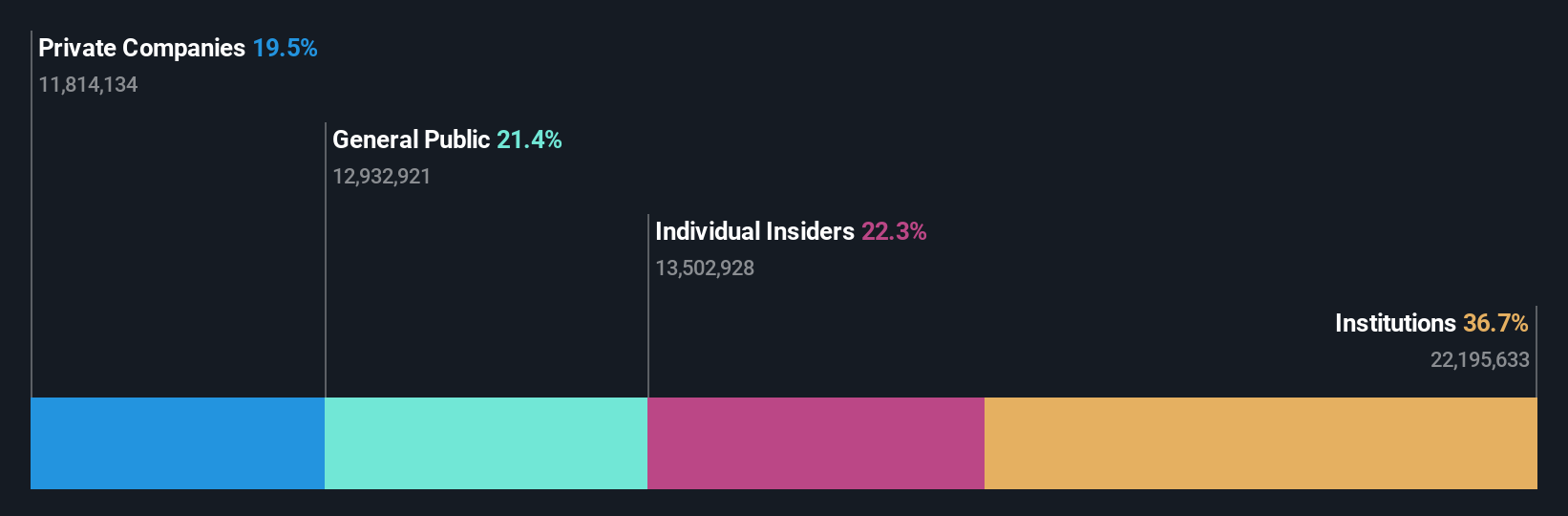

Dixon Technologies (India) (NSEI:DIXON)

Simply Wall St Growth Rating: ★★★★★★

Overview: Dixon Technologies (India) Limited provides electronic manufacturing services in India and has a market cap of ₹724.39 billion.

Operations: Dixon Technologies (India) Limited generates revenue from various segments, including consumer electronics, lighting products, home appliances, mobile phones, and security systems.

Insider Ownership: 24.6%

Earnings Growth Forecast: 36.1% p.a.

Dixon Technologies (India) has shown impressive growth, with earnings increasing by 55.3% over the past year and forecasted to grow 36.15% annually. Recent Q1 2025 results highlight strong performance, with sales reaching ₹65.80 billion and net income at ₹1.34 billion, nearly doubling from the previous year. Insider ownership remains high, reinforcing management's confidence in future prospects despite no significant insider trading activity in recent months.

- Click to explore a detailed breakdown of our findings in Dixon Technologies (India)'s earnings growth report.

- The valuation report we've compiled suggests that Dixon Technologies (India)'s current price could be inflated.

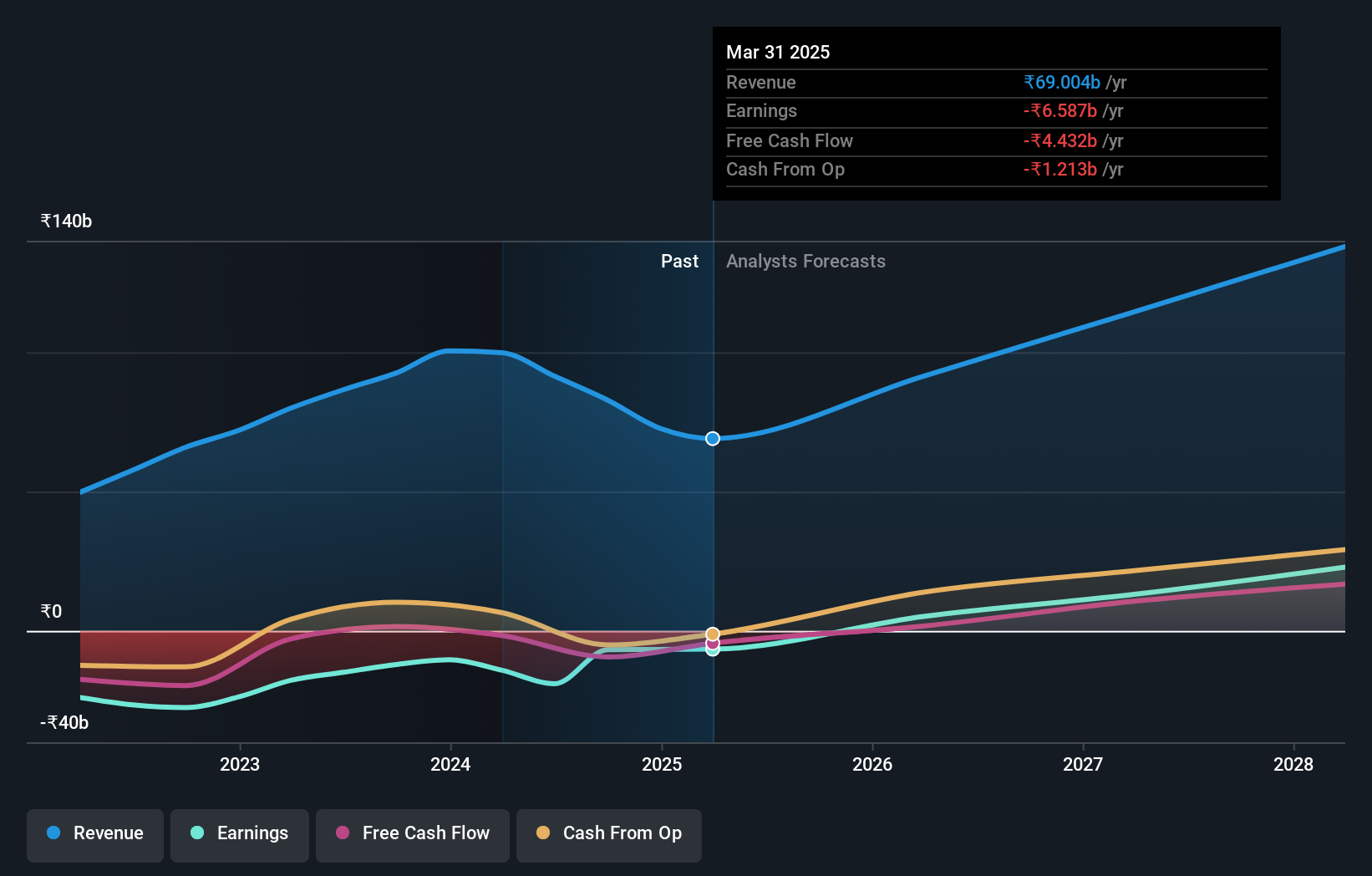

One97 Communications (NSEI:PAYTM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: One97 Communications Limited offers payment, commerce and cloud, and financial services to consumers and merchants in India, with a market cap of ₹314.48 billion.

Operations: One97 Communications Limited generates revenue primarily from data processing, which amounts to ₹91.38 billion.

Insider Ownership: 20.7%

Earnings Growth Forecast: 66% p.a.

One97 Communications, known for its Paytm brand, is a key growth company with significant insider ownership. Despite recent regulatory penalties and a substantial Q1 2024 net loss of ₹8.39 billion, the company continues to expand its business avenues. The strategic partnership with FlixBus and the launch of 'Paytm Health Saathi' demonstrate its efforts to diversify revenue streams and support merchant partners. Insider ownership remains high, reflecting confidence in long-term growth despite current financial challenges.

- Navigate through the intricacies of One97 Communications with our comprehensive analyst estimates report here.

- The analysis detailed in our One97 Communications valuation report hints at an deflated share price compared to its estimated value.

Where To Now?

- Click here to access our complete index of 88 Fast Growing Indian Companies With High Insider Ownership.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:APOLLOHOSP

Apollo Hospitals Enterprise

Provides healthcare services in India and internationally.

Flawless balance sheet with high growth potential.