Stock Analysis

3 High Insider Ownership Stocks With Minimum 20% Earnings Growth

Reviewed by Sasha Jovanovic

The Indian market has shown robust performance, gaining 1.8% recently and an impressive 46% over the past 12 months, with earnings expected to grow by 18% annually. In this thriving environment, stocks with high insider ownership and strong earnings growth can be particularly compelling, as they often signal confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Growth Rating |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | ★★★★★★ |

| Triveni Turbine (BSE:533655) | 28.6% | ★★★★★★ |

| Pitti Engineering (BSE:513519) | 33.6% | ★★★★★★ |

| Rajratan Global Wire (BSE:517522) | 19.8% | ★★★★★★ |

| Jupiter Wagons (NSEI:JWL) | 11.1% | ★★★★★★ |

| Dixon Technologies (India) (NSEI:DIXON) | 25% | ★★★★★★ |

| Paisalo Digital (BSE:532900) | 16.3% | ★★★★★★ |

| MTAR Technologies (NSEI:MTARTECH) | 38.4% | ★★★★★★ |

| Aether Industries (NSEI:AETHER) | 31.1% | ★★★★★☆ |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

Apollo Hospitals Enterprise (NSEI:APOLLOHOSP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Apollo Hospitals Enterprise Limited operates a network of healthcare services both in India and internationally, with a market capitalization of approximately ₹91.79 billion.

Operations: The company generates revenue primarily from three segments: Healthcare Services (₹95.87 billion), Retail Health & Diagnostics (₹13.19 billion), and Digital Health & Pharmacy Distribution (₹75.99 billion).

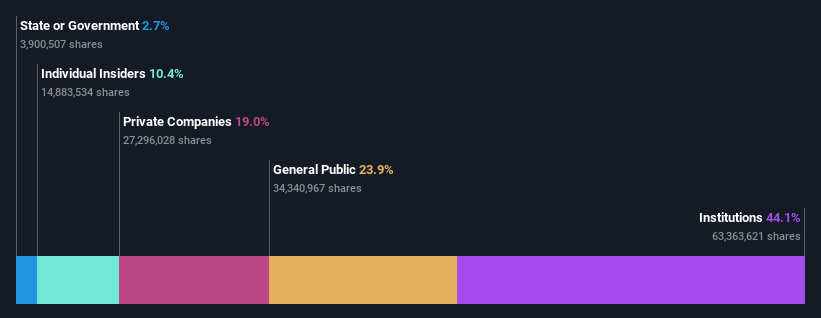

Insider Ownership: 10.4%

Earnings Growth Forecast: 36.1% p.a.

Apollo Hospitals Enterprise has been a notable performer in the Indian healthcare sector, with a robust insider ownership structure that aligns management interests with shareholder goals. Recent leadership changes, including Dr. Madhu Sasidhar's appointment as CEO of the hospital division, underscore a strategic continuity poised to harness growth opportunities. Financially, Apollo has demonstrated strong revenue and profit growth, with earnings increasing significantly over the past years and expected to continue outpacing market averages. However, it operates with a high level of debt which could be a concern for risk-averse investors.

- Get an in-depth perspective on Apollo Hospitals Enterprise's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Apollo Hospitals Enterprise's shares may be trading at a premium.

Dixon Technologies (India) (NSEI:DIXON)

Simply Wall St Growth Rating: ★★★★★★

Overview: Dixon Technologies (India) Limited specializes in providing electronic manufacturing services in India, with a market capitalization of approximately ₹484.16 billion.

Operations: The firm operates primarily in the electronic manufacturing services sector.

Insider Ownership: 25%

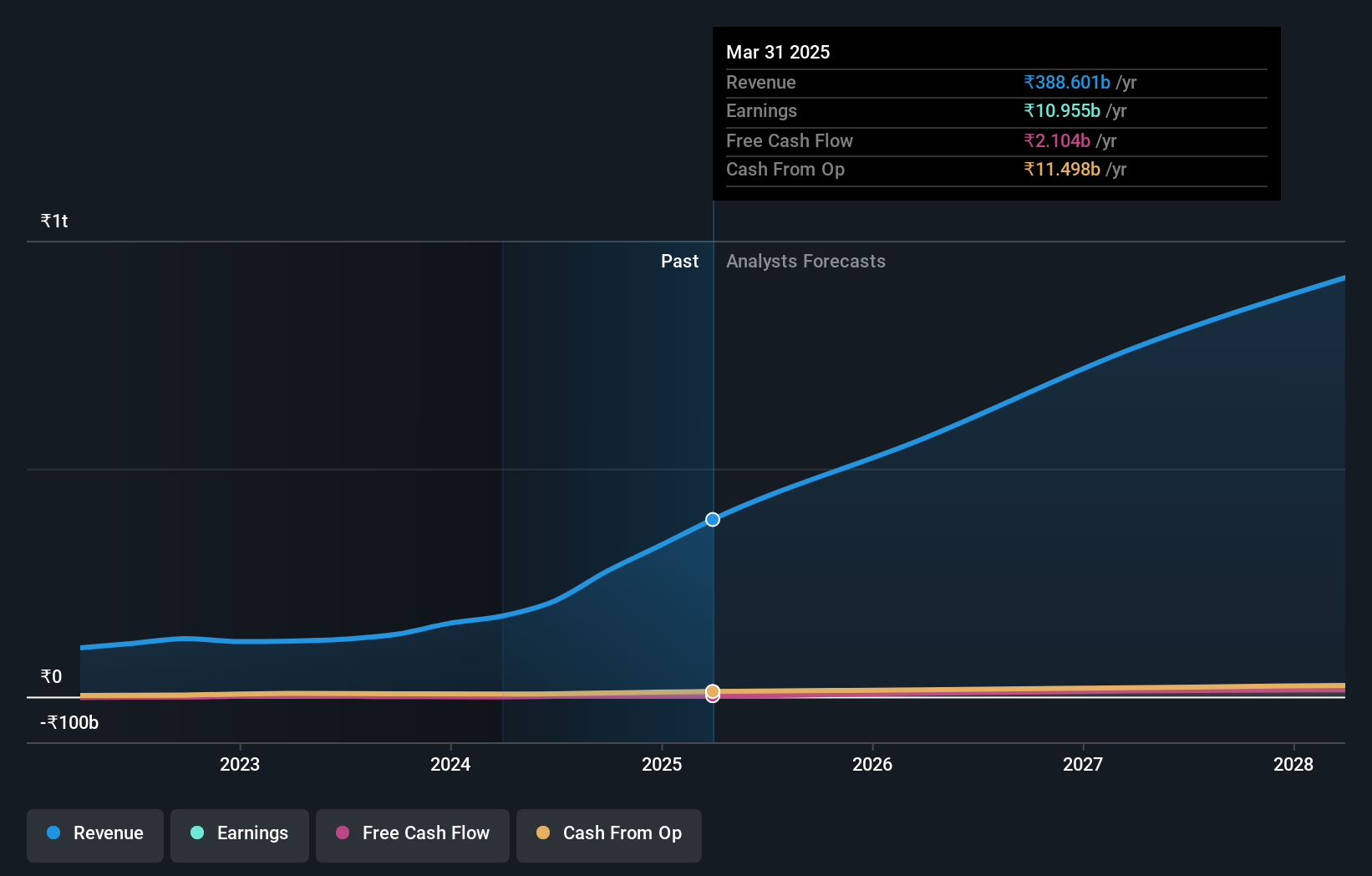

Earnings Growth Forecast: 27.1% p.a.

Dixon Technologies, a leader in India's electronics manufacturing sector, is actively expanding with the recent launch of a new facility in Dehradun, expected to significantly boost local employment and production capacities. The company is also exploring strategic acquisitions, such as purchasing a major stake in Transsion Holdings' Indian unit. Dixon's financial performance reflects robust growth with double revenue and profit last year and projections indicating continued strong growth in earnings and revenue above market averages. However, there has been notable executive turnover which could impact operational continuity.

- Navigate through the intricacies of Dixon Technologies (India) with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Dixon Technologies (India)'s share price might be on the expensive side.

Varun Beverages (NSEI:VBL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Varun Beverages Limited operates as a franchisee of PepsiCo, producing and distributing carbonated soft drinks and non-carbonated beverages, with a market capitalization of approximately ₹1.87 trillion.

Operations: The company generates ₹160.43 billion from the manufacturing and sale of beverages.

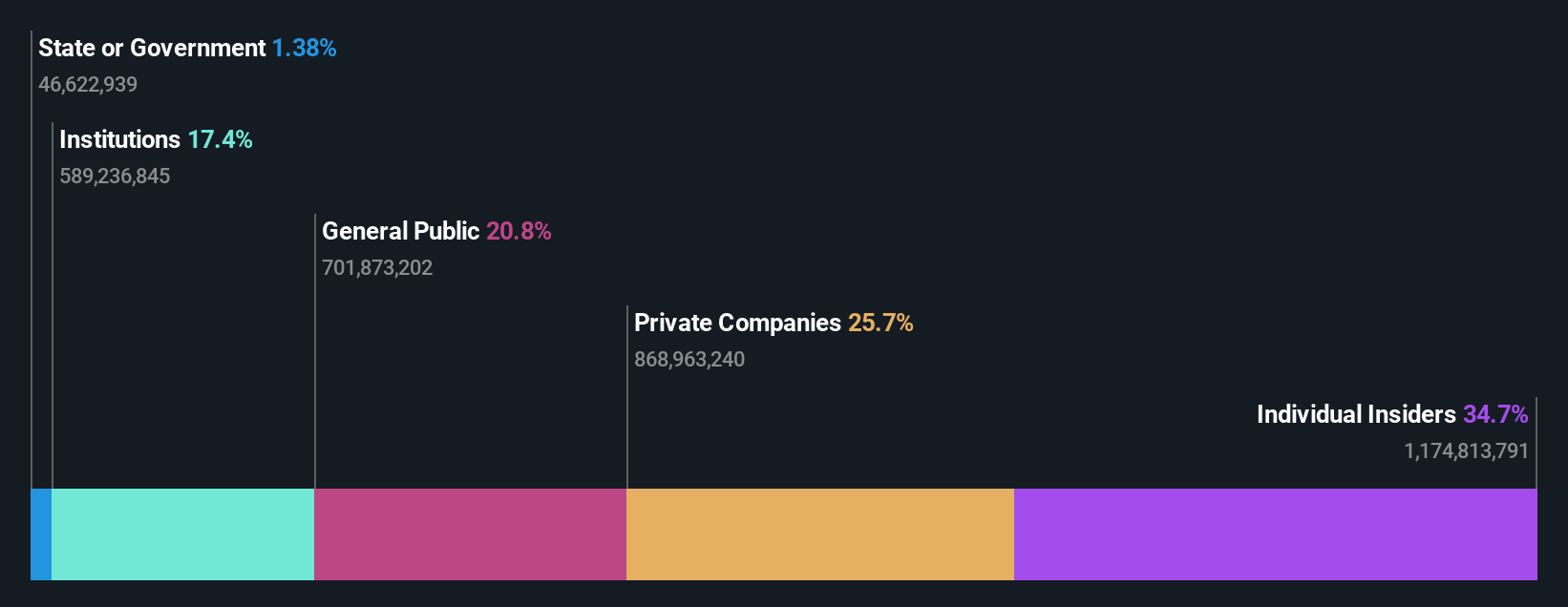

Insider Ownership: 36.4%

Earnings Growth Forecast: 20.4% p.a.

Varun Beverages, a prominent player in the Indian beverage industry, is poised for significant growth with earnings forecasted to increase by 20.37% annually. The company's revenue growth at 15.2% per year also outpaces the broader Indian market's 10.3%. Recent strategic expansions include starting production of carbonated and energy drinks in Uttar Pradesh, enhancing product diversity and market reach. Despite these positives, high debt levels and recent top executive resignations could pose challenges to sustaining momentum.

- Dive into the specifics of Varun Beverages here with our thorough growth forecast report.

- Our valuation report here indicates Varun Beverages may be overvalued.

Taking Advantage

- Click here to access our complete index of 86 Fast Growing Companies With High Insider Ownership.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities.

Valuation is complex, but we're helping make it simple.

Find out whether Varun Beverages is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:VBL

Varun Beverages

Varun Beverages Limited, together with its subsidiaries, operates as the franchisee of carbonated soft drinks (CSDs) and non-carbonated beverages (NCBs) sold under trademarks owned by PepsiCo.

High growth potential with excellent balance sheet.