- India

- /

- Consumer Durables

- /

- NSEI:DIXON

3 Growth Companies With High Insider Ownership On Indian Exchange Growing Revenues At 23%

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has risen 1.4%, driven by gains of 1.6% in the Financials sector, and it is up 46% over the last 12 months with earnings forecasted to grow by 17% annually. In this favorable environment, companies with high insider ownership and strong revenue growth stand out as potentially good investments due to their alignment of interests and proven performance.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.4% | 30.1% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 35% |

| Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 32.5% | 21.8% |

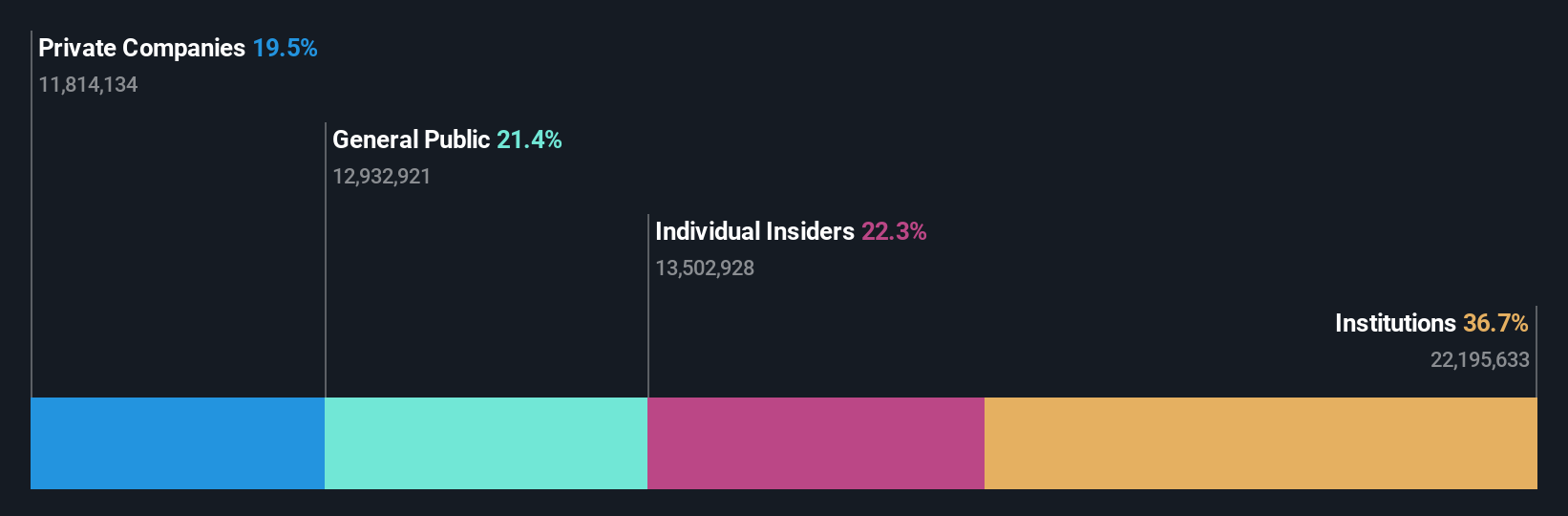

| Dixon Technologies (India) (NSEI:DIXON) | 24.6% | 36.6% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.2% |

| Paisalo Digital (BSE:532900) | 16.3% | 24.8% |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 32.3% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 35.8% |

| Pricol (NSEI:PRICOLLTD) | 25.5% | 24% |

| Aether Industries (NSEI:AETHER) | 31.1% | 45.9% |

Let's take a closer look at a couple of our picks from the screened companies.

Dixon Technologies (India) (NSEI:DIXON)

Simply Wall St Growth Rating: ★★★★★★

Overview: Dixon Technologies (India) Limited offers electronic manufacturing services in India and has a market cap of ₹791.49 billion.

Operations: Dixon Technologies' revenue segments include Home Appliances (₹12.51 billion), Lighting Products (₹7.92 billion), Mobile & EMS Division (₹143.16 billion), and Consumer Electronics & Appliances (₹41.21 billion).

Insider Ownership: 24.6%

Revenue Growth Forecast: 23.6% p.a.

Dixon Technologies (India) Limited, a growth company with high insider ownership, reported strong financial performance for Q1 2024, with revenue of ₹65.88 billion and net income of ₹1.34 billion—both nearly doubling from the previous year. The company's earnings are forecast to grow significantly at 36.57% annually over the next three years, outpacing the Indian market's average growth rate. Additionally, Dixon recently appointed Sunil Ranjhan as Chief Human Resource Officer to bolster its management team further.

- Dive into the specifics of Dixon Technologies (India) here with our thorough growth forecast report.

- The analysis detailed in our Dixon Technologies (India) valuation report hints at an inflated share price compared to its estimated value.

Godrej Consumer Products (NSEI:GODREJCP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Godrej Consumer Products Limited is a fast-moving consumer goods company that manufactures and markets personal care and home care products across India, Africa, Indonesia, the Middle East, the United States of America, and internationally with a market cap of ₹1.49 trillion.

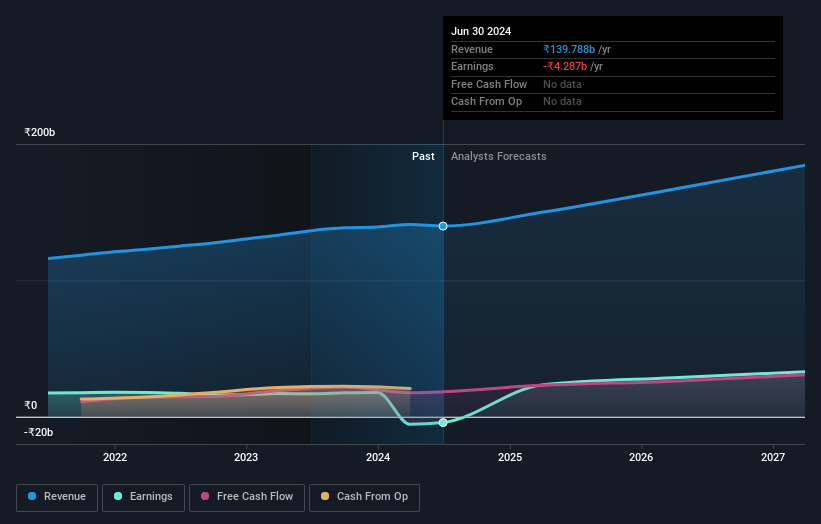

Operations: The company's revenue primarily comes from manufacturing personal, household, and hair care products, totaling ₹139.79 billion.

Insider Ownership: 13.8%

Revenue Growth Forecast: 10.1% p.a.

Godrej Consumer Products is forecast to grow revenue at 10.1% annually, slightly above the Indian market average. Earnings are expected to increase by 58.76% per year, with profitability anticipated within three years. Recent management changes include the appointment of Swati Bhattacharya as Global Head - Lightbox Creative Lab and Ashwin Moorthy as Global Head of Category Direction and Innovation, enhancing leadership for future growth initiatives such as their new Pet Care business venture.

- Click here and access our complete growth analysis report to understand the dynamics of Godrej Consumer Products.

- In light of our recent valuation report, it seems possible that Godrej Consumer Products is trading beyond its estimated value.

Varun Beverages (NSEI:VBL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Varun Beverages Limited, with a market cap of ₹2.05 trillion, operates as the franchisee for PepsiCo's carbonated soft drinks and non-carbonated beverages.

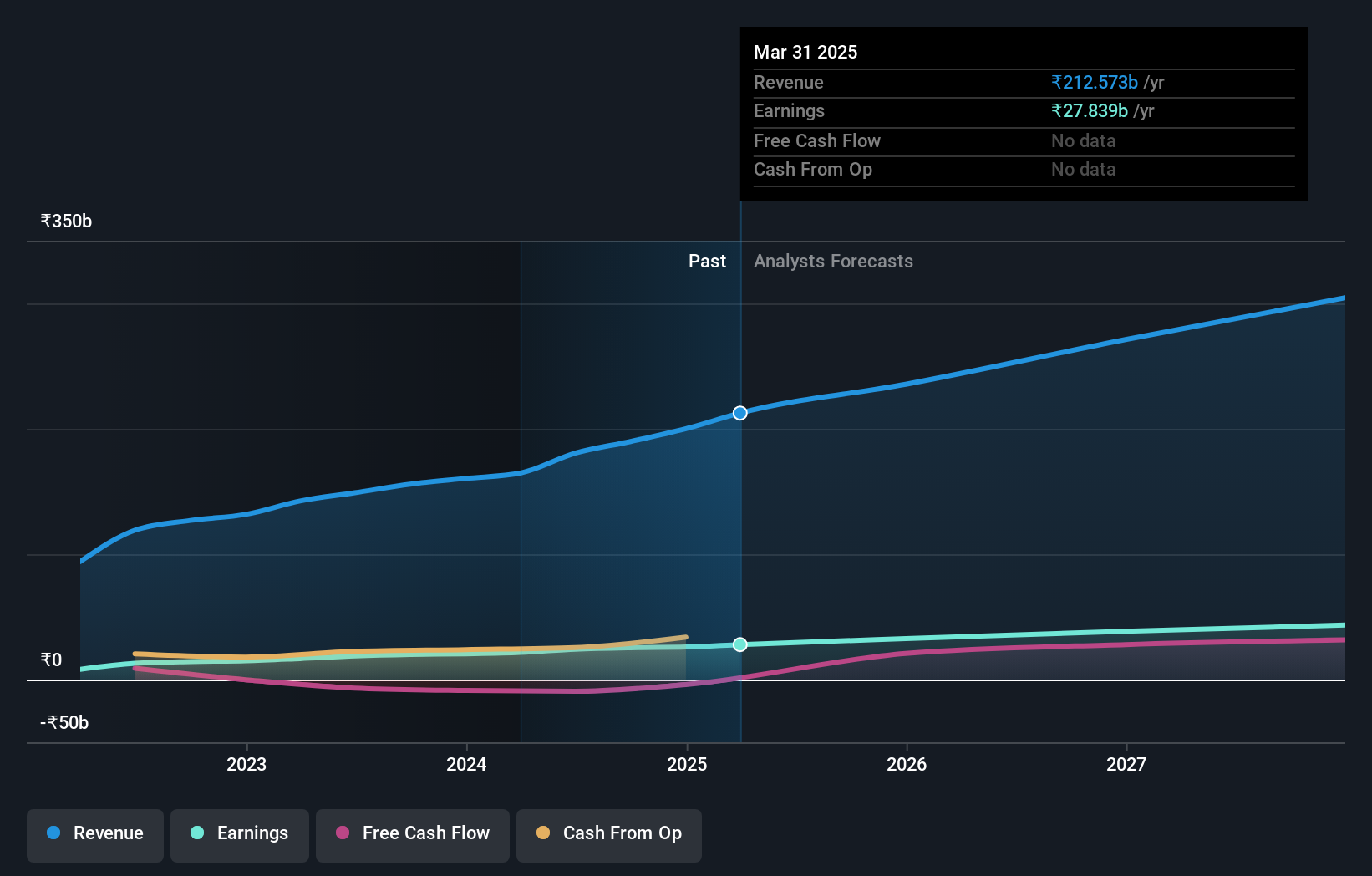

Operations: The company generates revenue primarily from the manufacturing and sale of beverages, amounting to ₹180.52 billion.

Insider Ownership: 36.3%

Revenue Growth Forecast: 15.4% p.a.

Varun Beverages has demonstrated strong revenue growth, with recent quarterly sales reaching ₹73.34 billion compared to ₹57.41 billion a year ago. Earnings per share increased from ₹7.65 to ₹9.64 in the same period, reflecting robust profitability. Insider ownership remains significant, ensuring aligned interests between management and shareholders. Recent amendments to the company's Memorandum of Association and a proposed stock split indicate strategic financial restructuring aimed at enhancing liquidity and shareholder value further.

- Click here to discover the nuances of Varun Beverages with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of Varun Beverages shares in the market.

Turning Ideas Into Actions

- Reveal the 92 hidden gems among our Fast Growing Indian Companies With High Insider Ownership screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:DIXON

Dixon Technologies (India)

Provides electronic manufacturing services in India.

Exceptional growth potential with flawless balance sheet.