- India

- /

- Commercial Services

- /

- NSEI:SORILINFRA

Does SORIL Infra Resources (NSE:SORILINFRA) Have A Healthy Balance Sheet?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies SORIL Infra Resources Limited (NSE:SORILINFRA) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for SORIL Infra Resources

How Much Debt Does SORIL Infra Resources Carry?

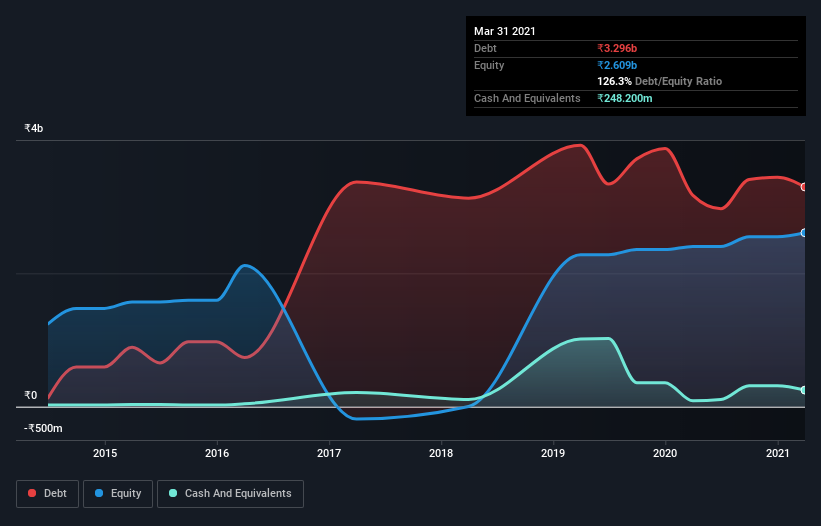

As you can see below, SORIL Infra Resources had ₹3.27b of debt, at March 2021, which is about the same as the year before. You can click the chart for greater detail. However, because it has a cash reserve of ₹248.2m, its net debt is less, at about ₹3.02b.

A Look At SORIL Infra Resources' Liabilities

According to the last reported balance sheet, SORIL Infra Resources had liabilities of ₹3.51b due within 12 months, and liabilities of ₹771.2m due beyond 12 months. Offsetting these obligations, it had cash of ₹248.2m as well as receivables valued at ₹4.09b due within 12 months. So these liquid assets roughly match the total liabilities.

This state of affairs indicates that SORIL Infra Resources' balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So while it's hard to imagine that the ₹5.17b company is struggling for cash, we still think it's worth monitoring its balance sheet.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Weak interest cover of 0.90 times and a disturbingly high net debt to EBITDA ratio of 9.0 hit our confidence in SORIL Infra Resources like a one-two punch to the gut. This means we'd consider it to have a heavy debt load. The good news is that SORIL Infra Resources grew its EBIT a smooth 97% over the last twelve months. Like a mother's loving embrace of a newborn that sort of growth builds resilience, putting the company in a stronger position to manage its debt. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since SORIL Infra Resources will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, SORIL Infra Resources burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

SORIL Infra Resources's conversion of EBIT to free cash flow and interest cover definitely weigh on it, in our esteem. But the good news is it seems to be able to grow its EBIT with ease. Looking at all the angles mentioned above, it does seem to us that SORIL Infra Resources is a somewhat risky investment as a result of its debt. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 4 warning signs for SORIL Infra Resources (2 are significant) you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you decide to trade SORIL Infra Resources, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:SORILINFRA

SORIL Infra Resources

SORIL Infra Resources Limited provides equipment hiring services in India.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives