- India

- /

- Construction

- /

- NSEI:SWSOLAR

The 9.5% return this week takes Sterling and Wilson Renewable Energy's (NSE:SWSOLAR) shareholders three-year gains to 154%

Sterling and Wilson Renewable Energy Limited (NSE:SWSOLAR) shareholders might be concerned after seeing the share price drop 12% in the last quarter. But in three years the returns have been great. The share price marched upwards over that time, and is now 154% higher than it was. To some, the recent share price pullback wouldn't be surprising after such a good run. If the business can perform well for years to come, then the recent drop could be an opportunity.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

See our latest analysis for Sterling and Wilson Renewable Energy

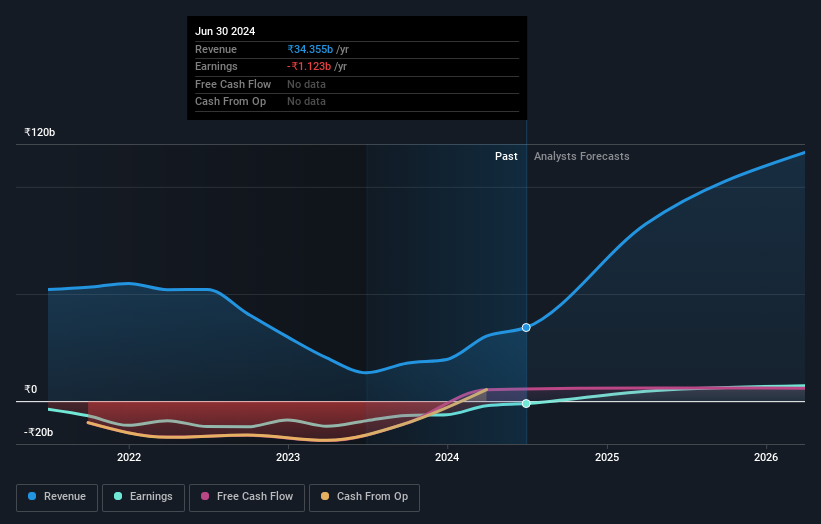

Given that Sterling and Wilson Renewable Energy didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 3 years Sterling and Wilson Renewable Energy saw its revenue shrink by 34% per year. So the share price gain of 36% per year is quite surprising. It's a good reminder that expectations about the future, not the past history, always impact share prices.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's nice to see that Sterling and Wilson Renewable Energy shareholders have received a total shareholder return of 82% over the last year. There's no doubt those recent returns are much better than the TSR loss of 1.0% per year over five years. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for Sterling and Wilson Renewable Energy you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SWSOLAR

Sterling and Wilson Renewable Energy

Provides renewable engineering, procurement, and construction (EPC) services in India, Europe, the Middle East, North Africa, rest of Africa, the United States, Latin America, and Australia.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives