- India

- /

- Construction

- /

- NSEI:SALASAR

Salasar Techno Engineering's (NSE:SALASAR) Earnings Are Of Questionable Quality

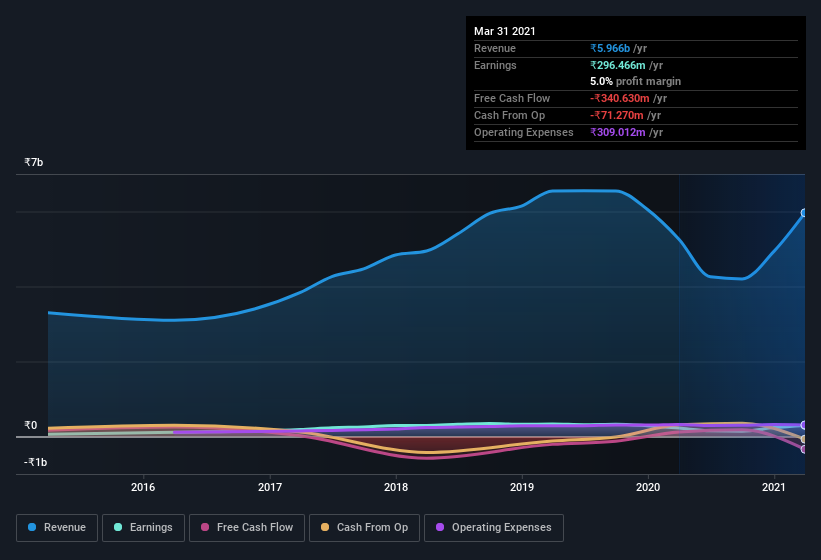

Last week's profit announcement from Salasar Techno Engineering Limited (NSE:SALASAR) was underwhelming for investors, despite headline numbers being robust. We think that the market might be paying attention to some underlying factors are concerning.

View our latest analysis for Salasar Techno Engineering

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. Salasar Techno Engineering expanded the number of shares on issue by 7.5% over the last year. Therefore, each share now receives a smaller portion of profit. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. You can see a chart of Salasar Techno Engineering's EPS by clicking here.

A Look At The Impact Of Salasar Techno Engineering's Dilution on Its Earnings Per Share (EPS).

As you can see above, Salasar Techno Engineering's net profit is roughly the same as what it was three years ago. In contrast, its earnings per share is down 8.4% per year over the same period. The 32% increase in profit would have impressed many. Then again, EPS was only up 32% over that period. So you can see that the dilution has had a bit of an impact on shareholders.

Changes in the share price do tend to reflect changes in earnings per share, in the long run. So Salasar Techno Engineering shareholders will want to see that EPS figure continue to increase. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Salasar Techno Engineering.

Our Take On Salasar Techno Engineering's Profit Performance

Each Salasar Techno Engineering share now gets a meaningfully smaller slice of its overall profit, due to dilution of existing shareholders. Because of this, we think that it may be that Salasar Techno Engineering's statutory profits are better than its underlying earnings power. But at least holders can take some solace from the 32% EPS growth in the last year. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. So while earnings quality is important, it's equally important to consider the risks facing Salasar Techno Engineering at this point in time. Every company has risks, and we've spotted 3 warning signs for Salasar Techno Engineering (of which 1 makes us a bit uncomfortable!) you should know about.

This note has only looked at a single factor that sheds light on the nature of Salasar Techno Engineering's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

When trading Salasar Techno Engineering or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:SALASAR

Salasar Techno Engineering

Engages in the manufacture and sale of galvanized and non-galvanized steel structures in India and internationally.

Proven track record with adequate balance sheet.