- India

- /

- Construction

- /

- NSEI:SALASAR

Is Salasar Techno Engineering's (NSE:SALASAR) 179% Share Price Increase Well Justified?

Unfortunately, investing is risky - companies can and do go bankrupt. But if you pick the right business to buy shares in, you can make more than you can lose. For example, the Salasar Techno Engineering Limited (NSE:SALASAR) share price has soared 179% return in just a single year. Also pleasing for shareholders was the 49% gain in the last three months. But this could be related to the strong market, which is up 22% in the last three months. However, the stock hasn't done so well in the longer term, with the stock only up 3.4% in three years.

View our latest analysis for Salasar Techno Engineering

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Over the last twelve months, Salasar Techno Engineering actually shrank its EPS by 57%.

This means it's unlikely the market is judging the company based on earnings growth. Indeed, when EPS is declining but the share price is up, it often means the market is considering other factors.

We are skeptical of the suggestion that the 0.6% dividend yield would entice buyers to the stock. Salasar Techno Engineering's revenue actually dropped 36% over last year. So the fundamental metrics don't provide an obvious explanation for the share price gain.

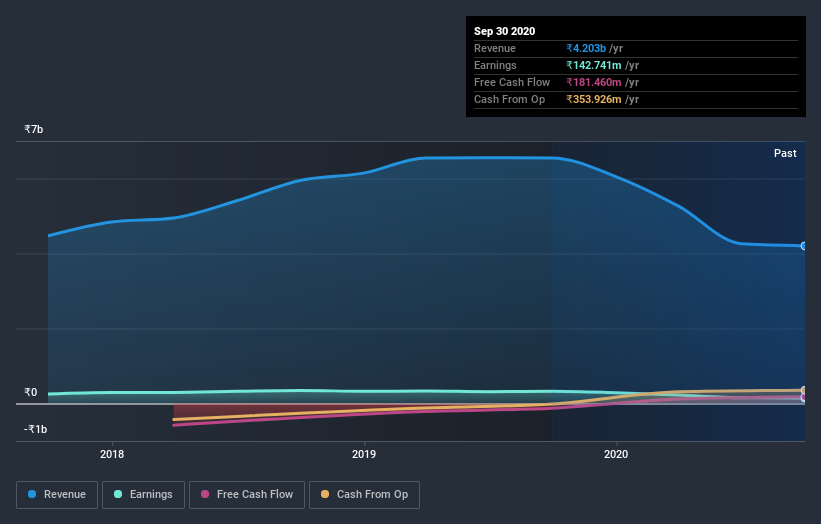

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Salasar Techno Engineering stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's nice to see that Salasar Techno Engineering shareholders have gained 181% (in total) over the last year. That includes the value of the dividend. That gain actually surpasses the 2.3% TSR it generated (per year) over three years. The improving returns to shareholders suggests the stock is becoming more popular with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 5 warning signs we've spotted with Salasar Techno Engineering (including 1 which shouldn't be ignored) .

We will like Salasar Techno Engineering better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you’re looking to trade Salasar Techno Engineering, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:SALASAR

Salasar Techno Engineering

Engages in the manufacture and sale of galvanized and non-galvanized steel structures in India and internationally.

Proven track record with adequate balance sheet.