Does Murudeshwar Ceramics (NSE:MURUDCERA) Have A Healthy Balance Sheet?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Murudeshwar Ceramics Ltd. (NSE:MURUDCERA) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Murudeshwar Ceramics

What Is Murudeshwar Ceramics's Debt?

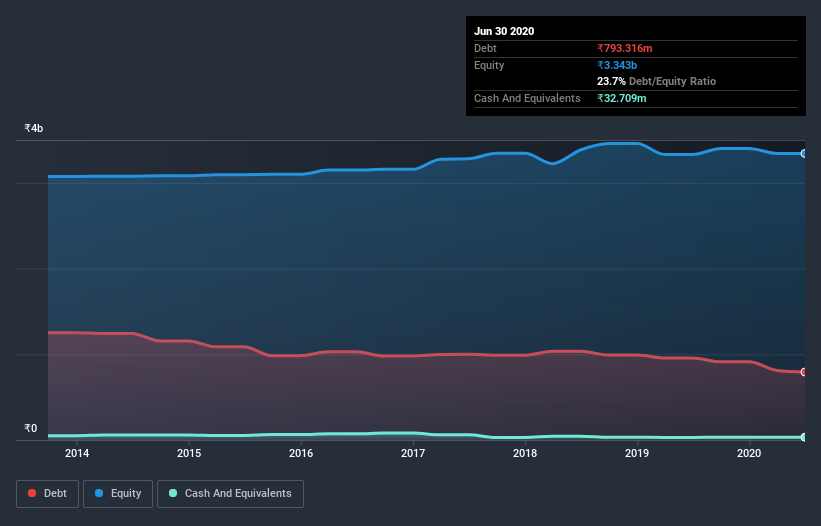

As you can see below, Murudeshwar Ceramics had ₹773.6m of debt at March 2020, down from ₹955.9m a year prior. However, because it has a cash reserve of ₹32.7m, its net debt is less, at about ₹740.8m.

A Look At Murudeshwar Ceramics's Liabilities

Zooming in on the latest balance sheet data, we can see that Murudeshwar Ceramics had liabilities of ₹1.08b due within 12 months and liabilities of ₹299.2m due beyond that. On the other hand, it had cash of ₹32.7m and ₹446.3m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₹903.2m.

When you consider that this deficiency exceeds the company's ₹680.3m market capitalization, you might well be inclined to review the balance sheet intently. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price. There's no doubt that we learn most about debt from the balance sheet. But it is Murudeshwar Ceramics's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Murudeshwar Ceramics had a loss before interest and tax, and actually shrunk its revenue by 32%, to ₹865m. That makes us nervous, to say the least.

Caveat Emptor

Not only did Murudeshwar Ceramics's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). To be specific the EBIT loss came in at ₹10m. Considering that alongside the liabilities mentioned above make us nervous about the company. It would need to improve its operations quickly for us to be interested in it. For example, we would not want to see a repeat of last year's loss of ₹101m. In the meantime, we consider the stock to be risky. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for Murudeshwar Ceramics (of which 1 can't be ignored!) you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you decide to trade Murudeshwar Ceramics, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:MURUDCERA

Murudeshwar Ceramics

Manufactures and trades in ceramic and vitrified floor and wall tiles in India, the Americas, Europe, and internationally.

Proven track record with adequate balance sheet.