We Think Shareholders May Consider Being More Generous With Jupiter Wagons Limited's (NSE:JWL) CEO Compensation Package

Shareholders will probably not be disappointed by the robust results at Jupiter Wagons Limited (NSE:JWL) recently and they will be keeping this in mind as they go into the AGM on 28 September 2022. The focus will probably be on the future strategic initiatives that the board and management will put in place to improve the business rather than executive remuneration when they cast their votes on company resolutions. Here is our take on why we think CEO compensation is fair and may even warrant a raise.

See our latest analysis for Jupiter Wagons

Comparing Jupiter Wagons Limited's CEO Compensation With The Industry

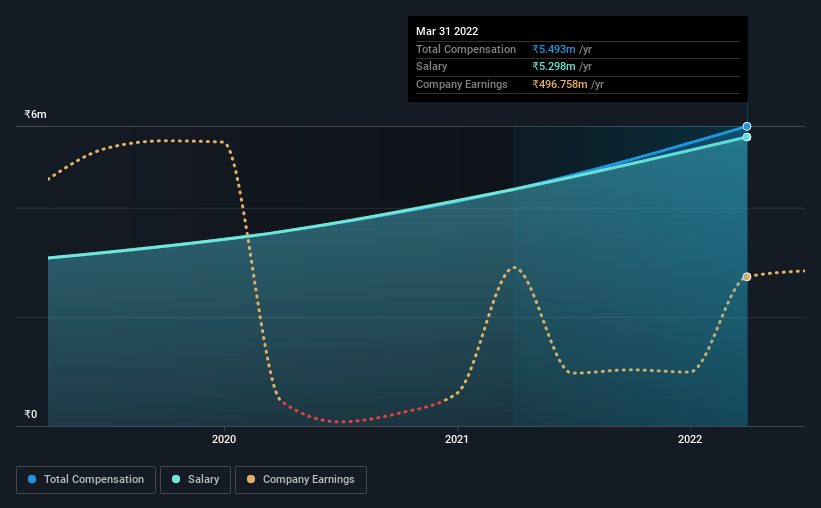

According to our data, Jupiter Wagons Limited has a market capitalization of ₹30b, and paid its CEO total annual compensation worth ₹5.5m over the year to March 2022. That's a notable increase of 27% on last year. We note that the salary portion, which stands at ₹5.30m constitutes the majority of total compensation received by the CEO.

On examining similar-sized companies in the industry with market capitalizations between ₹16b and ₹64b, we discovered that the median CEO total compensation of that group was ₹18m. In other words, Jupiter Wagons pays its CEO lower than the industry median.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | ₹5.3m | ₹4.3m | 96% |

| Other | ₹195k | - | 4% |

| Total Compensation | ₹5.5m | ₹4.3m | 100% |

Talking in terms of the industry, salary represented approximately 89% of total compensation out of all the companies we analyzed, while other remuneration made up 11% of the pie. Investors will find it interesting that Jupiter Wagons pays the bulk of its rewards through a traditional salary, instead of non-salary benefits. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Jupiter Wagons Limited's Growth

Jupiter Wagons Limited has reduced its earnings per share by 55% a year over the last three years. In the last year, its revenue is up 211%.

The decrease in EPS could be a concern for some investors. But in contrast the revenue growth is strong, suggesting future potential for EPS growth. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Jupiter Wagons Limited Been A Good Investment?

We think that the total shareholder return of 381%, over three years, would leave most Jupiter Wagons Limited shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Jupiter Wagons pays its CEO a majority of compensation through a salary. Overall, the company hasn't done too poorly performance-wise, but we would like to see some improvement. If it manages to keep up the current streak, CEO remuneration could well be one of shareholders' least concerns. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 2 warning signs for Jupiter Wagons that investors should think about before committing capital to this stock.

Important note: Jupiter Wagons is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:JWL

Jupiter Wagons

Manufactures and sells railway wagons, wagon components, and railway transportation equipment in India and internationally.

High growth potential with excellent balance sheet.