- India

- /

- Construction

- /

- NSEI:GRINFRA

G R Infraprojects Limited's (NSE:GRINFRA) Prospects Need A Boost To Lift Shares

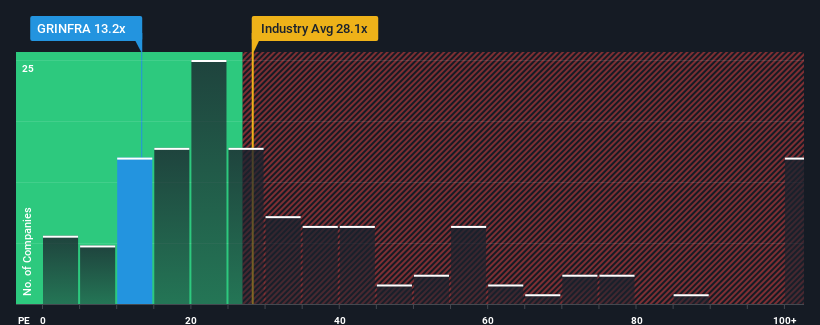

G R Infraprojects Limited's (NSE:GRINFRA) price-to-earnings (or "P/E") ratio of 13.2x might make it look like a strong buy right now compared to the market in India, where around half of the companies have P/E ratios above 34x and even P/E's above 65x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

While the market has experienced earnings growth lately, G R Infraprojects' earnings have gone into reverse gear, which is not great. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for G R Infraprojects

Is There Any Growth For G R Infraprojects?

There's an inherent assumption that a company should far underperform the market for P/E ratios like G R Infraprojects' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 14% decrease to the company's bottom line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 9.6% overall rise in EPS. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 6.0% per annum as estimated by the eleven analysts watching the company. With the market predicted to deliver 21% growth per annum, that's a disappointing outcome.

In light of this, it's understandable that G R Infraprojects' P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From G R Infraprojects' P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of G R Infraprojects' analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about these 3 warning signs we've spotted with G R Infraprojects (including 2 which are a bit unpleasant).

If these risks are making you reconsider your opinion on G R Infraprojects, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GRINFRA

G R Infraprojects

Through its subsidiaries, provides engineering, procurement, construction, and project management services for roads and highways, bridges, airport runway, railways and metro, tunneling and hydro, power transmission, multi modal logistic park, and optical fiber cable industries in India.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives