Did Blue Star Limited (NSE:BLUESTARCO) Insiders Sell Shares?

It is not uncommon to see companies perform well in the years after insiders buy shares. On the other hand, we'd be remiss not to mention that insider sales have been known to precede tough periods for a business. So before you buy or sell Blue Star Limited (NSE:BLUESTARCO), you may well want to know whether insiders have been buying or selling.

What Is Insider Selling?

Most investors know that it is quite permissible for company leaders, such as directors of the board, to buy and sell stock in the company. However, such insiders must disclose their trading activities, and not trade on inside information.

Insider transactions are not the most important thing when it comes to long-term investing. But logic dictates you should pay some attention to whether insiders are buying or selling shares. As Peter Lynch said, 'insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.

Check out our latest analysis for Blue Star

The Last 12 Months Of Insider Transactions At Blue Star

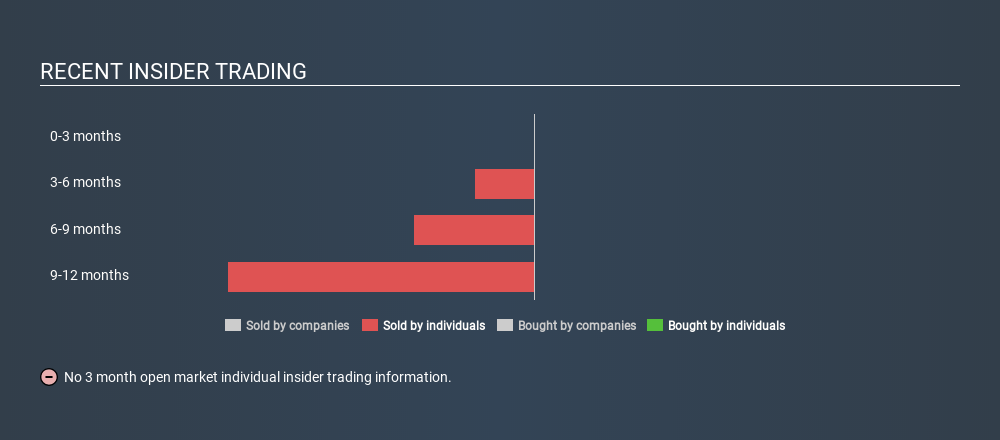

The insider, R. Aravindan, made the biggest insider sale in the last 12 months. That single transaction was for ₹7.9m worth of shares at a price of ₹794 each. That means that an insider was selling shares at slightly below the current price (₹841). As a general rule we consider it to be discouraging when insiders are selling below the current price, because it suggests they were happy with a lower valuation. Please do note, however, that sellers may have a variety of reasons for selling, so we don't know for sure what they think of the stock price. This single sale was just 32% of R. Aravindan's stake.

Insiders in Blue Star didn't buy any shares in the last year. You can see a visual depiction of insider transactions (by individuals) over the last 12 months, below. By clicking on the graph below, you can see the precise details of each insider transaction!

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Insider Ownership of Blue Star

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. A high insider ownership often makes company leadership more mindful of shareholder interests. Blue Star insiders own about ₹11b worth of shares (which is 15% of the company). This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

So What Do The Blue Star Insider Transactions Indicate?

It doesn't really mean much that no insider has traded Blue Star shares in the last quarter. It's heartening that insiders own plenty of stock, but we'd like to see more insider buying, since the last year of Blue Star insider transactions don't fill us with confidence. Therefore, you should should definitely take a look at this FREE report showing analyst forecasts for Blue Star.

But note: Blue Star may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NSEI:BLUESTARCO

Blue Star

Operates as a heating, ventilation, air conditioning, and commercial refrigeration (HVAC&R) company in India.

Flawless balance sheet with high growth potential.