- India

- /

- Auto Components

- /

- NSEI:BHARATFORG

If EPS Growth Is Important To You, Bharat Forge (NSE:BHARATFORG) Presents An Opportunity

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Bharat Forge (NSE:BHARATFORG). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Bharat Forge

How Fast Is Bharat Forge Growing Its Earnings Per Share?

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So EPS growth can certainly encourage an investor to take note of a stock. In impressive fashion, Bharat Forge's EPS grew from ₹9.11 to ₹20.78, over the previous 12 months. Year on year growth of 128% is certainly a sight to behold. Shareholders will be hopeful that this is a sign of the company reaching an inflection point.

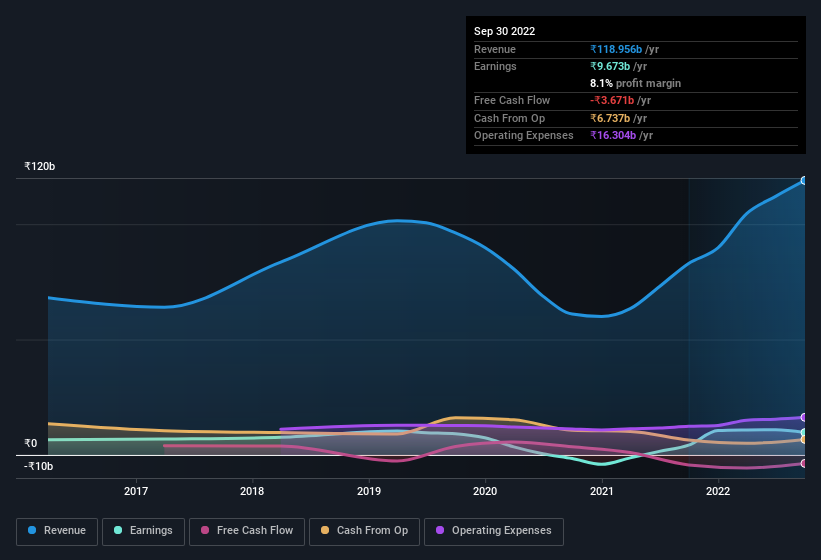

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Bharat Forge maintained stable EBIT margins over the last year, all while growing revenue 43% to ₹119b. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Bharat Forge's forecast profits?

Are Bharat Forge Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. Shareholders will be pleased by the fact that insiders own Bharat Forge shares worth a considerable sum. To be specific, they have ₹1.4b worth of shares. This considerable investment should help drive long-term value in the business. Despite being just 0.4% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Should You Add Bharat Forge To Your Watchlist?

Bharat Forge's earnings have taken off in quite an impressive fashion. That EPS growth certainly is attention grabbing, and the large insider ownership only serves to further stoke our interest. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. So at the surface level, Bharat Forge is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. Even so, be aware that Bharat Forge is showing 3 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Bharat Forge might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BHARATFORG

Bharat Forge

Engages in the manufacture and sale of forged and machined components in India and internationally.

High growth potential with solid track record.