- India

- /

- Auto Components

- /

- NSEI:BALKRISIND

Shareholders Will Probably Hold Off On Increasing Balkrishna Industries Limited's (NSE:BALKRISIND) CEO Compensation For The Time Being

Under the guidance of CEO Arvind Kumar Poddar, Balkrishna Industries Limited (NSE:BALKRISIND) has performed reasonably well recently. As shareholders go into the upcoming AGM on 30 June 2021, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders will still be cautious of paying the CEO excessively.

See our latest analysis for Balkrishna Industries

How Does Total Compensation For Arvind Kumar Poddar Compare With Other Companies In The Industry?

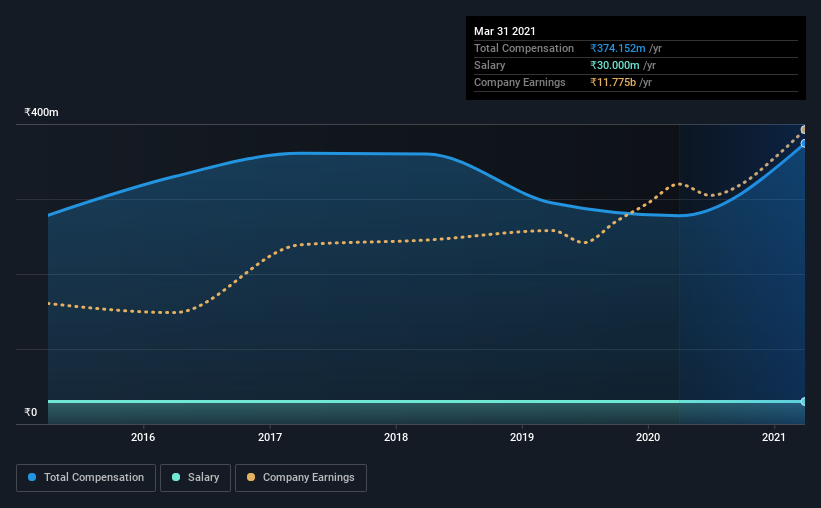

Our data indicates that Balkrishna Industries Limited has a market capitalization of ₹427b, and total annual CEO compensation was reported as ₹374m for the year to March 2021. That's a notable increase of 35% on last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at ₹30m.

On examining similar-sized companies in the industry with market capitalizations between ₹297b and ₹892b, we discovered that the median CEO total compensation of that group was ₹177m. Hence, we can conclude that Arvind Kumar Poddar is remunerated higher than the industry median. Moreover, Arvind Kumar Poddar also holds ₹17b worth of Balkrishna Industries stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | ₹30m | ₹30m | 8% |

| Other | ₹344m | ₹248m | 92% |

| Total Compensation | ₹374m | ₹278m | 100% |

Speaking on an industry level, nearly 79% of total compensation represents salary, while the remainder of 21% is other remuneration. In Balkrishna Industries' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Balkrishna Industries Limited's Growth

Balkrishna Industries Limited's earnings per share (EPS) grew 17% per year over the last three years. Its revenue is up 20% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's a real positive to see this sort of revenue growth in a single year. That suggests a healthy and growing business. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Balkrishna Industries Limited Been A Good Investment?

Boasting a total shareholder return of 116% over three years, Balkrishna Industries Limited has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. However, any decision to raise CEO pay might be met with some objections from the shareholders given that the CEO is already paid higher than the industry average.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 1 warning sign for Balkrishna Industries that investors should think about before committing capital to this stock.

Switching gears from Balkrishna Industries, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade Balkrishna Industries, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Balkrishna Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:BALKRISIND

Balkrishna Industries

Manufactures and sells tires in India, Europe, North America, and internationally.

Solid track record with excellent balance sheet and pays a dividend.