- India

- /

- Auto Components

- /

- NSEI:BALKRISIND

Balkrishna Industries' (NSE:BALKRISIND) Upcoming Dividend Will Be Larger Than Last Year's

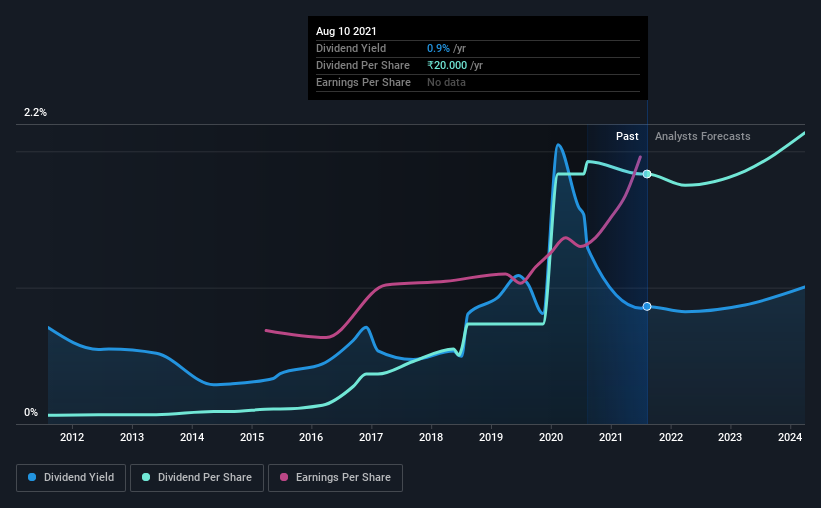

Balkrishna Industries Limited (NSE:BALKRISIND) has announced that it will be increasing its dividend on the 5th of September to ₹4.00. This makes the dividend yield 0.8%, which is above the industry average.

Check out our latest analysis for Balkrishna Industries

Balkrishna Industries' Payment Has Solid Earnings Coverage

A big dividend yield for a few years doesn't mean much if it can't be sustained. However, based ont he last payment, Balkrishna Industries was earning enough to cover the dividend pretty comfortably. The business is earning enough to make the dividend feasible, but the cash payout ratio of 94% shows that most of the cash is going back to the shareholders, which could constrain growth prospects going forward.

The next year is set to see EPS grow by 3.0%. If the dividend continues on this path, the payout ratio could be 31% by next year, which we think can be pretty sustainable going forward.

Balkrishna Industries Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. The dividend has gone from ₹0.70 in 2011 to the most recent annual payment of ₹20.00. This means that it has been growing its distributions at 40% per annum over that time. Rapidly growing dividends for a long time is a very valuable feature for an income stock.

The Dividend Looks Likely To Grow

The company's investors will be pleased to have been receiving dividend income for some time. It's encouraging to see Balkrishna Industries has been growing its earnings per share at 25% a year over the past five years. Earnings have been growing rapidly, and with a low payout ratio we think that the company could turn out to be a great dividend stock.

In Summary

Overall, this is a reasonable dividend, and it being raised is an added bonus. On the plus side, the dividend looks sustainable by most measures but it is let down by the lack of cash flows. This looks like it could be a good dividend stock going forward, but we would note that the payout ratio has been at higher levels in the past so it could happen again.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. Companies that are growing earnings tend to be the best dividend stocks over the long term. See what the 8 analysts we track are forecasting for Balkrishna Industries for free with public analyst estimates for the company. We have also put together a list of global stocks with a solid dividend.

If you decide to trade Balkrishna Industries, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Balkrishna Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:BALKRISIND

Balkrishna Industries

Manufactures and sells tires in India, Europe, North America, and internationally.

Solid track record with excellent balance sheet and pays a dividend.