- India

- /

- Auto Components

- /

- NSEI:AUTOAXLES

Automotive Axles (NSE:AUTOAXLES) Is Increasing Its Dividend To ₹4.50

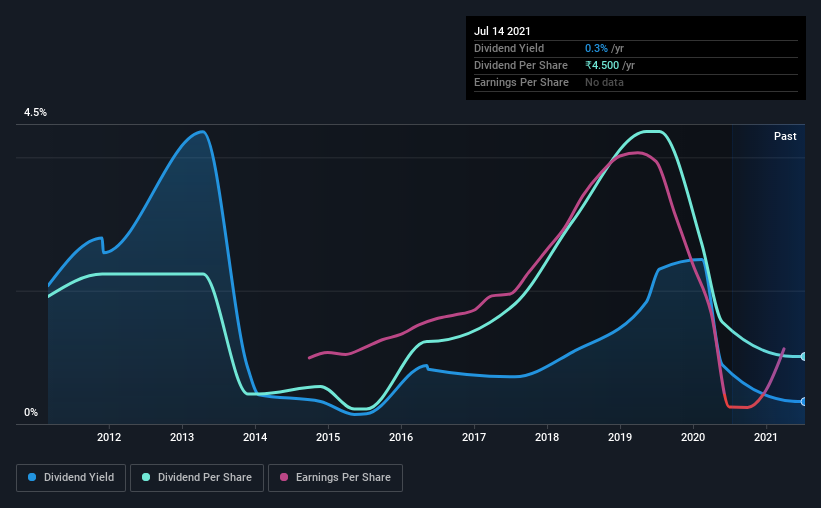

The board of Automotive Axles Limited (NSE:AUTOAXLES) has announced that it will be increasing its dividend on the 9th of September to ₹4.50. Although the dividend is now higher, the yield is only 0.3%, which is below the industry average.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Automotive Axles' stock price has increased by 35% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

See our latest analysis for Automotive Axles

Automotive Axles' Earnings Easily Cover the Distributions

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock. However, Automotive Axles' earnings easily cover the dividend. As a result, a large proportion of what it earned was being reinvested back into the business.

Looking forward, EPS could fall by 8.2% if the company can't turn things around from the last few years. If the dividend continues along recent trends, we estimate the payout ratio could be 33%, which we consider to be quite comfortable, with most of the company's earnings left over to grow the business in the future.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. Since 2011, the first annual payment was ₹8.50, compared to the most recent full-year payment of ₹4.50. Doing the maths, this is a decline of about 6.2% per year. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

Dividend Growth Is Doubtful

Dividends have been going in the wrong direction, so we definitely want to see a different trend in the earnings per share. Automotive Axles has seen earnings per share falling at 8.2% per year over the last five years. Declining earnings will inevitably lead to the company paying a lower dividend in line with lower profits.

Our Thoughts On Automotive Axles' Dividend

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We would probably look elsewhere for an income investment.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. Case in point: We've spotted 3 warning signs for Automotive Axles (of which 1 is potentially serious!) you should know about. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

When trading Automotive Axles or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:AUTOAXLES

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives