- Israel

- /

- Renewable Energy

- /

- TASE:ENLT

Did You Miss Enlight Renewable Energy's (TLV:ENLT) Whopping 714% Share Price Gain?

Long term investing can be life changing when you buy and hold the truly great businesses. While the best companies are hard to find, but they can generate massive returns over long periods. To wit, the Enlight Renewable Energy Ltd (TLV:ENLT) share price has soared 714% over five years. This just goes to show the value creation that some businesses can achieve. In more good news, the share price has risen 8.3% in thirty days.

We love happy stories like this one. The company should be really proud of that performance!

See our latest analysis for Enlight Renewable Energy

While Enlight Renewable Energy made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

For the last half decade, Enlight Renewable Energy can boast revenue growth at a rate of 19% per year. Even measured against other revenue-focussed companies, that's a good result. Arguably, this is well and truly reflected in the strong share price gain of 52%(per year) over the same period. Despite the strong run, top performers like Enlight Renewable Energy have been known to go on winning for decades. On the face of it, this looks lke a good opportunity, although we note sentiment seems very positive already.

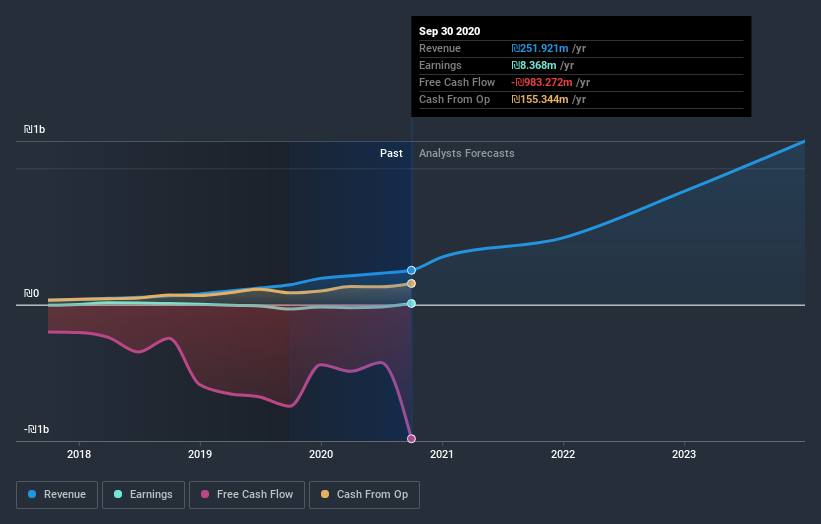

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that Enlight Renewable Energy has improved its bottom line lately, but what does the future have in store? If you are thinking of buying or selling Enlight Renewable Energy stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

It's good to see that Enlight Renewable Energy has rewarded shareholders with a total shareholder return of 74% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 52% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 4 warning signs for Enlight Renewable Energy (3 are significant) that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IL exchanges.

When trading Enlight Renewable Energy or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Enlight Renewable Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:ENLT

Enlight Renewable Energy

Operates a renewable energy platform in Israel, the Middle East, North Africa, Europe, and the United States.

Proven track record with moderate growth potential.

Market Insights

Community Narratives