- Israel

- /

- Telecom Services and Carriers

- /

- TASE:BEZQ

Does Bezeq Offer More Value After Shares Jump 57% With FCF Outlook in 2025?

Reviewed by Simply Wall St

If you have ever found yourself eyeing Bezeq The Israel Telecommunication stock and wondering if now is the time to jump in, you are definitely not alone. Bezeq's reputation as an industry anchor in Israel means its moves, or lack of them, tend to attract plenty of attention from investors both local and abroad. Over the last year, Bezeq has pulled off a substantial gain of 57.2%, outpacing many expectations and rewarding those who stuck with it. The stock's climb of 19.4% year-to-date, along with a five-year rise of 84.9%, points to a robust long-term narrative that is catching the eye of growth-focused and value-oriented investors alike.

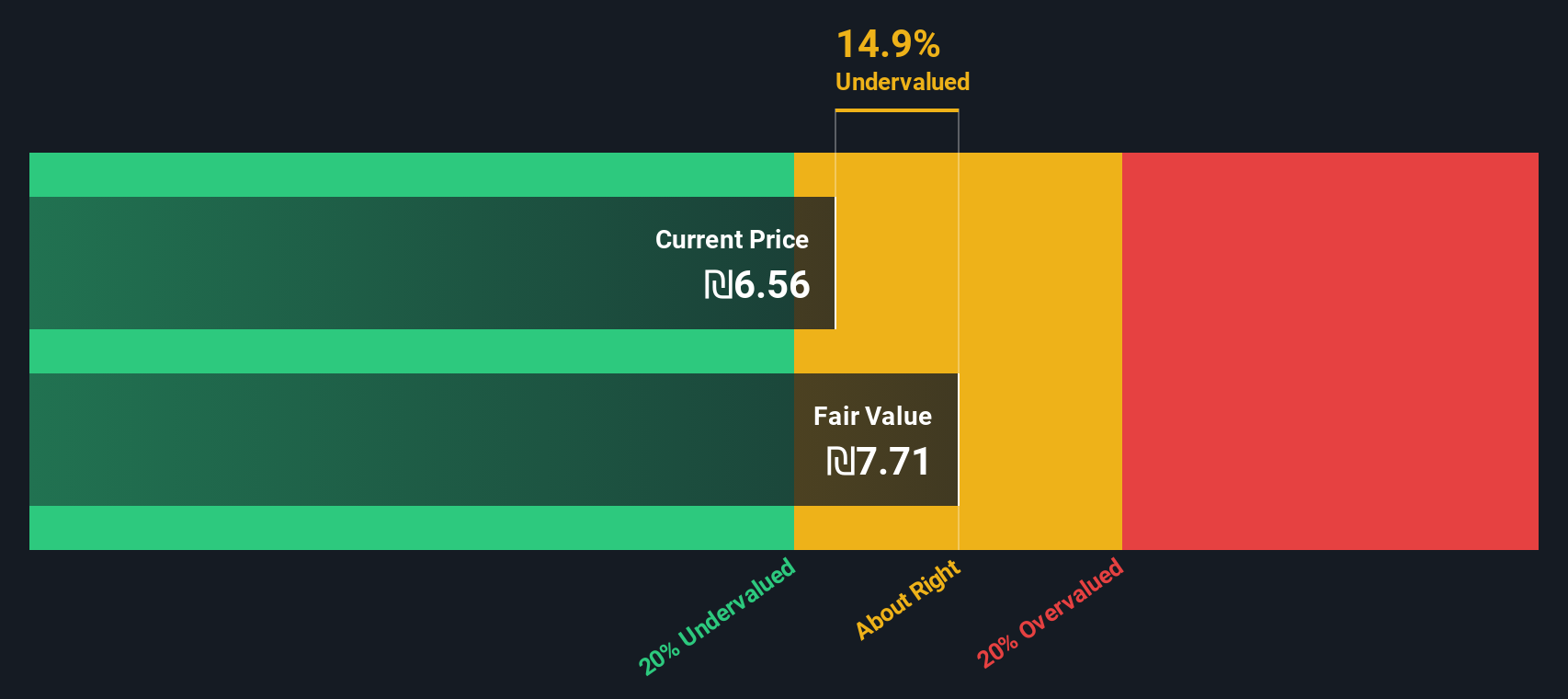

Recent market sentiment around Bezeq seems to reflect shifting perceptions of risk, especially as the company continues to operate in a rapidly evolving telecom landscape. Even modest gains over the past week (0.2%) and month (2.2%) suggest a steady momentum rather than a speculative spike. The question that naturally follows is whether the current price, last closing at 6.315, still makes sense when weighed against the company's financial fundamentals.

Here is where valuation comes into play, and it is not always straightforward. Based on a composite of six key undervaluation checks, Bezeq scores a 4, indicating it appears undervalued in four out of six major ways. We will break down what those checks are and why they matter, as we walk through Bezeq's valuation from several expert perspectives. Stick around though, because after we look at the standard valuation approaches, I am going to share an even smarter way to understand what Bezeq's numbers mean for your own portfolio decisions.

Bezeq The Israel Telecommunication delivered 57.2% returns over the last year. See how this stacks up to the rest of the Telecom industry.Approach 1: Bezeq The Israel Telecommunication Discounted Cash Flow (DCF) Analysis

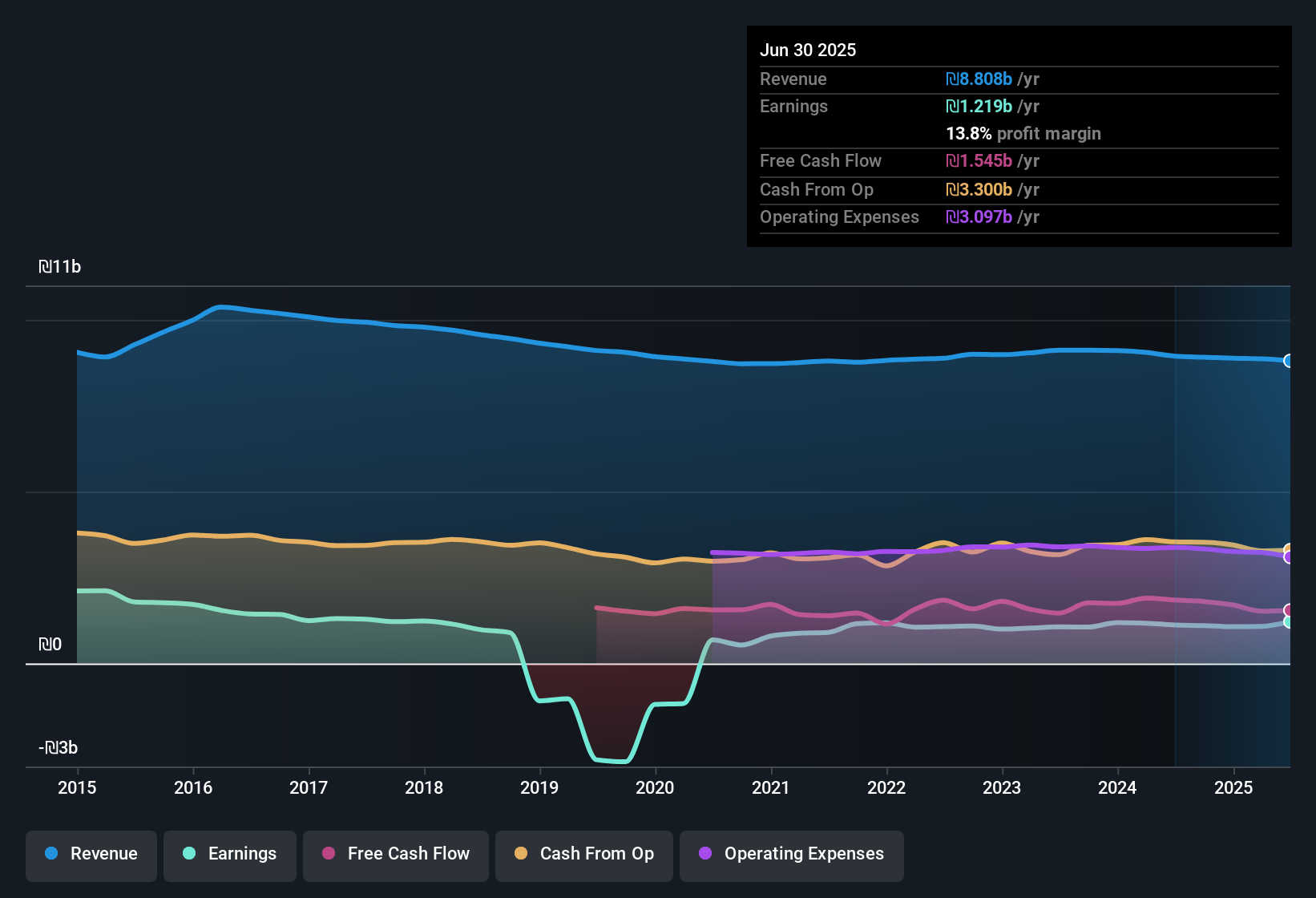

The Discounted Cash Flow (DCF) model is a fundamental method for determining a company’s intrinsic value by projecting its future free cash flows and then discounting those amounts back to today using a required rate of return. This helps estimate what the business is worth now, based on predictions about how much cash it will generate in the future.

Currently, Bezeq The Israel Telecommunication generates Free Cash Flow (FCF) of around ₪1.6 billion. Looking forward, analysts estimate the FCF for 2024 will be ₪952 million. These cash flows are projected to continue over the next decade with figures such as ₪1.5 billion in 2026 and recent projections reaching up to ₪1.56 billion by 2035. While only the next five years are based on analyst forecasts, subsequent years are extrapolated to give a broader view of future performance.

The DCF analysis calculates an estimated intrinsic value per share of ₪8.50. With Bezeq’s current share price at ₪6.32, this implies the stock is trading at a 25.7% discount to its fair value. This significant discount suggests that, according to the DCF model, the stock may be undervalued if other factors align.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Bezeq The Israel Telecommunication.

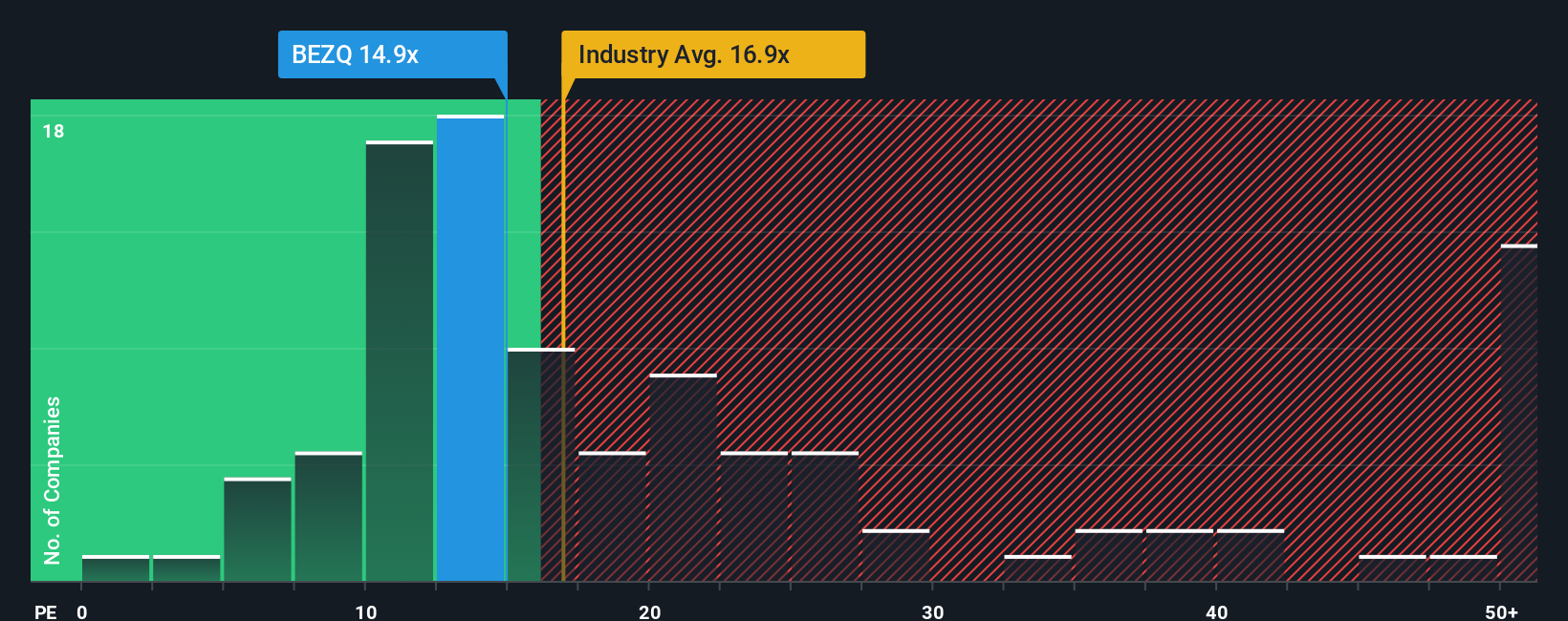

Approach 2: Bezeq The Israel Telecommunication Price vs Earnings (PE)

The price-to-earnings (PE) ratio is a widely used valuation tool, especially for established and profitable companies like Bezeq The Israel Telecommunication. It tells investors how much they are paying for each shekel of the company’s net earnings. A lower PE can imply a bargain, while a higher number might indicate investors expect stronger future growth or are willing to pay a premium for perceived stability.

What constitutes a "normal" or "fair" PE ratio is influenced by factors like a company’s earnings growth prospects, profitability, and the level of risk in its business. Generally, companies with strong growth expectations or lower risk profiles will command higher PE multiples. The reverse is true for slower-growing or riskier firms.

Bezeq’s current PE ratio is 14.4x, standing below the telecom industry average of 16.7x and also below its peer group’s average of 26.5x. On the surface, this could suggest the stock is trading at a discount compared to competitors. However, it is important to look deeper than just averages.

Simply Wall St’s proprietary Fair Ratio metric estimates what Bezeq’s PE should be, accounting for its unique combination of earnings growth, profit margins, industry dynamics, market capitalization and risk profile. This approach goes beyond industry or peer comparisons by directly aligning the ratio with the company’s financial reality.

By weighing all these company-specific factors, the Fair Ratio provides a more meaningful benchmark for valuation. Comparing Bezeq’s actual PE multiple to its Fair Ratio, the difference is very small. This indicates the market price is aligned with Bezeq’s true underlying value.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Bezeq The Israel Telecommunication Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply the story you believe about a company, grounded in your own expectations for things like its fair value, future revenue, earnings, and profit margins. Rather than just following the numbers, Narratives help you link Bezeq The Israel Telecommunication’s big-picture story to real financial forecasts, and then to a fair value that actually reflects your point of view.

This approach is both powerful and accessible. It is available for anyone to use right in the Simply Wall St Community page, where millions of investors share and compare their Narratives. With Narratives, it becomes much easier to decide when to buy or sell. You compare your estimated Fair Value to the current market Price, all while factoring in your own story about the company's future.

Best of all, Narratives update dynamically whenever new information such as earnings releases or major news arrives, so your investment case always stays up-to-date. To see Narratives in action for Bezeq The Israel Telecommunication, just look at the range. Some investors project a notably high fair value for the stock, while others set it at the lower end, reflecting their unique outlooks and assumptions.

Do you think there's more to the story for Bezeq The Israel Telecommunication? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bezeq The Israel Telecommunication might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:BEZQ

Bezeq The Israel Telecommunication

Provides communications services to business and private customers in Israel.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives