- Israel

- /

- Electronic Equipment and Components

- /

- TASE:SNCM

Suny Cellular Communication's (TLV:SNCM one-year decrease in earnings delivers investors with a 17% loss

One simple way to benefit from a rising market is to buy an index fund. In contrast individual stocks will provide a wide range of possible returns, and may fall short. For example, that's what happened with Suny Cellular Communication Ltd (TLV:SNCM) over the last year - it's share price is down 44% versus a market decline of 16%. On the other hand, the stock is actually up 16% over three years. Even worse, it's down 29% in about a month, which isn't fun at all. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

See our latest analysis for Suny Cellular Communication

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

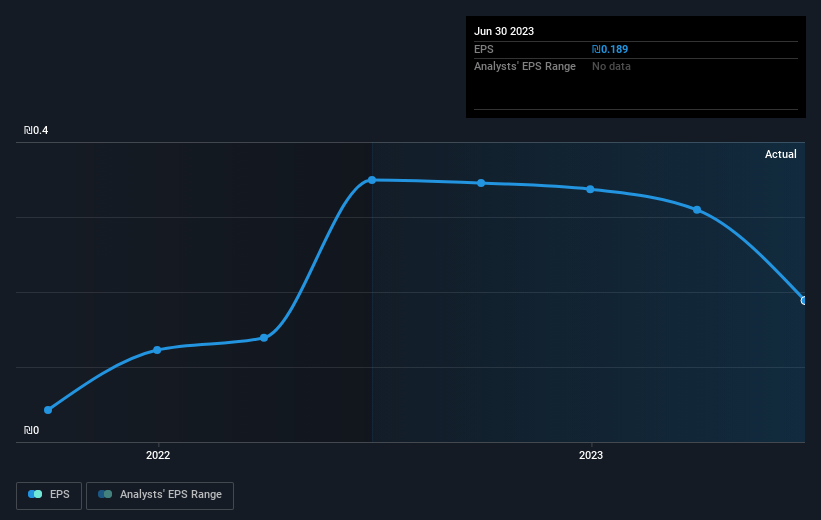

Unfortunately Suny Cellular Communication reported an EPS drop of 46% for the last year. This change in EPS is remarkably close to the 44% decrease in the share price. Given the lower EPS we might have expected investors to lose confidence in the stock, but that doesn't seemed to have happened. Rather, the share price is remains a similar multiple of the EPS, suggesting the outlook remains the same.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into Suny Cellular Communication's key metrics by checking this interactive graph of Suny Cellular Communication's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Suny Cellular Communication's TSR for the last 1 year was -17%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

The total return of 17% received by Suny Cellular Communication shareholders over the last year isn't far from the market return of -16%. So last year was actually even worse than the last five years, which cost shareholders 1.3% per year. Weak performance over the long term usually destroys market confidence in a stock, but bargain hunters may want to take a closer look for signs of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Suny Cellular Communication better, we need to consider many other factors. For instance, we've identified 4 warning signs for Suny Cellular Communication that you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Israeli exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:SNCM

Suny Cellular Communication

Engages in importing and marketing cell phones, accessories, and storage devices in Israel.

Excellent balance sheet and good value.