What NICE (TASE:NICE)'s New AI Ops Center Means for Shareholders

Reviewed by Sasha Jovanovic

- Earlier this week, NiCE announced the launch of its AI Ops Center, an operational backbone designed to keep enterprise AI Agents reliable, secure, and ready for business on the Cognigy platform.

- This development directly addresses mounting enterprise challenges around maintaining consistent and resilient customer experience stacks amid increasingly complex AI operations.

- We’ll explore how the new AI Ops Center may influence NICE’s investment outlook, particularly its focus on operational reliability in enterprise AI.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

NICE Investment Narrative Recap

For shareholders in NICE, the core thesis rests on enduring demand for AI-powered customer experience (CX) platforms and the company's ability to deliver operational reliability at enterprise scale. The launch of the AI Ops Center strengthens NICE’s focus on making its AI solutions more robust and responsive but does not materially impact the key short-term catalyst, sustaining subscription revenue growth from cloud and AI-driven services. The most significant risk remains margin pressure from ongoing investments and international expansion, which could weigh on near-term profitability if operating leverage falls short.

Among recent developments, the partnership expansion with Salesforce (August 2025) stands out as especially relevant. This integration of CXone Mpower with Salesforce further positions NICE’s platform at the center of enterprise CX transformation, tying directly to the theme of operational reliability and seamless, large-scale adoption, a core catalyst for future revenue resilience. These product and partnership moves continue to anchor NICE's profile among global enterprise clients, though execution risk remains.

On the other hand, investors should not overlook that persistent margin pressure from cloud investments...

Read the full narrative on NICE (it's free!)

NICE's outlook forecasts $3.6 billion in revenue and $741.0 million in earnings by 2028. This is based on an anticipated 8.5% annual revenue growth and a $203.9 million increase in earnings from the current $537.1 million.

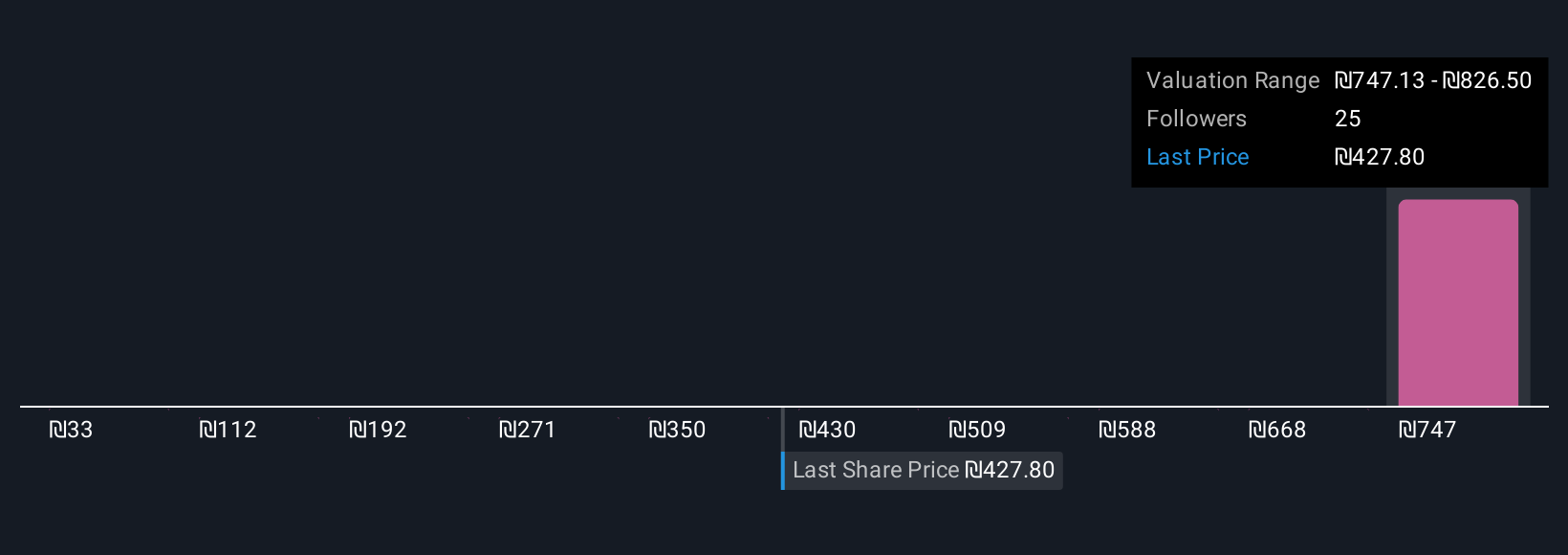

Uncover how NICE's forecasts yield a ₪750.02 fair value, a 71% upside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community place NICE’s worth anywhere between ₪32.83 and ₪825.35 per share. Margin pressure from ongoing global expansion remains a pivotal factor for NICE’s performance, so consider how these outlooks reflect the company’s profitability debate.

Explore 6 other fair value estimates on NICE - why the stock might be worth as much as 88% more than the current price!

Build Your Own NICE Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NICE research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free NICE research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NICE's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NICE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:NICE

NICE

Provides AI-powered cloud platforms for customer engagement, and financial crime and compliance worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives