Even after rising 13% this past week, Terminal X Online (TLV:TRX) shareholders are still down 65% over the past year

Terminal X Online Ltd. (TLV:TRX) shareholders will doubtless be very grateful to see the share price up 42% in the last month. But that isn't much consolation to those who have suffered through the declines of the last year. Like an arid lake in a warming world, shareholder value has evaporated, with the share price down 65% in that time. It's not that amazing to see a bounce after a drop like that. It may be that the fall was an overreaction.

The recent uptick of 13% could be a positive sign of things to come, so let's take a look at historical fundamentals.

View our latest analysis for Terminal X Online

Given that Terminal X Online didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Terminal X Online grew its revenue by 14% over the last year. That's not a very high growth rate considering it doesn't make profits. It's likely this muted growth has contributed to the share price decline of 65% in the last year. Like many holders, we really want to see better revenue growth in companies that lose money. Of course, the market can be too impatient at times. Why not take a closer look at this one so you're ready to pounce if growth does accelerate.

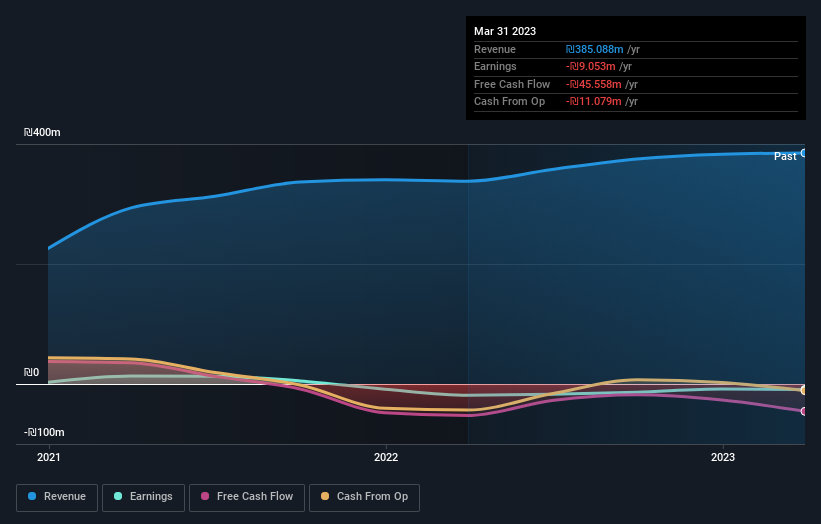

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Terminal X Online's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We doubt Terminal X Online shareholders are happy with the loss of 65% over twelve months. That falls short of the market, which lost 11%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. Putting aside the last twelve months, it's good to see the share price has rebounded by 3.5%, in the last ninety days. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 2 warning signs we've spotted with Terminal X Online (including 1 which is potentially serious) .

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Israeli exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Terminal X Online might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:TRX

Terminal X Online

Offers clothing, footwear, fashion accessories, cosmetics, and beauty products for men, women, and teens under various brands through online.

Excellent balance sheet and slightly overvalued.