- Israel

- /

- Oil and Gas

- /

- TASE:EQTL

Three Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

In a week marked by market volatility and shifting investor sentiment, global indices like the S&P 500 and Russell 2000 have experienced notable declines, reflecting uncertainty surrounding policy changes from the incoming Trump administration and broader economic conditions. As investors navigate these turbulent waters, identifying stocks with strong fundamentals and growth potential becomes crucial for those seeking opportunities amidst market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| SG Mart | 3.62% | 96.95% | 95.31% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| Wema Bank | 53.09% | 32.38% | 56.06% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

| Bhakti Multi Artha | 45.21% | 32.37% | -16.43% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Unieuro (BIT:UNIR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Unieuro S.p.A. is a company that functions as a distributor and retailer of consumer electronics and household appliances in Italy and internationally, with a market cap of €237.58 million.

Operations: Unieuro generates revenue primarily through the sale of consumer electronics and household appliances. The company reported a market capitalization of €237.58 million.

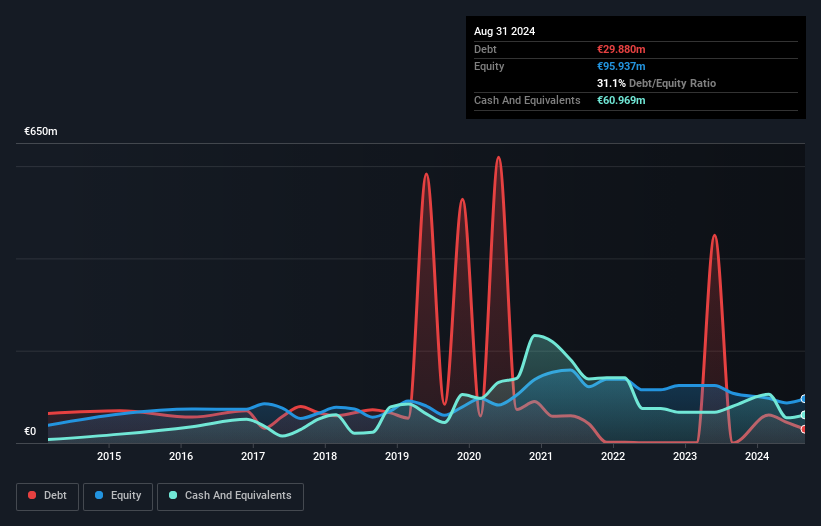

Unieuro, a notable player in the specialty retail sector, has demonstrated impressive financial resilience. Over the past five years, its debt-to-equity ratio dropped significantly from 140% to 31.1%, indicating effective debt management. Despite a large one-off loss of €20.8M impacting recent results, Unieuro's earnings grew by 65% last year and are projected to increase by nearly 49% annually moving forward. The company is set for delisting following Fnac Darty's acquisition of over 91% of its shares, marking a strategic shift as it integrates into a larger European retail framework.

- Delve into the full analysis health report here for a deeper understanding of Unieuro.

Understand Unieuro's track record by examining our Past report.

Equital (TASE:EQTL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Equital Ltd. operates in the real estate, oil and gas, and residential construction sectors both in Israel and internationally, with a market cap of ₪5.21 billion.

Operations: Equital generates revenue primarily from its real estate, oil and gas, and residential construction sectors. The company's net profit margin is notable at 15.2%.

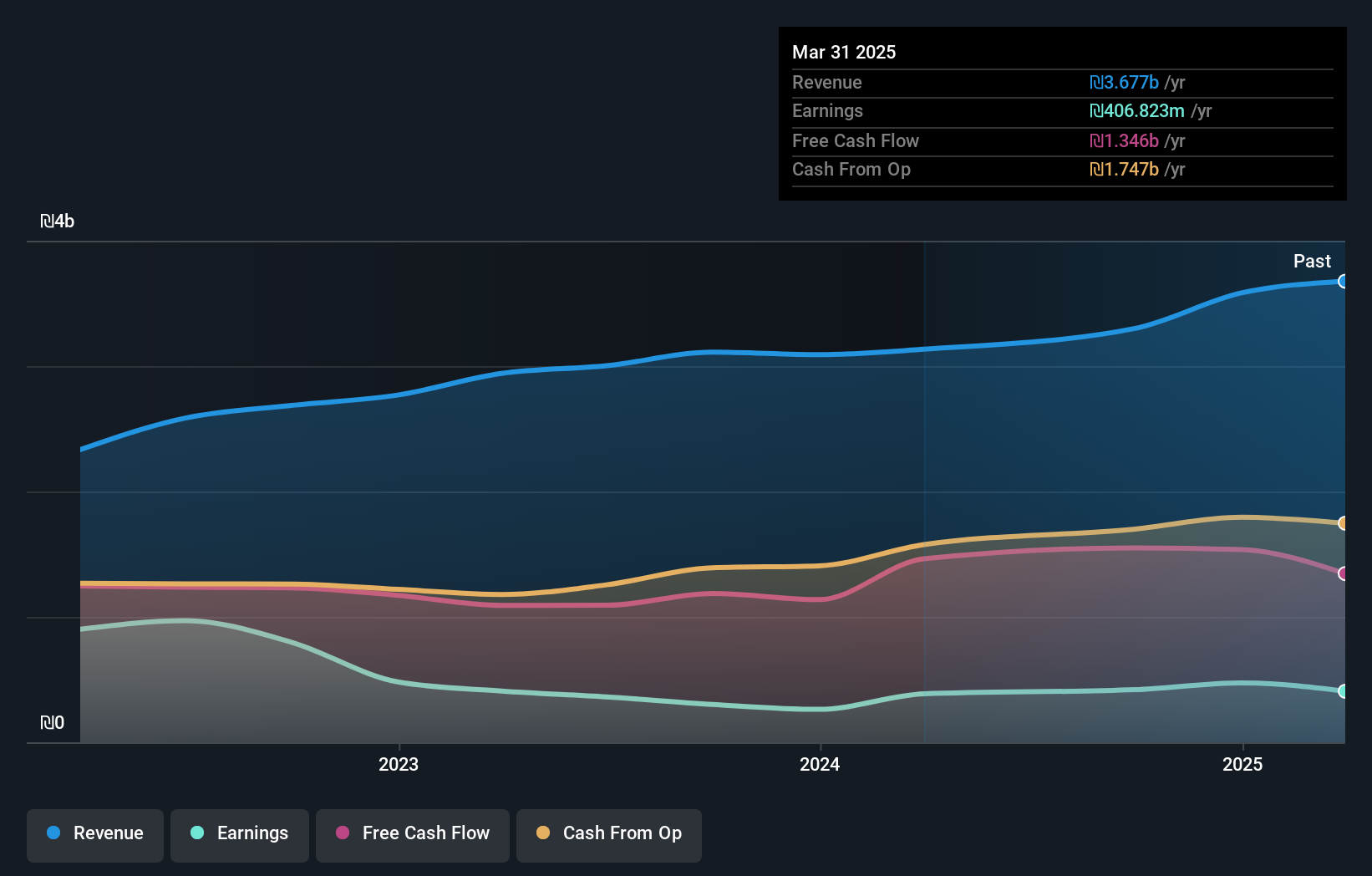

Equital's financial landscape paints a compelling picture, with its interest payments comfortably covered by EBIT at 5x, indicating strong operational efficiency. Over the past year, earnings surged by 9.6%, outpacing the Oil and Gas industry's -4.8% change, showcasing robust performance in a challenging sector. Despite a high net debt to equity ratio of 46.8%, Equital's debt management has improved significantly over five years from 99.4% to 62.3%. Recent earnings announcements highlight growth, with revenue reaching ILS 857 million for Q2 and net income climbing to ILS 81 million from ILS 71 million previously, indicating solid profitability trends.

- Click here to discover the nuances of Equital with our detailed analytical health report.

Assess Equital's past performance with our detailed historical performance reports.

Max Stock (TASE:MAXO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Max Stock Ltd. operates various discount stores in Israel with a market cap of ₪1.53 billion.

Operations: The company's primary revenue stream is derived from retail trade, amounting to ₪1.22 billion.

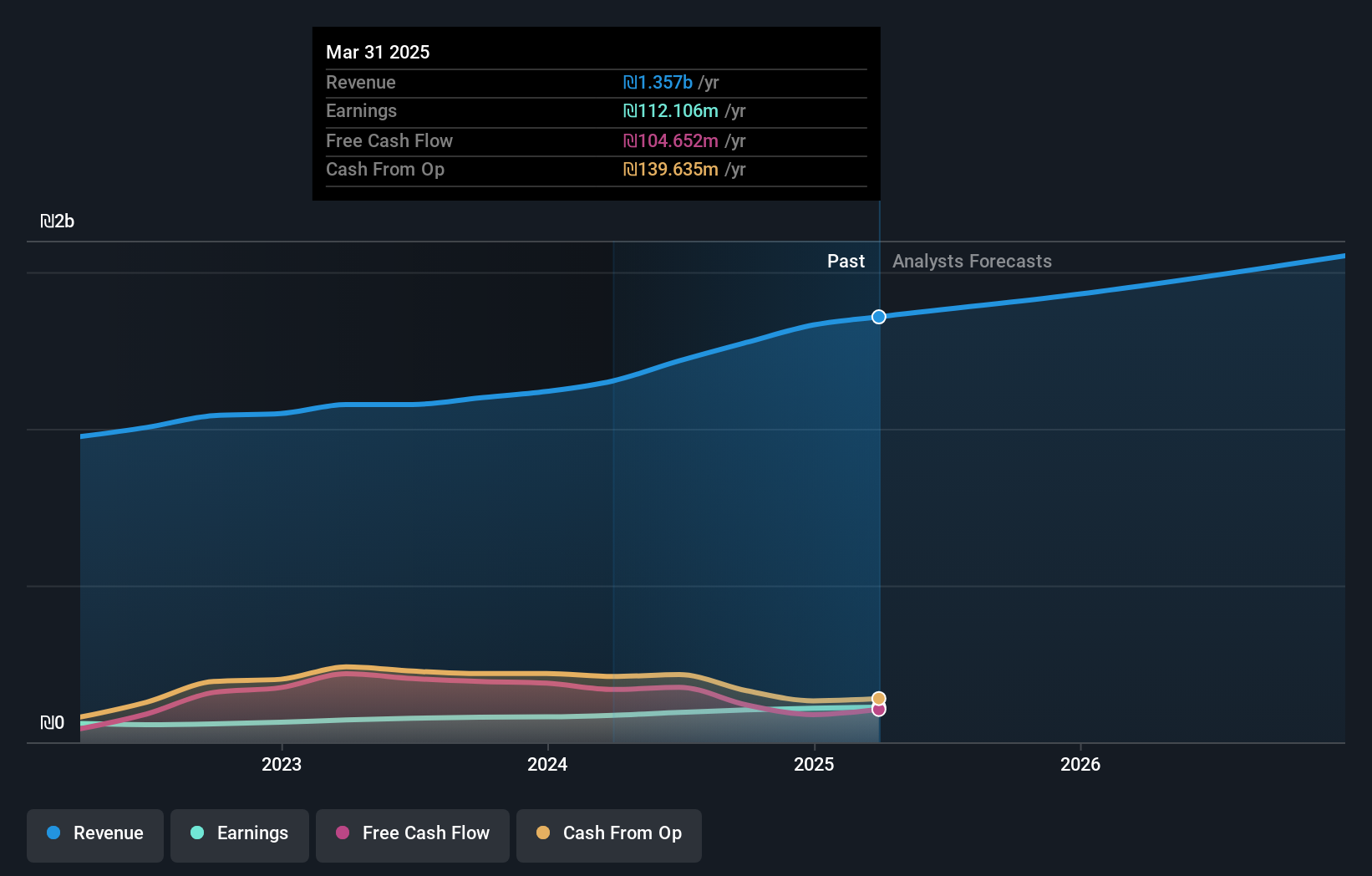

Max Stock, a relatively small player in the retail industry, shows promise with its financial health and growth trajectory. Its earnings have surged by 25% over the past year, outpacing the industry average of 8%. The company is trading at a notable discount of 34% below its estimated fair value, suggesting potential upside for investors. With interest payments well covered by EBIT at 6.7 times and cash exceeding total debt, financial stability seems assured. Additionally, Max Stock's debt-to-equity ratio has impressively decreased from 185% to just over 10% in five years. Looking ahead, revenue is projected to grow annually by approximately 7%.

- Navigate through the intricacies of Max Stock with our comprehensive health report here.

Evaluate Max Stock's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Discover the full array of 4651 Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:EQTL

Equital

Through its subsidiaries, engages in the real estate, oil and gas, and residential construction businesses in Israel and internationally.

Proven track record with adequate balance sheet.