- Israel

- /

- Oil and Gas

- /

- TASE:SPGS

Take Care Before Jumping Onto Electra Power (2019) Ltd (TLV:ELCP) Even Though It's 26% Cheaper

Electra Power (2019) Ltd (TLV:ELCP) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 24%.

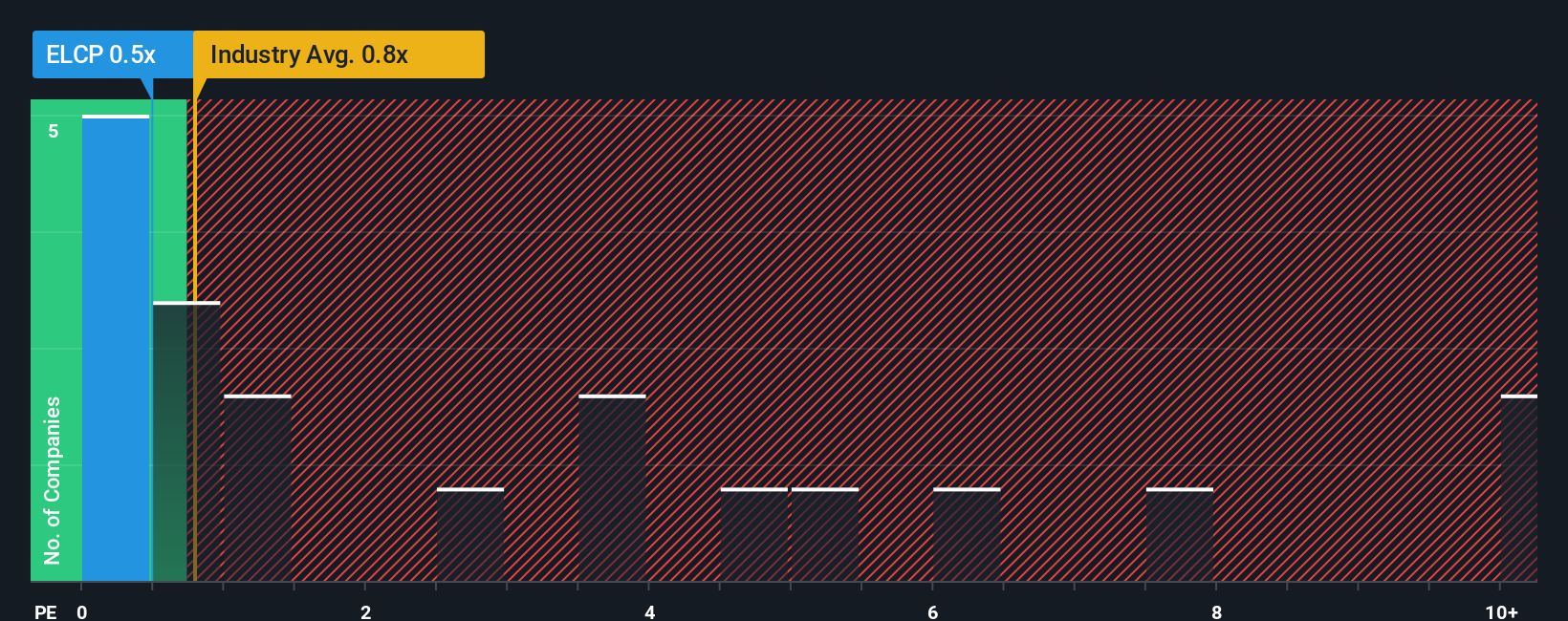

Even after such a large drop in price, Electra Power (2019) may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.5x, considering almost half of all companies in the Oil and Gas industry in Israel have P/S ratios greater than 1x and even P/S higher than 5x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Electra Power (2019)

What Does Electra Power (2019)'s Recent Performance Look Like?

The revenue growth achieved at Electra Power (2019) over the last year would be more than acceptable for most companies. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Electra Power (2019), take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Electra Power (2019)?

The only time you'd be truly comfortable seeing a P/S as low as Electra Power (2019)'s is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company grew revenue by an impressive 29% last year. The latest three year period has also seen a 26% overall rise in revenue, aided extensively by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to shrink 4.0% in the next 12 months, the company's positive momentum based on recent medium-term revenue results is a bright spot for the moment.

In light of this, it's quite peculiar that Electra Power (2019)'s P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

The Bottom Line On Electra Power (2019)'s P/S

Electra Power (2019)'s recently weak share price has pulled its P/S back below other Oil and Gas companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Electra Power (2019) revealed that despite growing revenue over the medium-term in a shrinking industry, the P/S doesn't reflect this as it's lower than the industry average. We think potential risks might be placing significant pressure on the P/S ratio and share price. Amidst challenging industry conditions, perhaps a key concern is whether the company can sustain its superior revenue growth trajectory. While the chance of the share price dropping sharply is fairly remote, investors do seem to be anticipating future revenue instability.

Before you take the next step, you should know about the 4 warning signs for Electra Power (2019) (3 are a bit unpleasant!) that we have uncovered.

If these risks are making you reconsider your opinion on Electra Power (2019), explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:SPGS

Supergas Power (2019)

Supergas Power (2019) Ltd markets, sells, and distributes liquefied petroleum gas, natural gas, electricity, and thermal energy in Israel.

Moderate risk with poor track record.

Similar Companies

Market Insights

Community Narratives