- Israel

- /

- Capital Markets

- /

- TASE:KSTN

Keystone REIT Ltd. (TLV:KSTN) Will Pay A ₪0.098 Dividend In Four Days

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Keystone REIT Ltd. (TLV:KSTN) is about to trade ex-dividend in the next 4 days. The ex-dividend date is one business day before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade takes at least two business day to settle. Thus, you can purchase Keystone REIT's shares before the 28th of September in order to receive the dividend, which the company will pay on the 9th of October.

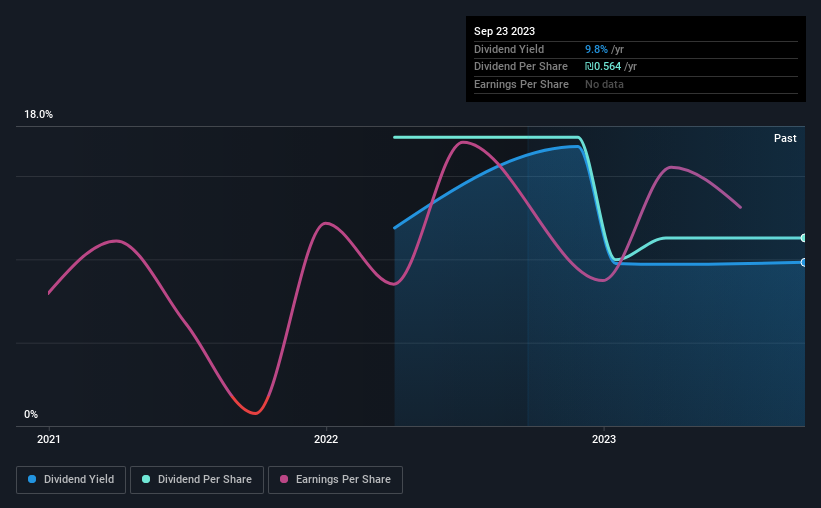

The company's next dividend payment will be ₪0.098 per share, and in the last 12 months, the company paid a total of ₪0.56 per share. Looking at the last 12 months of distributions, Keystone REIT has a trailing yield of approximately 9.8% on its current stock price of ₪5.747. If you buy this business for its dividend, you should have an idea of whether Keystone REIT's dividend is reliable and sustainable. So we need to investigate whether Keystone REIT can afford its dividend, and if the dividend could grow.

View our latest analysis for Keystone REIT

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Keystone REIT is paying out just 5.2% of its profit after tax, which is comfortably low and leaves plenty of breathing room in the case of adverse events.

Generally speaking, the lower a company's payout ratios, the more resilient its dividend usually is.

Click here to see how much of its profit Keystone REIT paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. From this perspective, we're disturbed to see earnings per share plunged 26% over the last 12 months, and we'd wonder if the company has had some kind of major event that has skewed the calculation.

Keystone REIT also issued more than 5% of its market cap in new stock during the past year, which we feel is likely to hurt its dividend prospects in the long run. Trying to grow the dividend while issuing large amounts of new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill.

Unfortunately Keystone REIT has only been paying a dividend for a year or so, so there's not much of a history to draw insight from.

Final Takeaway

Is Keystone REIT an attractive dividend stock, or better left on the shelf? Keystone REIT's earnings per share have declined over the past 12 months, although we note that it is paying out a low fraction of its earnings. Ordinarily we wouldn't be too concerned about a one-year decline, especially given the payout ratio is low. This makes us wonder if the company is incurring costs by reinvesting in its business. From a dividend perspective we struggle to see value in a company with declining earnings per share, but it's also true that a one-year decline often doesn't mean much. So we wouldn't be too quick to write this one off. It doesn't appear an outstanding opportunity, but could be worth a closer look.

If you want to look further into Keystone REIT, it's worth knowing the risks this business faces. Be aware that Keystone REIT is showing 3 warning signs in our investment analysis, and 2 of those are concerning...

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Keystone Infra might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:KSTN

Keystone Infra

Keystone REIT Ltd. operates in the asset management and custody banks industry.

Solid track record second-rate dividend payer.

Market Insights

Community Narratives