- United Arab Emirates

- /

- Consumer Services

- /

- ADX:DRIVE

Exploring Undiscovered Gems In The Middle East This November 2025

Reviewed by Simply Wall St

In November 2025, the Middle East stock markets have been experiencing some turbulence, with most Gulf markets easing due to weak oil prices and lackluster earnings reports. Despite these challenges, the search for undiscovered gems continues as investors look for stocks that demonstrate resilience and potential growth amid broader market pressures. Identifying such opportunities often involves finding companies with strong fundamentals and strategic positioning within their sectors.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| Bulbuloglu Vinc Sanayi ve Ticaret Anonim Sirketi | 21.47% | 16.40% | 50.84% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

| Marmaris Altinyunus Turistik Tesisler | NA | 47.57% | -36.80% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Emirates Driving Company P.J.S.C (ADX:DRIVE)

Simply Wall St Value Rating: ★★★★★★

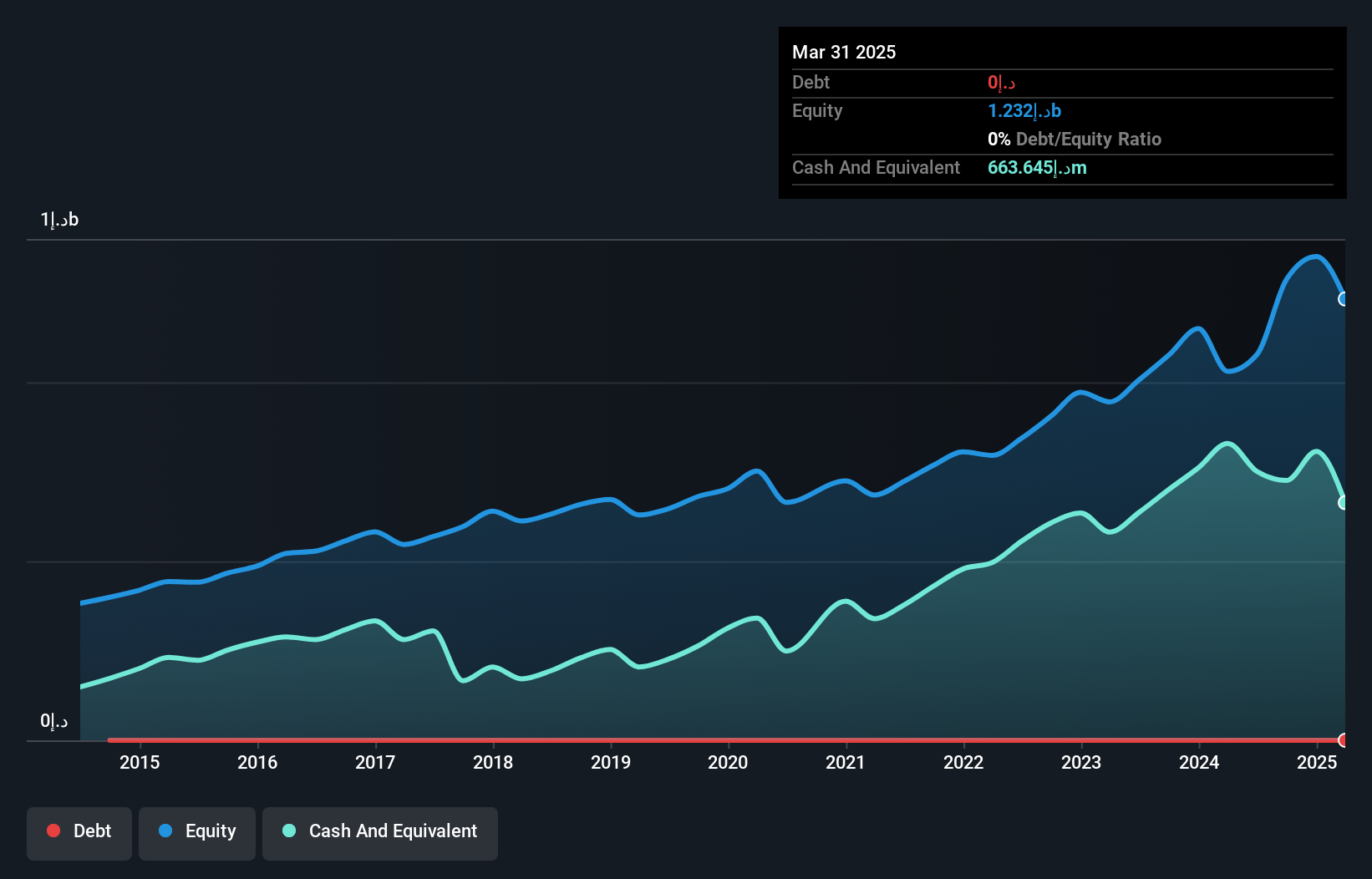

Overview: Emirates Driving Company P.J.S.C., along with its subsidiaries, specializes in managing and developing motor vehicle driving training in the United Arab Emirates, with a market capitalization of AED3.39 billion.

Operations: Emirates Driving Company P.J.S.C. generates revenue primarily from car and related services, totaling AED738.10 million. The company's financial performance is highlighted by its net profit margin, which stands at 50%.

Emirates Driving Company P.J.S.C. is showing strong financial health with no debt over the past five years, positioning it as a solid player in its field. The company reported third-quarter sales of AED 209.33 million, a notable increase from AED 161.69 million last year, while net income rose to AED 109.29 million from AED 85.26 million previously. Its earnings growth of 20% surpasses the industry average of 10%, highlighting its competitive edge in consumer services. Trading at a discount of around 34% below estimated fair value suggests potential for future appreciation in share price.

Atreyu Capital Markets (TASE:ATRY)

Simply Wall St Value Rating: ★★★★★★

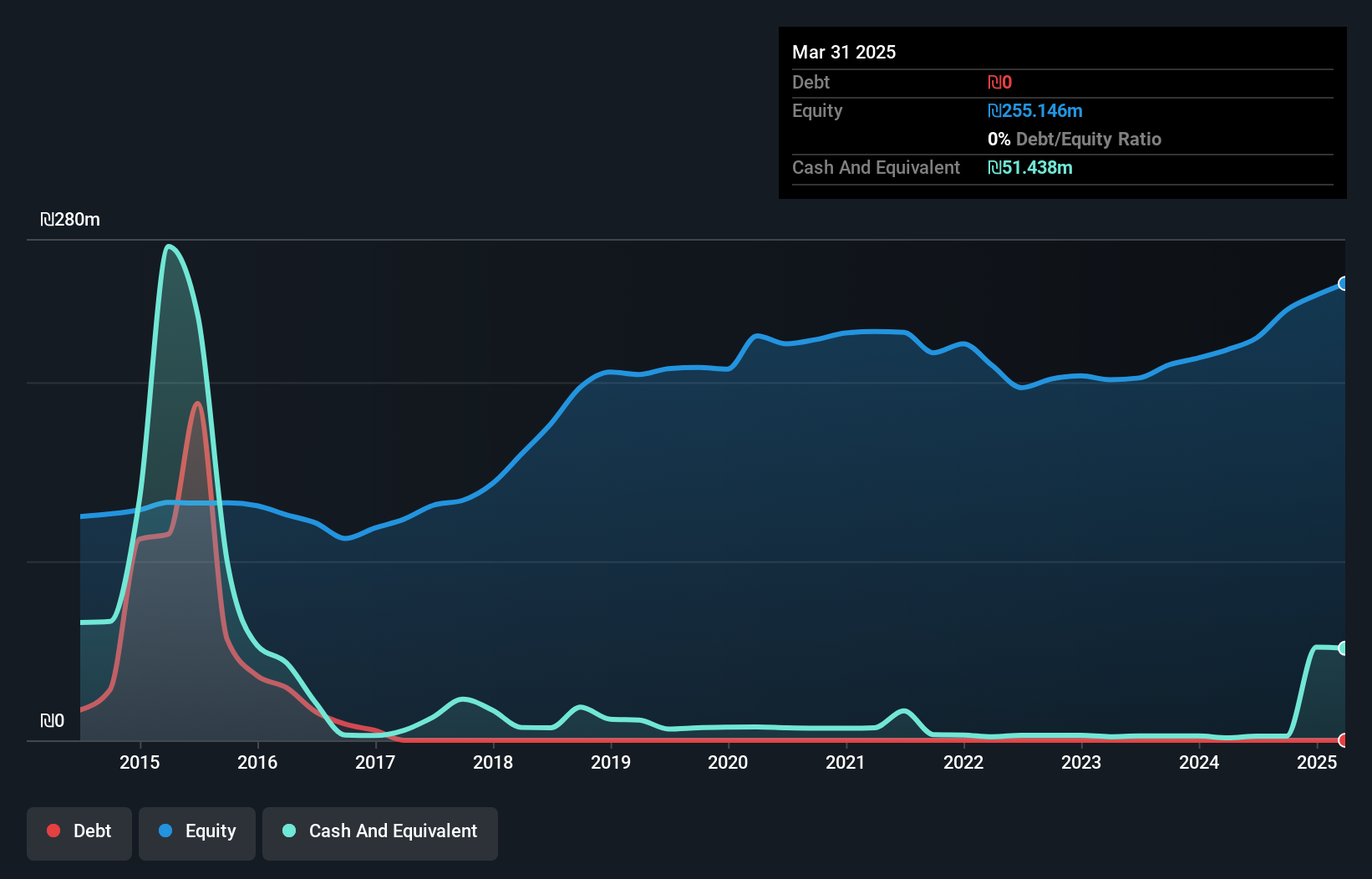

Overview: Atreyu Capital Markets Ltd operates through its subsidiaries to provide investment management services in Israel, with a market capitalization of ₪1.17 billion.

Operations: Atreyu Capital Markets generates revenue primarily from its investment management segment, amounting to ₪105.53 million. The company has a market capitalization of ₪1.17 billion.

Atreyu Capital Markets, a nimble player in the financial sector, has shown solid performance with recent revenue reaching ILS 27.54 million for Q2 2025, up from ILS 24.65 million last year. Net income also rose to ILS 26.36 million compared to ILS 23.64 million previously, indicating robust profitability despite not matching the industry's pace of growth at 42%. With earnings growing at an annual rate of 3% over five years and a price-to-earnings ratio of just under 12x against the market’s average of over 16x, Atreyu offers value potential without any debt concerns on its balance sheet.

- Get an in-depth perspective on Atreyu Capital Markets' performance by reading our health report here.

Understand Atreyu Capital Markets' track record by examining our Past report.

Fox-Wizel (TASE:FOX)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Fox-Wizel Ltd. is a company that designs, acquires, markets, and distributes a wide range of products including clothing, accessories, footwear, and home fashion across Israel and international markets such as Canada, Europe, and Asia with a market cap of ₪5.25 billion.

Operations: Fox-Wizel generates revenue primarily from its Sports segment, which includes Nike and Foot Locker in Israel, Canada, and Europe, contributing ₪2.47 billion. The Fashion and Home Fashion segment in Israel also plays a significant role with revenue of ₪2.15 billion.

Fox-Wizel, a player in the Specialty Retail sector, has seen its earnings grow by 11.3% over the past year, outpacing the industry average of 4.9%. Despite this growth, recent financial results show a mixed performance with second-quarter sales increasing to ILS 1.62 billion from ILS 1.59 billion last year, yet net income dropped to ILS 52.39 million from ILS 95.58 million. The company's debt-to-equity ratio has improved from 90.7% to a more manageable 70.1% over five years, though interest coverage remains tight at just 2.7 times EBIT—below the preferred threshold of three times coverage for comfort.

- Click here to discover the nuances of Fox-Wizel with our detailed analytical health report.

Gain insights into Fox-Wizel's historical performance by reviewing our past performance report.

Taking Advantage

- Discover the full array of 207 Middle Eastern Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emirates Driving Company P.J.S.C might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:DRIVE

Emirates Driving Company P.J.S.C

Manages and develops motor vehicles driving training in the United Arab Emirates.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives