- Israel

- /

- Construction

- /

- TASE:WNBZ

Further weakness as Wind Buzz Technologies (TLV:WNBZ) drops 15% this week, taking three-year losses to 49%

For many investors, the main point of stock picking is to generate higher returns than the overall market. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. Unfortunately, that's been the case for longer term Wind Buzz Technologies Ltd (TLV:WNBZ) shareholders, since the share price is down 86% in the last three years, falling well short of the market decline of around 6.3%. And over the last year the share price fell 28%, so we doubt many shareholders are delighted. Shareholders have had an even rougher run lately, with the share price down 24% in the last 90 days. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

If the past week is anything to go by, investor sentiment for Wind Buzz Technologies isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for Wind Buzz Technologies

With zero revenue generated over twelve months, we don't think that Wind Buzz Technologies has proved its business plan yet. We can't help wondering why it's publicly listed so early in its journey. Are venture capitalists not interested? So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). Investors will be hoping that Wind Buzz Technologies can make progress and gain better traction for the business, before it runs low on cash.

We think companies that have neither significant revenues nor profits are pretty high risk. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized). It certainly is a dangerous place to invest, as Wind Buzz Technologies investors might realise.

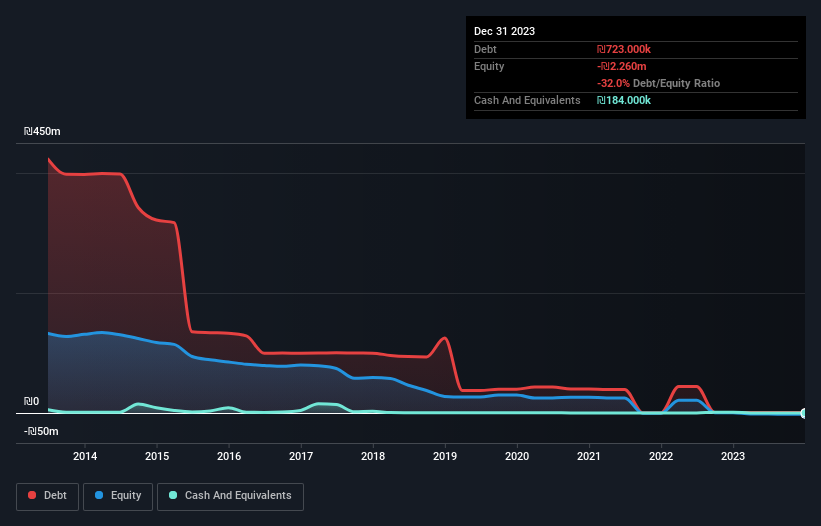

Wind Buzz Technologies had liabilities exceeding cash by ₪3.3m when it last reported in December 2023, according to our data. That puts it in the highest risk category, according to our analysis. But with the share price diving 23% per year, over 3 years , it's probably fair to say that some shareholders no longer believe the company will succeed. The image below shows how Wind Buzz Technologies' balance sheet has changed over time; if you want to see the precise values, simply click on the image.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. Given that situation, would you be concerned if it turned out insiders were relentlessly selling stock? It would bother me, that's for sure. You can click here to see if there are insiders selling.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Wind Buzz Technologies' total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Wind Buzz Technologies hasn't been paying dividends, but its TSR of -49% exceeds its share price return of -86%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

While the broader market gained around 8.9% in the last year, Wind Buzz Technologies shareholders lost 28%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 7% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 7 warning signs for Wind Buzz Technologies you should be aware of, and 6 of them are significant.

But note: Wind Buzz Technologies may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Israeli exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Wind Buzz Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:WNBZ

Wind Buzz Technologies

Wind Buzz Technologies Ltd initiates, develops, constructs, leases, manages, and maintains commercial investment properties in Israel.

Medium-low with weak fundamentals.