- Israel

- /

- Construction

- /

- TASE:SBEN

Positive earnings growth hasn't been enough to get Shikun & Binui Energy (TLV:SBEN) shareholders a favorable return over the last year

It's understandable if you feel frustrated when a stock you own sees a lower share price. But often it is not a reflection of the fundamental business performance. The Shikun & Binui Energy Ltd (TLV:SBEN) share price is down 12% in the last year. However, that's better than the market's overall decline of 15%. Shikun & Binui Energy hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. On the other hand the share price has bounced 8.5% over the last week.

Although the past week has been more reassuring for shareholders, they're still in the red over the last year, so let's see if the underlying business has been responsible for the decline.

See our latest analysis for Shikun & Binui Energy

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate twelve months during which the Shikun & Binui Energy share price fell, it actually saw its earnings per share (EPS) improve by 100%. It's quite possible that growth expectations may have been unreasonable in the past.

It's surprising to see the share price fall so much, despite the improved EPS. So it's well worth checking out some other metrics, too.

Shikun & Binui Energy's revenue is actually up 98% over the last year. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

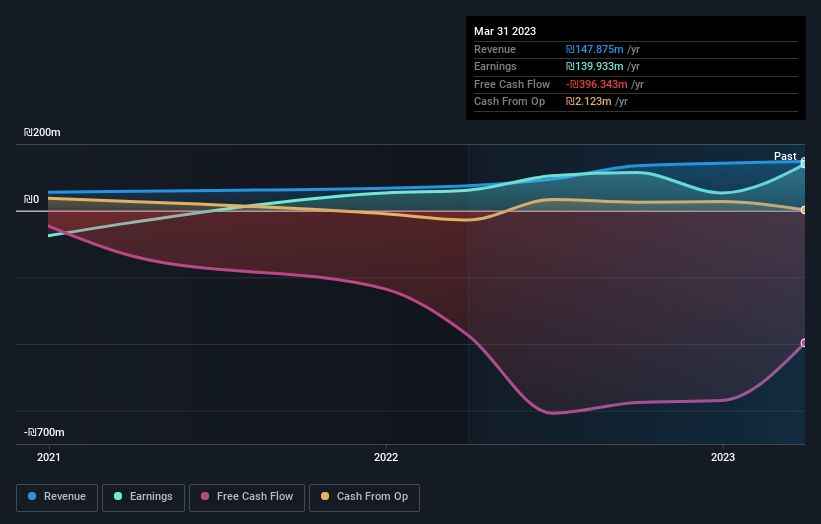

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on Shikun & Binui Energy's earnings, revenue and cash flow.

A Different Perspective

It's not great that Shikun & Binui Energy shares failed to make money for shareholders in the last year, but the silver lining is that the loss of 12%, wasn't as bad as the broader market loss of about 15%. On the plus side, the share price has bounced a full 2.7% in the last three months. It could be that the share price dropped so far that the business was cheap on the numbers, but the future will ultimately determine the value of the stock. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 2 warning signs for Shikun & Binui Energy (1 can't be ignored) that you should be aware of.

But note: Shikun & Binui Energy may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Israeli exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:SBEN

Shikun & Binui Energy

Engages in the development, financing, construction, and operation of power generation plants based on solar energy, hydro, wind, and natural gas energies in Israel and internationally.

Acceptable track record and overvalued.