Stock Analysis

Parkomat International's (TLV:PRKM) stock is up by a considerable 29% over the past three months. We, however wanted to have a closer look at its key financial indicators as the markets usually pay for long-term fundamentals, and in this case, they don't look very promising. Particularly, we will be paying attention to Parkomat International's ROE today.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

View our latest analysis for Parkomat International

How Do You Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Parkomat International is:

7.6% = ₪2.1m ÷ ₪28m (Based on the trailing twelve months to June 2023).

The 'return' is the amount earned after tax over the last twelve months. So, this means that for every ₪1 of its shareholder's investments, the company generates a profit of ₪0.08.

What Is The Relationship Between ROE And Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Parkomat International's Earnings Growth And 7.6% ROE

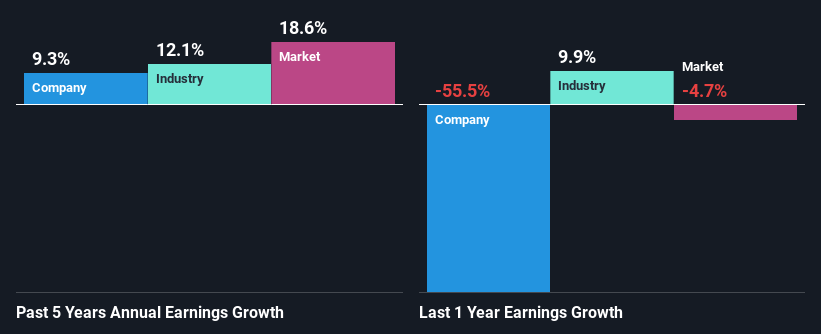

When you first look at it, Parkomat International's ROE doesn't look that attractive. However, given that the company's ROE is similar to the average industry ROE of 8.2%, we may spare it some thought. Having said that, Parkomat International has shown a modest net income growth of 9.3% over the past five years. Taking into consideration that the ROE is not particularly high, we reckon that there could also be other factors at play which could be influencing the company's growth. Such as - high earnings retention or an efficient management in place.

As a next step, we compared Parkomat International's net income growth with the industry and were disappointed to see that the company's growth is lower than the industry average growth of 12% in the same period.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. Is Parkomat International fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Parkomat International Making Efficient Use Of Its Profits?

Parkomat International has a significant three-year median payout ratio of 97%, meaning that it is left with only 3.0% to reinvest into its business. This implies that the company has been able to achieve decent earnings growth despite returning most of its profits to shareholders.

While Parkomat International has seen growth in its earnings, it only recently started to pay a dividend. It is most likely that the company decided to impress new and existing shareholders with a dividend.

Summary

On the whole, Parkomat International's performance is quite a big let-down. While the company has posted decent earnings growth, the company is retaining little to no profits and is reinvesting those profits at a low rate of return. This makes us doubtful if that growth could continue, especially if by any chance the business is faced with any sort of risk. So far, we've only made a quick discussion around the company's earnings growth. To gain further insights into Parkomat International's past profit growth, check out this visualization of past earnings, revenue and cash flows.

Valuation is complex, but we're helping make it simple.

Find out whether Parkomat International is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:PRKM

Parkomat International

Parkomat International Ltd engages in the design, development, production, assembly, and service of mechanical and robotic parking facilities for real estate projects in Israel.

Outstanding track record with adequate balance sheet.