- Saudi Arabia

- /

- Healthcare Services

- /

- SASE:4018

Undiscovered Gems in Middle East Stocks To Explore September 2025

Reviewed by Simply Wall St

As optimism around a potential U.S. Federal Reserve rate cut grows, most major Gulf markets have seen gains, even as weak oil prices temper some of the upward momentum. This environment creates an intriguing backdrop for investors looking to explore lesser-known opportunities within the Middle East's stock markets, where identifying companies with strong fundamentals and growth potential can be particularly rewarding amidst such dynamic economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mendelson Infrastructures & Industries | 23.85% | 5.17% | 7.38% | ★★★★★★ |

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| Makina Takim Endüstrisi | NA | 46.07% | 57.44% | ★★★★★★ |

| Terminal X Online | 14.88% | 12.11% | 41.14% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Y.D. More Investments | 50.84% | 28.28% | 35.02% | ★★★★★☆ |

| C. Mer Industries | 109.27% | 13.77% | 72.47% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

| Rotshtein Realestate | 142.50% | 22.29% | 13.79% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

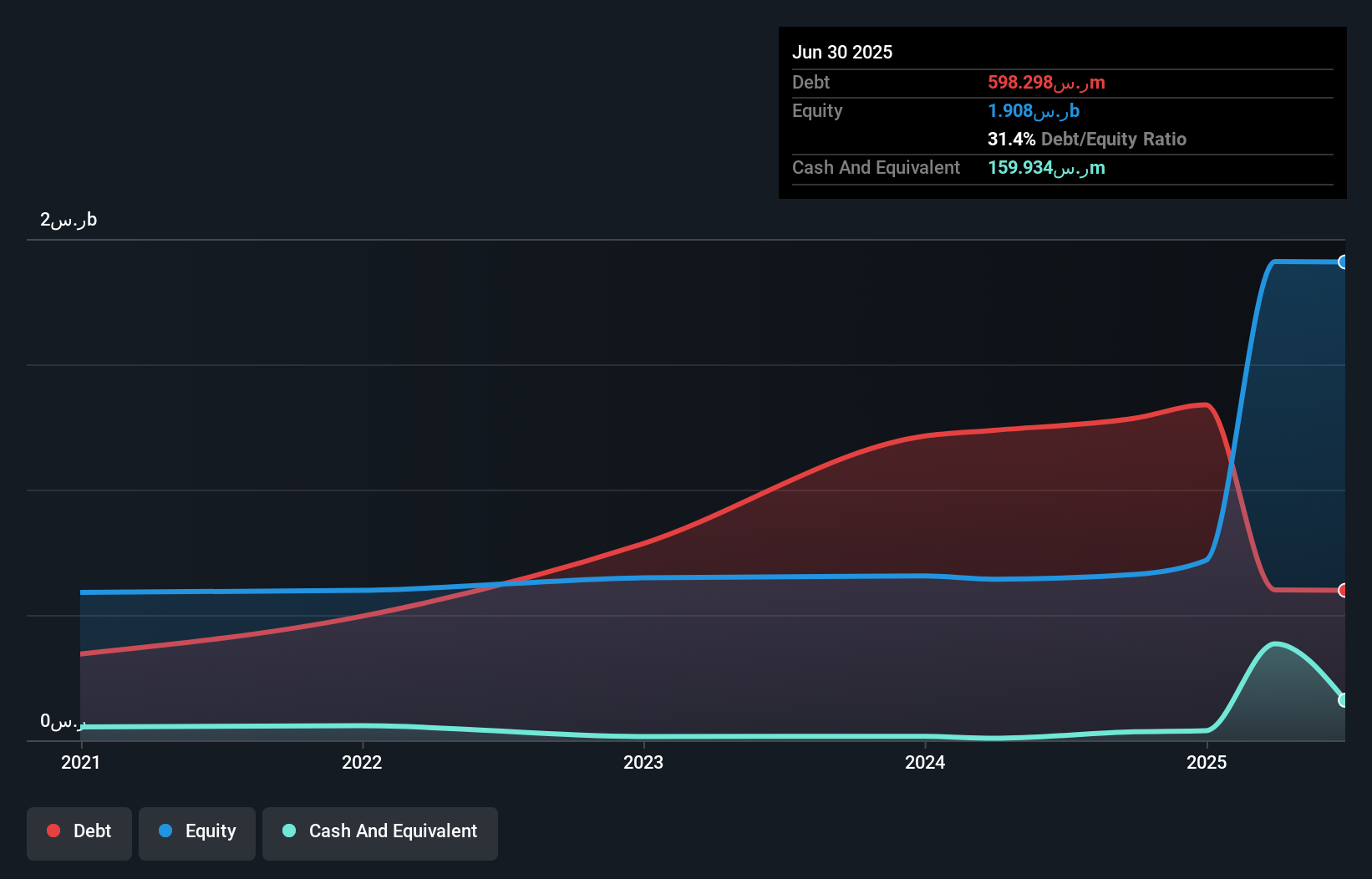

Middle East Pharmaceutical Industries (SASE:4016)

Simply Wall St Value Rating: ★★★★★☆

Overview: Middle East Pharmaceutical Industries Company focuses on the research, development, manufacture, and marketing of generic medicines and pharmaceutical preparations both in Saudi Arabia and internationally, with a market cap of SAR2.51 billion.

Operations: The company's revenue streams are primarily derived from private customers, contributing SAR286.25 million, followed by public customers at SAR95 million and export customers at SAR50.82 million.

Middle East Pharmaceutical Industries, a vibrant player in the pharma sector, reported a solid earnings growth of 16.9% over the past year, outpacing the industry average of 5.1%. Recent financials show SAR 117.66 million in sales for Q2 2025 and net income at SAR 24.81 million, reflecting an upward trend from last year's figures. The company also announced dividends totaling SAR 22 million for H1 2025, with each share earning SAR 1.10. A notable agreement with Adalvo Limited positions them to distribute GLP-1 products across MENA regions, showcasing strategic expansion efforts valued at EUR 3 million over seven years.

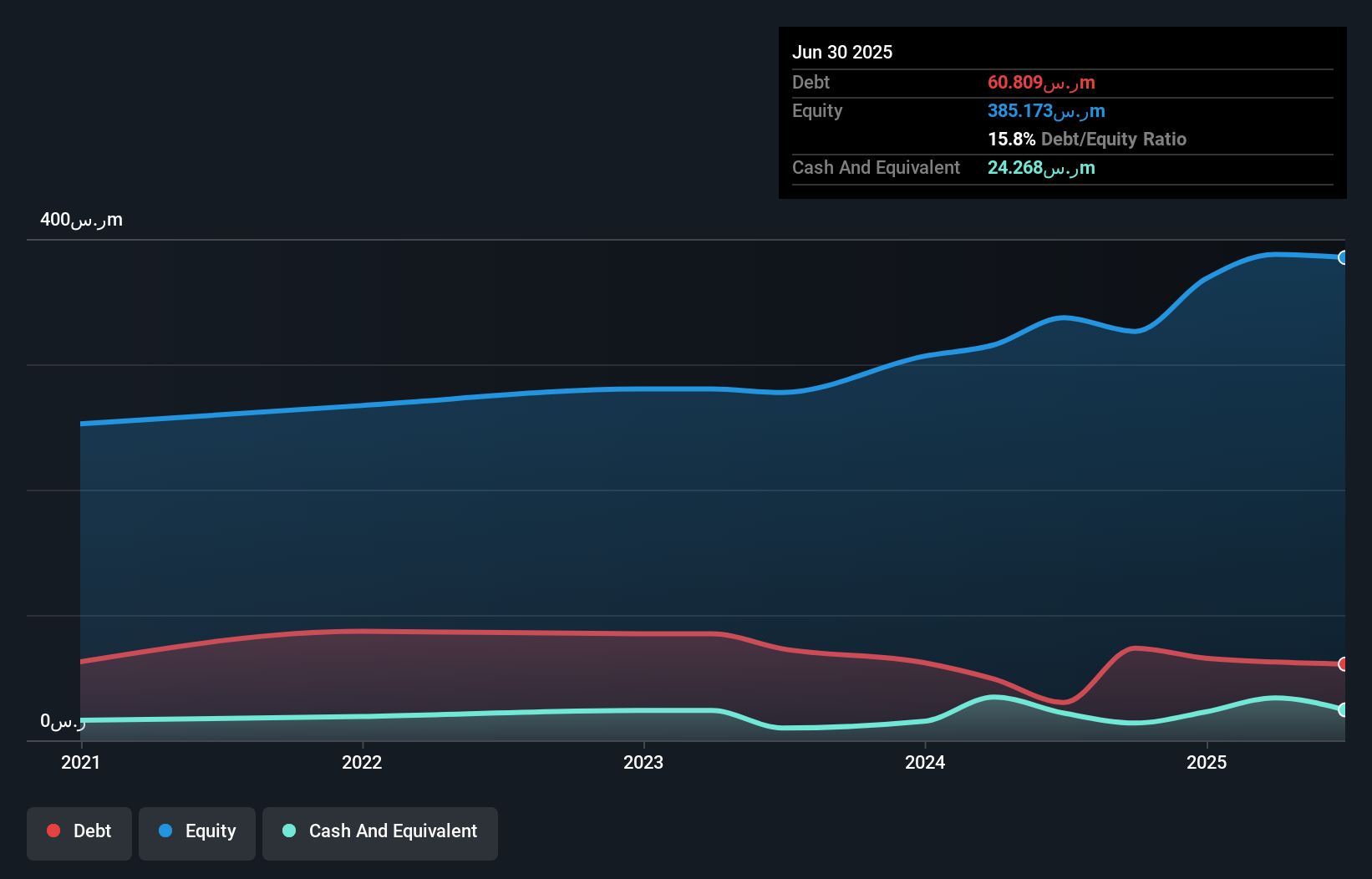

Almoosa Health (SASE:4018)

Simply Wall St Value Rating: ★★★★★☆

Overview: Almoosa Health Company is a private healthcare provider in Saudi Arabia with a market cap of SAR7.39 billion.

Operations: The company generates revenue primarily from healthcare services, with significant costs attributed to medical supplies and personnel expenses. Its net profit margin is 15%, reflecting its ability to manage operational costs effectively.

Almoosa Health, a nimble player in the healthcare sector, has been making waves with impressive earnings growth of 152.3% over the past year, outpacing the industry average of 7.2%. The company's net income for the first half of 2025 surged to SAR 102.9 million from SAR 12.5 million a year earlier, reflecting its robust operational performance. With interest payments well-covered by EBIT at a ratio of 4.6x and trading at nearly 39% below estimated fair value, Almoosa appears undervalued. Recent expansion efforts include opening Al-Nakheel Medical Center as part of a SAR 3.1 billion investment plan across Saudi Arabia.

- Get an in-depth perspective on Almoosa Health's performance by reading our health report here.

Gain insights into Almoosa Health's past trends and performance with our Past report.

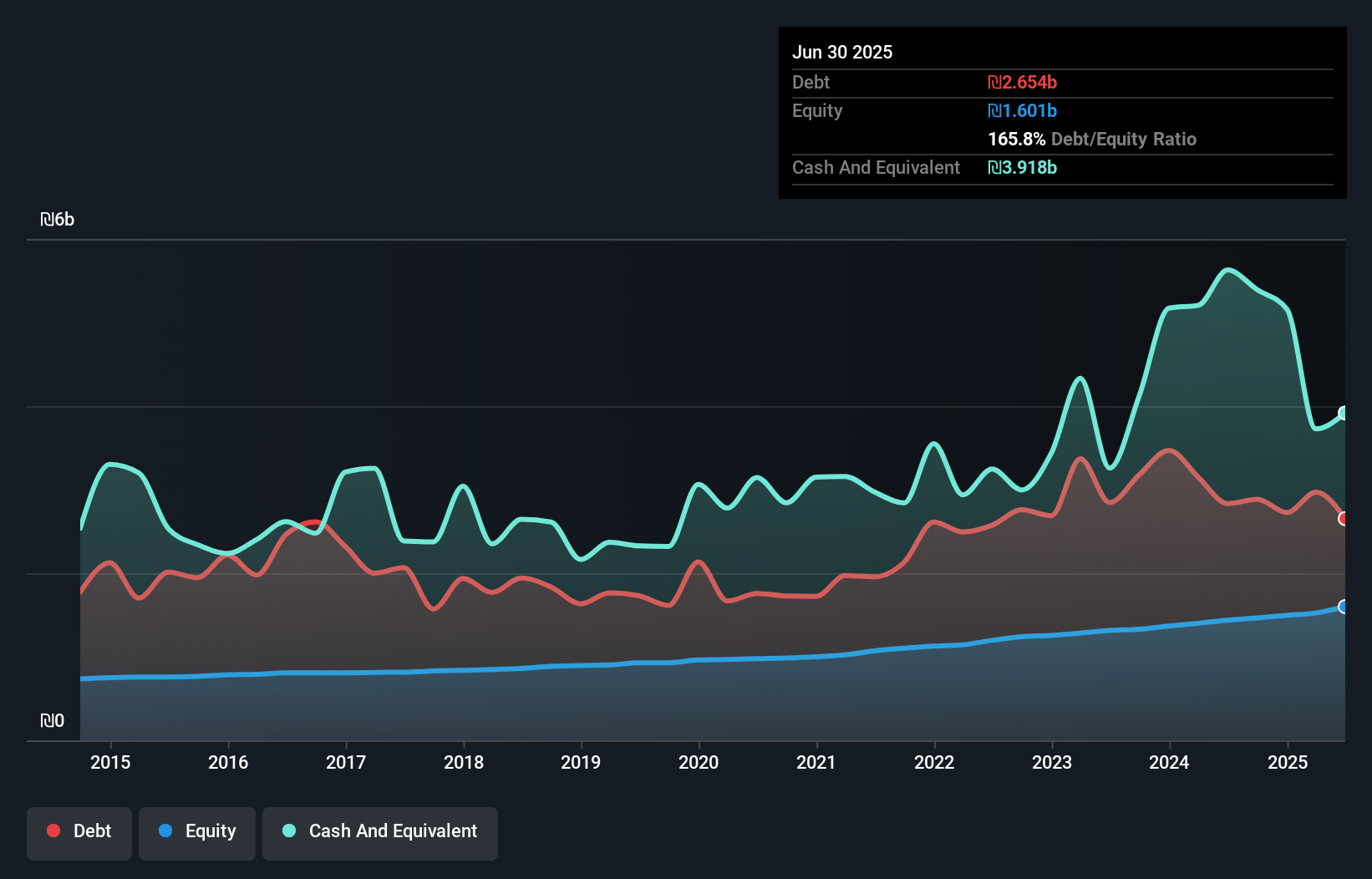

Bank of Jerusalem (TASE:JBNK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bank of Jerusalem Ltd. offers commercial banking services in Israel and has a market capitalization of ₪1.76 billion.

Operations: The primary revenue streams for this entity include housing loans and household-related services, generating ₪212 million and ₪261.80 million respectively. Private banking contributes an additional ₪26.90 million, while institutional investors add ₪6.70 million to the revenue mix.

With assets totaling ₪21.9 billion and equity of ₪1.6 billion, Bank of Jerusalem stands out in its sector. The bank's liabilities are primarily low-risk, with 85% funded by customer deposits, which is a safer bet than external borrowing. Total deposits amount to ₪17.3 billion against loans of ₪15.8 billion, showcasing a balanced approach to lending and funding. Its price-to-earnings ratio at 9.8x suggests undervaluation compared to the IL market's 15.2x benchmark, while earnings growth over the past year reached an impressive 20.2%, surpassing the industry average of 11.6%.

Turning Ideas Into Actions

- Unlock more gems! Our Middle Eastern Undiscovered Gems With Strong Fundamentals screener has unearthed 196 more companies for you to explore.Click here to unveil our expertly curated list of 199 Middle Eastern Undiscovered Gems With Strong Fundamentals.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:4018

Almoosa Health

Operates as a private healthcare provider in the Kingdom of Saudi Arabia.

High growth potential with solid track record.

Market Insights

Community Narratives