Glanbia (ISE:GL9): Assessing Valuation Against Recent Growth and Market Expectations

Reviewed by Simply Wall St

Glanbia (ISE:GL9) shares have moved only slightly over the past week, leaving investors to weigh its steady performance and recent annual figures. In this context, it is worth considering how the company’s growth rates compare with peers.

See our latest analysis for Glanbia.

Glanbia’s share price has crept steadily higher this year, gaining nearly 12% year-to-date as sentiment appears to reflect both solid earnings growth and cautious optimism for the sector. The stock’s total shareholder return of 7.4% over the past twelve months, along with an impressive 46% over three years, signals that momentum is building for investors who value steady compounding over volatility.

If you’re looking to cast a wider net in search of standout performers, this is an ideal time to expand your search and discover fast growing stocks with high insider ownership

With Glanbia’s share price climbing this year while remaining below analyst price targets, the key question emerges: is the stock undervalued enough to offer upside, or is the market simply factoring in future growth expectations?

Most Popular Narrative: 13.1% Undervalued

Glanbia’s most widely followed narrative suggests a fair value that is meaningfully above the latest closing price, leaving room for investor optimism around future earnings and growth plans.

Ongoing expansion and investment in Health & Nutrition and Dairy Nutrition divisions, supported by growing global demand for functional foods, supplements, and high-protein offerings (including plant-based), position Glanbia to capture rising revenue and achieve mid-single-digit volume-led growth, especially in international and emerging markets like Asia and Latin America. This can positively impact top-line growth.

Want to know what’s driving Glanbia’s strong fair value? This narrative is betting on a dramatic surge in profits, expanding margin potential, and an ambitious future earnings target. Curious which bold financial projections the consensus is wagering will materialize? Unlock the key numbers and storylines underlying this bullish price estimate.

Result: Fair Value of $17.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued high input costs or increased competition in Glanbia’s key nutrition markets could reduce earnings momentum and challenge bullish forecasts.

Find out about the key risks to this Glanbia narrative.

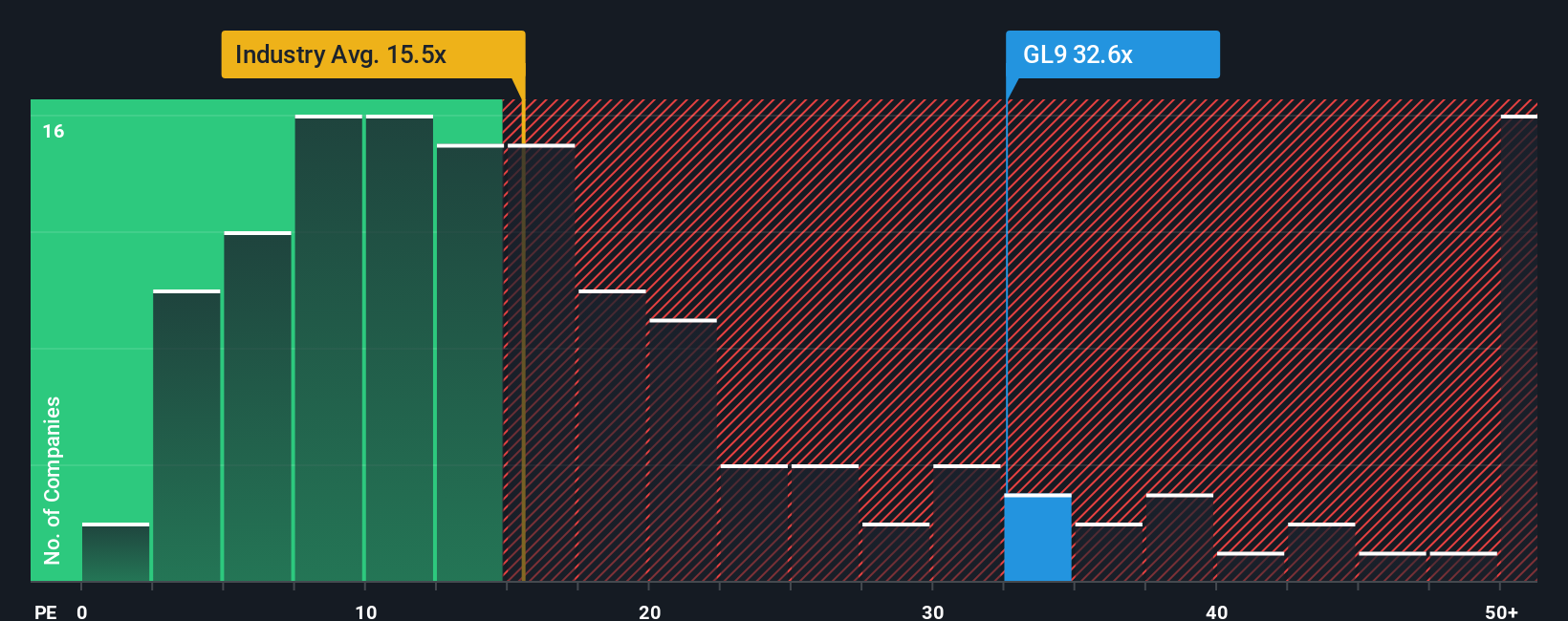

Another View: Multiples Tell a Different Story

Looking beyond fair value estimates, Glanbia trades at a price-to-earnings ratio of 35.2x. This is much higher than both its industry peers, who average 14.3x, and the fair ratio of 24.8x that the market could trend toward. This gap suggests the stock could be at risk of de-rating if growth stalls. Which view should investors trust when deciding their next move?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Glanbia Narrative

If you see the story differently or want to dive deeper into Glanbia’s numbers, you can craft your own perspective in just a few minutes. Do it your way.

A great starting point for your Glanbia research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Make your next smart move now and unlock stock picks built for today's market. Waiting could mean missing the next big winner.

- Capture breakout potential by checking out these 3571 penny stocks with strong financials with robust financials that stand out from the crowd.

- Maximize your portfolio’s tech edge when you browse these 25 AI penny stocks at the forefront of artificial intelligence innovation.

- Secure opportunities for steady returns by evaluating these 15 dividend stocks with yields > 3% with attractive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ISE:GL9

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives