Stock Analysis

Should You Be Adding AIB Group (ISE:A5G) To Your Watchlist Today?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like AIB Group (ISE:A5G), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for AIB Group

How Fast Is AIB Group Growing Its Earnings Per Share?

In the last three years AIB Group's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. Impressively, AIB Group's EPS catapulted from €0.41 to €0.97, over the last year. It's a rarity to see 138% year-on-year growth like that. That could be a sign that the business has reached a true inflection point.

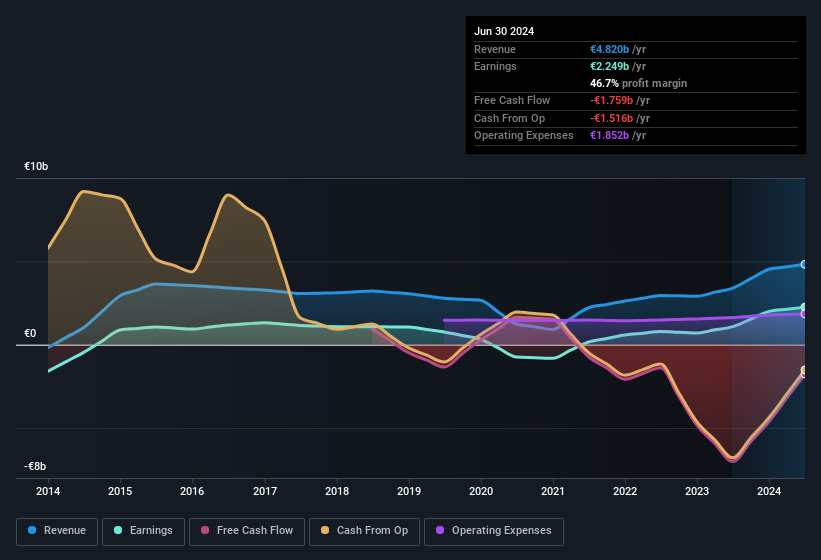

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Our analysis has highlighted that AIB Group's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. EBIT margins for AIB Group remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 42% to €4.8b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for AIB Group's future profits.

Are AIB Group Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news for AIB Group shareholders is that no insiders reported selling shares in the last year. With that in mind, it's heartening that Tanya Horgan, the company insider of the company, paid €44k for shares at around €4.43 each. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

Recent insider purchases of AIB Group stock is not the only way management has kept the interests of the general public shareholders in mind. Namely, AIB Group has a very reasonable level of CEO pay. Our analysis has discovered that the median total compensation for the CEOs of companies like AIB Group, with market caps over €7.3b, is about €4.0m.

The CEO of AIB Group only received €613k in total compensation for the year ending December 2023. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does AIB Group Deserve A Spot On Your Watchlist?

AIB Group's earnings have taken off in quite an impressive fashion. Not to mention the company's insiders have been adding to their portfolios and the CEO's remuneration policy looks to have had shareholders in mind seeing as it's quite modest for the company size. The strong EPS growth suggests AIB Group may be at an inflection point. If these have piqued your interest, then this stock surely warrants a spot on your watchlist. Still, you should learn about the 2 warning signs we've spotted with AIB Group (including 1 which is a bit unpleasant).

Keen growth investors love to see insider activity. Thankfully, AIB Group isn't the only one. You can see a a curated list of Irish companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ISE:A5G

AIB Group

Provides banking and financial products and services to retail, business, and corporate customers in the Republic of Ireland and the United Kingdom.