Undiscovered Gems With Strong Fundamentals For September 2024

Reviewed by Simply Wall St

As global markets navigate mixed signals and economic data, small-cap stocks have shown resilience, with the S&P 600 index reflecting steady performance despite broader market volatility. In light of these conditions, identifying stocks with strong fundamentals becomes crucial for investors seeking long-term growth opportunities. In this article, we highlight three undiscovered gems that exhibit robust financial health and promising prospects for September 2024.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Etihad Atheeb Telecommunication | NA | 26.82% | 62.18% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MOBI Industry | 28.24% | 6.15% | 18.49% | ★★★★★☆ |

| Britam Holdings | 10.05% | 3.47% | 16.62% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 8.04% | -3.72% | ★★★★★☆ |

| Standard Chartered Bank Kenya | 6.93% | 8.35% | 16.18% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We'll examine a selection from our screener results.

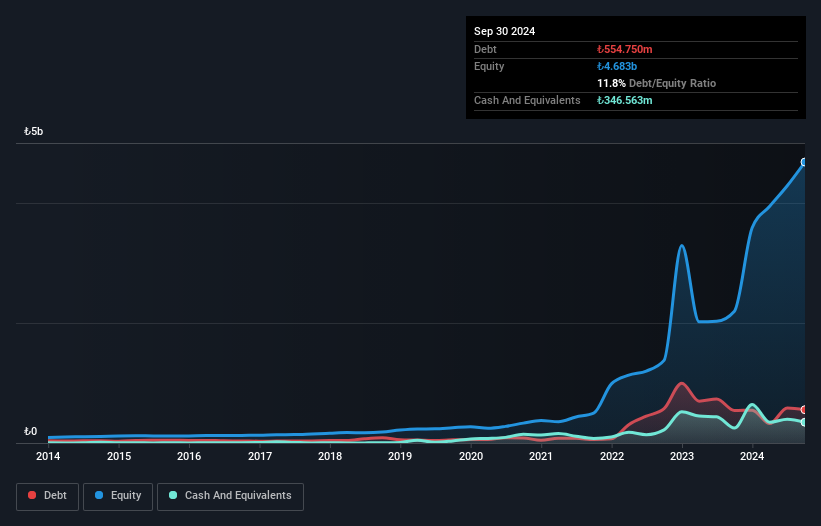

Jantsa Jant Sanayi ve Ticaret (IBSE:JANTS)

Simply Wall St Value Rating: ★★★★★★

Overview: Jantsa Jant Sanayi ve Ticaret A.S. manufactures and sells steel wheels for commercial, industrial, and agricultural machinery primarily in Turkey, with a market cap of TRY19.26 billion.

Operations: Jantsa Jant Sanayi ve Ticaret generates revenue primarily from rim production, amounting to TRY7.30 billion.

Jantsa Jant Sanayi ve Ticaret has seen its debt-to-equity ratio drop significantly from 20.8% to 8.2% over five years, indicating improved financial health. The company’s earnings growth of 7.5% last year outpaced the Machinery industry’s 4.9%, showcasing robust performance despite a volatile share price recently. Trading at 40.3% below estimated fair value, JANTS also reported TRY 1,227 million in sales and TRY 16 million net income for Q1-2024, down from TRY 1,470 million and TRY 24 million respectively a year ago.

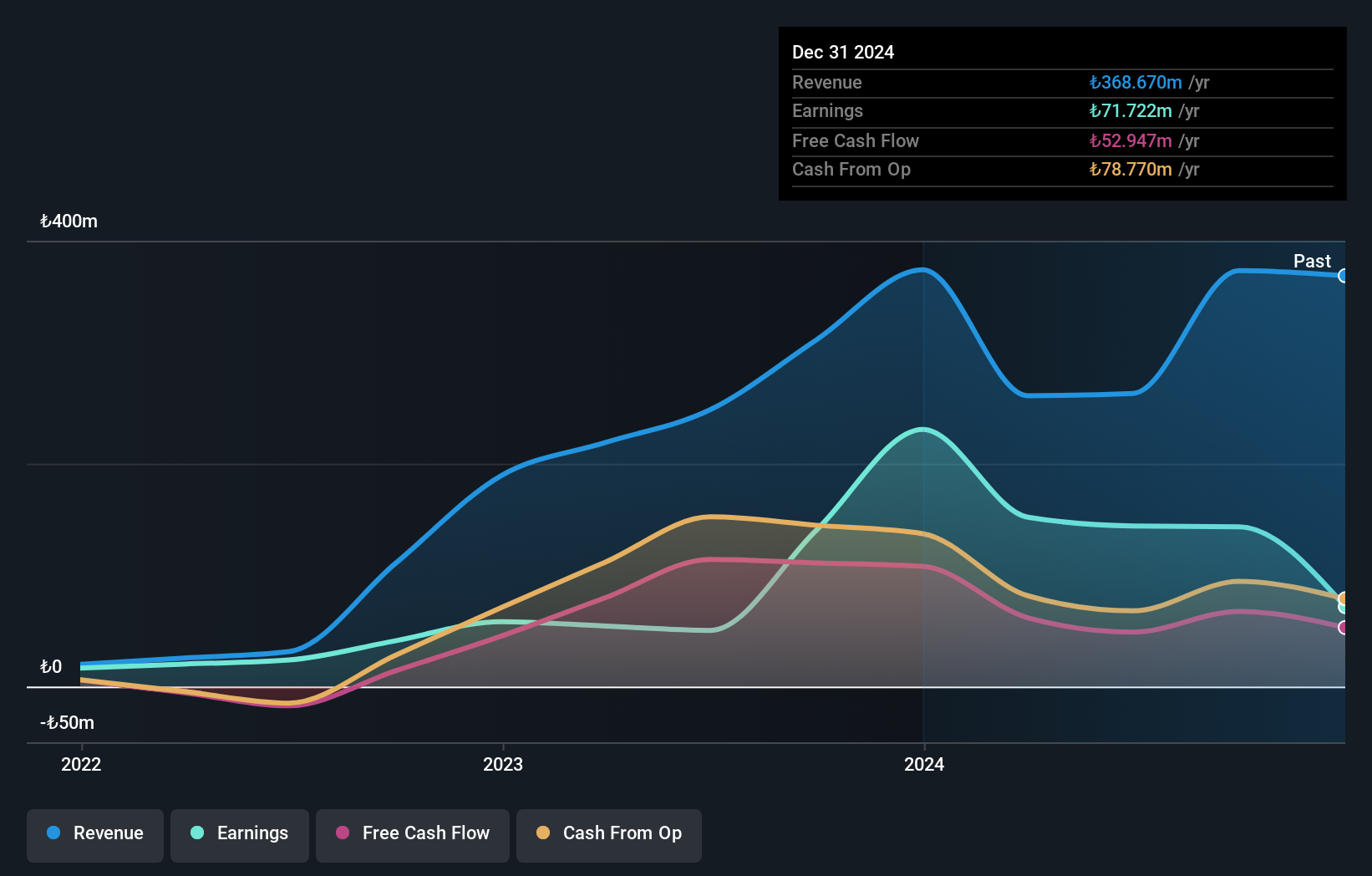

Kustur Kusadasi Turizm Endüstrisi (IBSE:KSTUR)

Simply Wall St Value Rating: ★★★★★★

Overview: Kustur Kusadasi Turizm Endüstrisi A.S. operates holiday clubs in Turkey and has a market cap of TRY18.89 billion.

Operations: Kustur Kusadasi Turizm Endüstrisi A.S. generates revenue primarily from its casinos and resorts, amounting to TRY258.96 million.

Kustur Kusadasi Turizm Endüstrisi has seen remarkable earnings growth of 174.3% over the past year, significantly outpacing the Hospitality industry's -5.2%. The company boasts a high level of non-cash earnings and has been debt-free for the last five years, indicating strong financial health. Despite recent share price volatility, KSTUR's profitability ensures that cash runway is not an issue. With no debt to worry about, interest coverage isn't a concern either.

- Delve into the full analysis health report here for a deeper understanding of Kustur Kusadasi Turizm Endüstrisi.

Understand Kustur Kusadasi Turizm Endüstrisi's track record by examining our Past report.

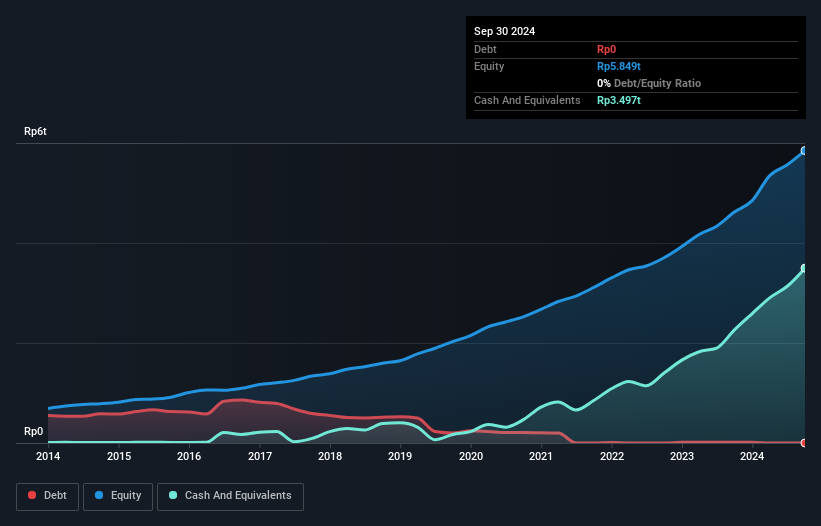

Siantar Top (IDX:STTP)

Simply Wall St Value Rating: ★★★★★★

Overview: PT Siantar Top Tbk, along with its subsidiaries, manufactures and sells snacks in Indonesia and has a market cap of IDR20.57 billion.

Operations: Revenue for Siantar Top primarily comes from food processing, contributing IDR4.43 billion, while other segments add IDR302 million.

Siantar Top, a small cap food company, has shown impressive growth metrics. Its earnings surged by 68.5% over the past year, outpacing the Food industry’s -6.7%. The firm is debt-free now, unlike five years ago when its debt to equity ratio stood at 28%. Additionally, it trades at 42% below its estimated fair value. These factors combined with high-quality past earnings and positive free cash flow make it an intriguing investment prospect.

- Dive into the specifics of Siantar Top here with our thorough health report.

Assess Siantar Top's past performance with our detailed historical performance reports.

Taking Advantage

- Click through to start exploring the rest of the 4855 Undiscovered Gems With Strong Fundamentals now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IDX:STTP

Outstanding track record with flawless balance sheet.