- China

- /

- Capital Markets

- /

- SZSE:000567

Discovering Undiscovered Gems with Strong Fundamentals In July 2024

Reviewed by Simply Wall St

In the current market landscape, small-cap and value stocks have been outperforming their large-cap growth counterparts, driven by mixed economic indicators and investor sentiment. As we navigate this dynamic environment, it's crucial to identify stocks with strong fundamentals that can weather the fluctuations. A good stock in today's market is one that demonstrates solid financial health, consistent earnings growth, and a robust business model—qualities that are essential for long-term stability amid economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Jadranski naftovod d.d | 1.65% | 9.49% | 6.75% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Amana Cooperative Insurance | NA | 2.55% | 12.80% | ★★★★★★ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 8.04% | -3.72% | ★★★★★☆ |

| Productive Business Solutions | 148.68% | 16.40% | 54.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Capricorn Group | 63.66% | 7.59% | 9.16% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Saratoga Investama Sedaya (IDX:SRTG)

Simply Wall St Value Rating: ★★★★★☆

Overview: PT Saratoga Investama Sedaya Tbk is a private equity and venture capital firm specializing in early stage, growth stage, and special situations investments with a market cap of IDR21.66 billion.

Operations: Saratoga Investama Sedaya generates revenue primarily through its private equity and venture capital investments. The firm has a market cap of IDR21.66 billion.

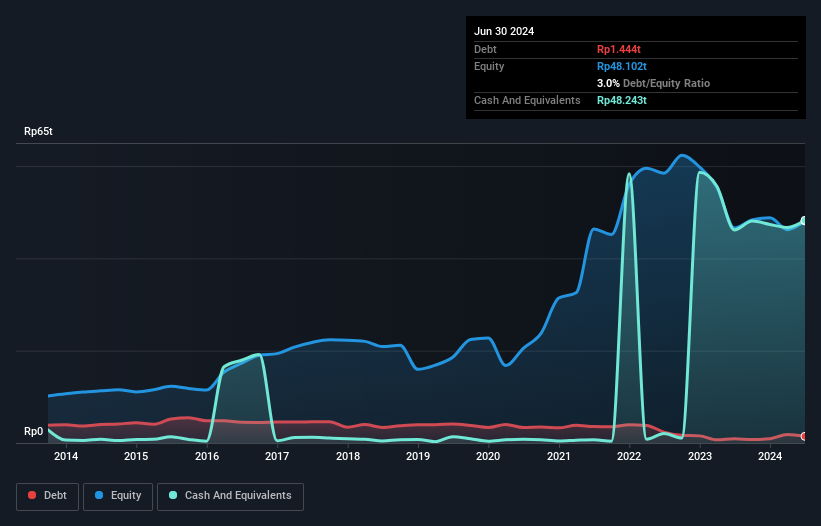

Saratoga Investama Sedaya (SRTG) has shown notable improvement, reducing its debt to equity ratio from 22.2% to 3% over five years. The company's price-to-earnings ratio of 13.4x is attractive compared to the Indonesian market's 15.2x, and it became profitable this year, outperforming the Capital Markets industry (-9.5%). Despite recent earnings losses, SRTG's interest payments are well covered by EBIT at 19.2x coverage, indicating financial stability and potential for future growth with an expected annual earnings increase of 16.82%.

Hainan Haide Capital Management (SZSE:000567)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hainan Haide Capital Management Co., Ltd. operates in the financial services sector and has a market cap of CN¥9.71 billion.

Operations: Hainan Haide Capital Management generates revenue primarily from its financial services operations. The company's net profit margin is a key metric to assess its profitability.

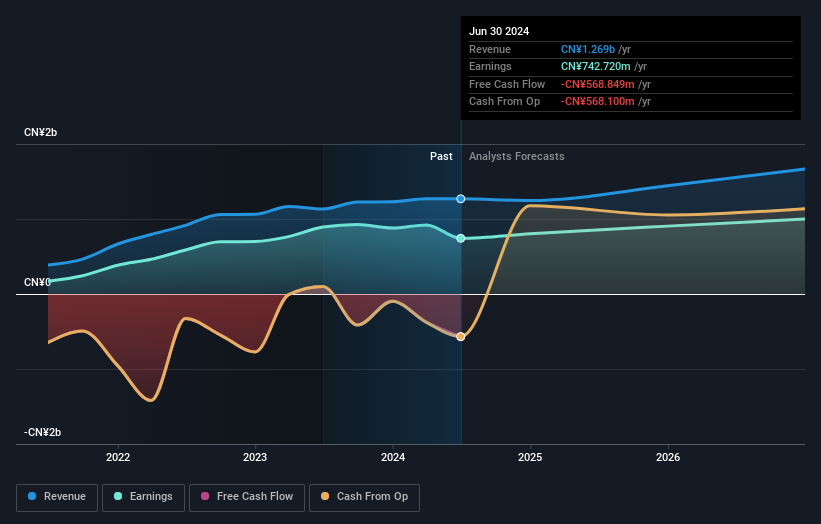

Hainan Haide Capital Management's earnings surged 20.4% over the past year, outpacing the Capital Markets industry, which saw an 11% decline. The company trades at a price-to-earnings ratio of 11.6x, significantly lower than the CN market average of 27.4x, suggesting good relative value. Additionally, its debt to equity ratio has climbed from 17.9% to 57.8% in five years while maintaining strong EBIT coverage of interest payments at 5.3x.

- Get an in-depth perspective on Hainan Haide Capital Management's performance by reading our health report here.

Learn about Hainan Haide Capital Management's historical performance.

Qingdao Baheal Medical (SZSE:301015)

Simply Wall St Value Rating: ★★★★★★

Overview: Qingdao Baheal Medical INC. focuses on the research, development, production, and sale of pharmaceutical products with a market cap of CN¥11.32 billion.

Operations: Qingdao Baheal Medical INC. generates revenue primarily through the sale of pharmaceutical products. The company has a market cap of CN¥11.32 billion, reflecting its significant presence in the industry.

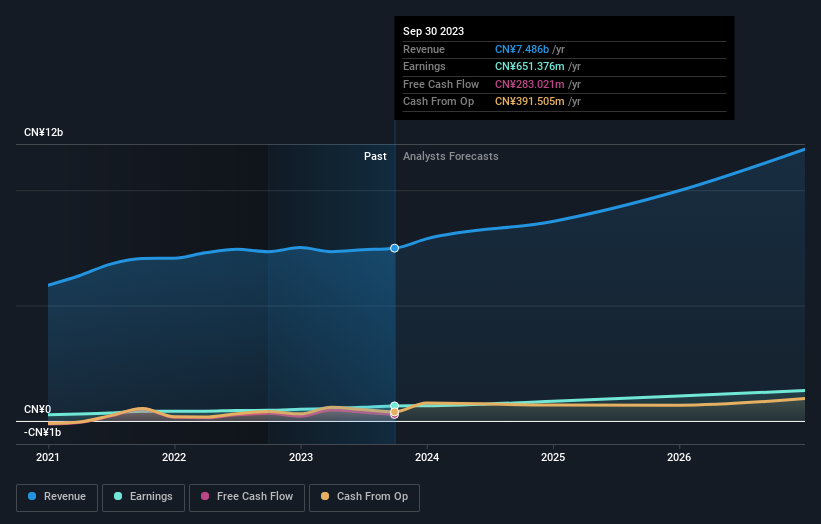

Qingdao Baheal Medical has been making waves with a 30.7% earnings growth over the past year, outpacing the Healthcare industry's -2.5%. The company is trading at 72.6% below its estimated fair value and boasts high-quality earnings. Debt levels have improved significantly, with a reduction in the debt-to-equity ratio from 71.2% to 45.7% over five years, and it remains profitable with positive free cash flow of CNY 480M as of July 2024.

- Click here and access our complete health analysis report to understand the dynamics of Qingdao Baheal Medical.

Evaluate Qingdao Baheal Medical's historical performance by accessing our past performance report.

Next Steps

- Delve into our full catalog of 4820 Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hainan Haide Capital Management might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000567

Hainan Haide Capital Management

Hainan Haide Capital Management Co., Ltd.

Adequate balance sheet and fair value.